Gold and Silver Drift as Federal Reserve Will Target $2 to $4 Trillion in Bond Buys

Commodities / Gold and Silver 2010 Oct 26, 2010 - 07:38 AM GMTBy: GoldCore

Slight dollar strength has contributed to gold and silver falling marginally in London trading so far today. Physical demand remains robust with buyers continuing to accumulate on the dips. With monetary easing set to continue and indeed deepen in the coming months this is likely to continue. Support is at $1,317/oz and resistance is at $1,348/oz and $1,385/oz.

Slight dollar strength has contributed to gold and silver falling marginally in London trading so far today. Physical demand remains robust with buyers continuing to accumulate on the dips. With monetary easing set to continue and indeed deepen in the coming months this is likely to continue. Support is at $1,317/oz and resistance is at $1,348/oz and $1,385/oz.

Economists at Goldman Sachs estimate the Federal Reserve may need to buy a staggering $4 trillion worth of assets such as Treasury securities in order to ensure long term interest rates remain low. The massive scale of the asset-purchasing quantitative easing policy is creating unease about the prospect of adding significantly to the Fed's already bloated balance sheet and about the dollar's status as reserve currency.

Gold is currently trading at $1,331.98/oz, €956.54/oz, £839.21/oz.

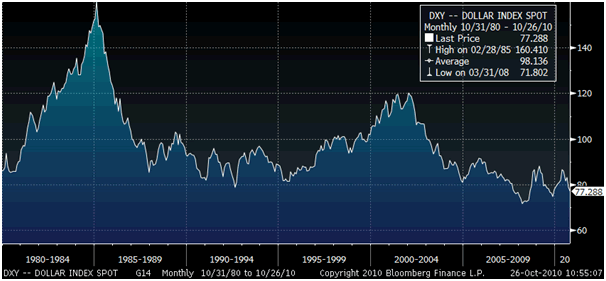

US Dollar Index - 1980 to Today (Monthly).

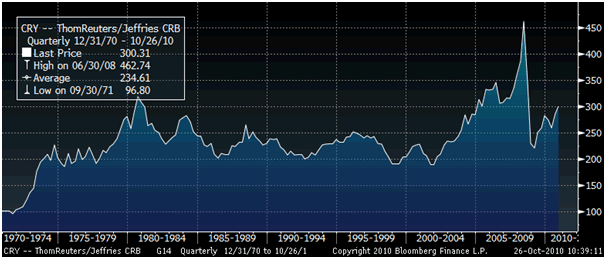

Complacency about the gradual reemergence of inflation remains prevalent particularly with US policy makers and the Federal Reserve. Rising precious metal and commodity prices as seen in the Thomson Reuters/Jefferies CRB Index (see charts below) may signal that Ben Bernanke's aim of creating inflation will be easily achieved. While many commodities have risen recently, many remain well below their nominal highs of June 2008. Then the CRB was trading at 462.74. Many commodities remain well below their nominal highs of the 30 years ago when the CRB traded at nominal highs in 1980 at 319.40 (see chart below). This would suggest that the recent increase in the price of commodities is sustainable as prices remain well below their inflation adjusted prices of the early 1980s.

Thomson Reuters/ Jefferies CRB Index - 40 Years (Quarterly).

Increasing concerns about the dollar as global reserve currency and as a store of value could see the dollar fall to record lows (see US Dollar chart above) which would lead to further gains in commodity and precious metal markets. QE2 and predictions that it might involve trillions of dollars more will likely see the dollar come under further pressure and will not help increasing tensions over competitive currency devaluations and currency wars.

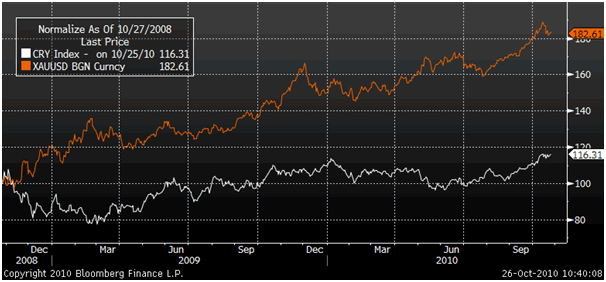

Gold in USD and Thomson Reuters/ Jefferies CRB Index - 2 years (Daily).

Gold may again be the proverbial "canary in the coalmine" and its recent rise in value and outperformance of most commodities could signal that commodity prices are set to rise in the coming years. This seems likely given the challenging fundamentals of a finite planet being confronted by strong demographic pressures and a growing global population and growing middle classes in emerging economies.

Geopolitical risk has not gone away and a reminder of this was seen in reports from Iranian state-run Press TV that Iran has started loading fuel into its first nuclear power plant. Accusations that President Hamid Karzai in Afghanistan accepted cash from the regime in Iran came after Karzai accused the United States on Monday of exporting killing to Afghanistan. Tensions in the region remain high and a further increase in geopolitical tension, particularly with Iran, could again lead to safe haven buying of gold.

Silver

China remained a net importer of silver in September, with imports in the first nine months of the year surging 24.7% on the year and exports in the period down 60.2 percent, official trade data showed.

Silver is currently trading at $23.39/oz, €16.79/oz and £14.72/oz.

Platinum Group Metals

Platinum is trading at $1,688.25/oz, palladium is at $603/oz and rhodium is at $2,225/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.