QE2 to Dilute the U.S. Dollar and Boost Gold and Silver

Commodities / Gold and Silver 2010 Nov 08, 2010 - 06:02 AM GMTBy: Bob_Kirtley

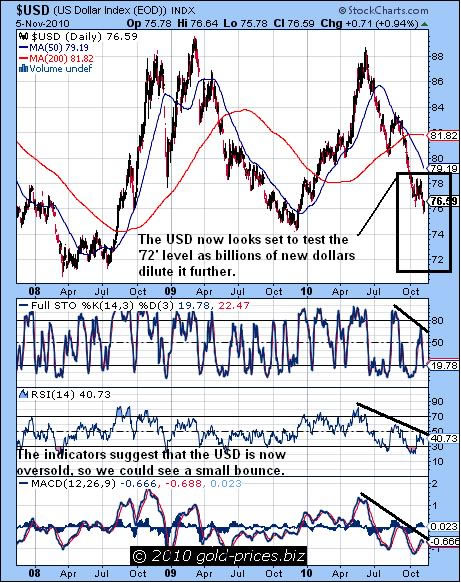

We kick off with a quick look at the chart for the USD which now looks set to test the ‘72′ level of support as billions of new dollars dilute it further. However, the indicators suggest that the USD is now oversold, so we could see a small bounce from this point. Any upward move we believe would be short lived as those holdings dollars at the moment must surely be considering their options and making plans to limit their exposure to any further devaluation of the dollar.

We kick off with a quick look at the chart for the USD which now looks set to test the ‘72′ level of support as billions of new dollars dilute it further. However, the indicators suggest that the USD is now oversold, so we could see a small bounce from this point. Any upward move we believe would be short lived as those holdings dollars at the moment must surely be considering their options and making plans to limit their exposure to any further devaluation of the dollar.

Should the ‘72′ level be breached then there are a number of possible staging posts on the way down that could provide a floor on which the dollar could stabilize. But we all know that once the rot sets in it is very hard to reverse as more and more investors lose their patience and withdraw their support. Its not off the radar that the dollar could lose another 30% of its value from here taking it down the ‘50′ level on the USD index. Other nations, who are currently involved in a race to the bottom with their own fiat money will try and keep pace, however, their mantra is austerity and not stimulus so we expect the dollar to win the race to the bottom, as silly as this sounds.

Overall the world of paper money appears to have little going for it and the world of hard assets appears to be the place to be. The choice of just which hard asset offers the best protection is for you to make, we have made this choice and are firmly entrenched in the gold and silver camp. Owning physical metal and actually having it in your own hands is probably the ultimate form of protection as it cannot be diluted and is not at the mercy of third parties, who may or may not use your gold for other purposes.

The gold and silver mining stocks are also getting some recognition as profitable businesses, thus attracting more investors. Over the last year or two gold and silver have taken the lead and the mining stocks have tended to follow, however, the unhedged gold stocks, as represented by the HUI index have recently picked up the pace somewhat and moved higher with some gusto, as we can see on the chart below.

The HUI Index of gold miners has added 50 points over the last few weeks for a gain of 10% on the back of some good results from mining companies and rising gold prices. The competition for investment funds remains intense as the various gold funds offer an attractive, liquid and easy way to participate in this market. The rapid rise of these funds and shear magnitude of their holdings offers the larger investor the freedom to trade in and out of these funds with ease, whereas a large stake in one mining company can be difficult to exit due to the companies lack of liquidity.

Even so, as the producers begin to offer more in terms of leverage to gold and silver, investors will be tempted into spreading their investment dollars accordingly.

This new influx of capital could soon propel the stocks into an environment where they react to gold prices on a much higher ratio of say 3:1 or 4:1. Should this occur and gold prices continue to rise we will see stocks make gains in one day equivalent to the price that you could have acquired them for just few short years ago. The next move could be truly electric so ensure that you have finalized your strategy and are now executing those plans.

Don’t be one those people who thought about investing in this sector but didn’t get around to taking some form of action. This is it, its here, right now, your ball!

Stay on your toes and have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.