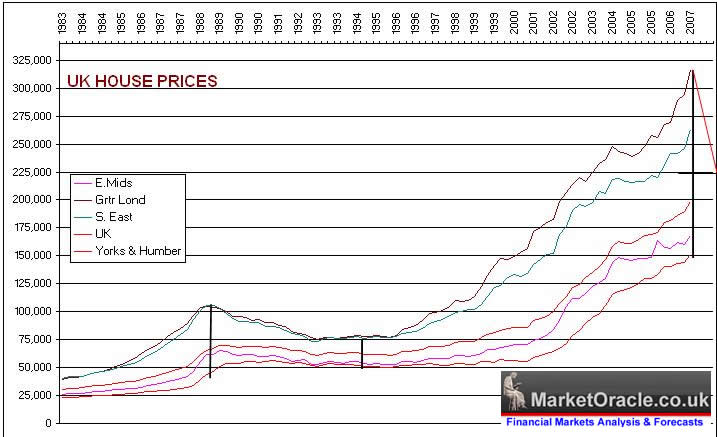

UK House Prices Fall by Fastest Pace in 2 Years as Housing Market Slump Gathers Pace

Housing-Market / UK Housing Oct 11, 2007 - 12:45 AM GMTBy: Nadeem_Walayat

The Royal Institute of Surveyors (RICS) monthly report shows house prices fell for a second consecutive month and are falling at their fastest pace in over 2 years, with 14.6% of surveyors reporting a fall in UK house prices.

The Royal Institute of Surveyors (RICS) monthly report shows house prices fell for a second consecutive month and are falling at their fastest pace in over 2 years, with 14.6% of surveyors reporting a fall in UK house prices.

RICS spokesman, Jeremy Leaf, said: “Although house prices continue to fall, the underlying economy remains strong. A major correction in the market seems unlikely while economic growth is above trend and employment conditions remain buoyant.

“The combination of rising interest rates, the introduction of HIPs and volatility in the financial markets resulting in tightening of lending criteria has certainly affected the confidence of buyers and sellers.

“As a result, some would-be buyers are turning to the rental market whereas others, conscious that the next move in interest rates is now likely to be down rather than up and market meltdown is highly improbable, are seizing the opportunity to negotiate with more flexible vendors in a less competitive market-place."

The Market Oracle forecast as of 22nd August 07 is for a 15% fall in UK house prices over the next 2 years.

UK Housing Market Forecast for 2008-09 - As of 22nd August 2007 |

UK House Prices to fall by 15% over two years, falling prices to be accompanied by cuts in UK interest rates. (22nd Aug 07), (1st May 07) (25th Sept 07) |

By Nadeem Walayat

(c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.