US Stock Markets Long and Short-term Outlook

Stock-Markets / US Stock Markets Oct 07, 2007 - 08:06 AM GMTBy: Joseph_Russo

Is a full-blown buying-panic about to ensue, or are we approaching a near-term, or perhaps a more significant cresting terminal of major import?

Is a full-blown buying-panic about to ensue, or are we approaching a near-term, or perhaps a more significant cresting terminal of major import?

The answer is painfully clear. Nobody knows but the esteemed Mr. Price.

We have learned a long, long time ago – that virtually ANYTHING is possible regarding both short and longer-term outcomes in financial markets.

Fundamentals, logic, technical's, as well as the most perfectly counted Elliott Wave Patterns have a sinister way of breeding deception with alarming frequency.

In defiance of the majority's immediate expectation bias, the “PRICE-ACTION” remains the most fruitful common denominator in determining both the short and long-term intent of nominal-values.

As one speculates amid this rather perverse, and psychologically-driven price discovery process, emotions and bias run high. Due to this unavoidable human condition, it is crucial that one find a disciplined means to step-back and view price action for what it is, and not what one thinks, or hopes it will be.

Once this means is attained, an individual regiment must then be adopted to enter and exit positions based purely on boundaries, targets, risk tolerance, and personal trading preferences.

Following our short-term trading recap below, we will wrap up with a longer-term briefing of the major indices in our regular market update.

All The Right Stuff

A small handful of our clients have alluded that although we masterfully lay all of the ground-work relative to elected entry-locations and exit-targets, that we do not prognosticate or express staunch enough predictive bias to either support or dissuade them from taking or holding onto positions.

As we layout the evolving price landscape, there is simply no time for hand-holding or table pounding banter. In our view, such emotional endeavor is a simply a waste of valuable time and a huge drain on productive energy.

As the dynamic landscape is drafted, all one is called upon to do is to align one's money management criteria and trade preferences with the dynamic boundaries and price targets set forth - then get all of the appropriate orders in front of the market and manage their trades – win, lose, or draw.

Upon impartial assessment of wave-structures in concert with traditional chart analysis, we continue to successfully-plot forward-looking navigational landscapes based solely upon the reality that “ price-action” dictates.

Thereafter, we apply the balance of our technical acumen to confirm or negate longer-term prospective wave structures whilst keenly observing success or marginalization of our shorter-term proprietary trade-trigger boundaries.

Below is a recent account of trade-triggers and price-target outcomes from Elliott Wave Technology's Near Term Outlook . The results speak for themselves.

You Get Out of it, What You Put into it

Bear in mind that the chart landscapes we furnish are archived in clear graphic form, and include a full compliment of consistent and impartial commentary assessments.

By no means do we predict prices, nor do we issue specific buy and sell recommendations in advance of trade-triggers electing, or upon price-targets achieving objectives.

Although we graphically identify explicit entry-triggers along with point-values and price-target objectives, decisions to place orders and manage trades through fruition are the sole the responsibility of each individual.

The Near Term Outlook covers the short-term Dow, S&P, and NDX five-days-per-week, and issues near-term updates for the Dollar, Gold, Crude Oil, and the HUI two times per week.

In addition, NTO subscribers receive an Interim Monthly Forecast, as well as our longer-view Millennium Wave Quarterly reports to balance one's perspectives in every time-horizon.

Subscription premiums for the NTO are currently a scant $50.00 per month. The Interim Monthly Forecast and Millennium Wave Quarterly reports are currently available as stand-alone subscriptions for $19.00 per month and $25.00 per quarter respectively.

Consistency and outstanding achievement in accurately drafting both short and long-term market landscapes has ballooned our subscriber-base more than three-fold in recent months. Growing demand dictates that we soon raise our three subscription premiums to $75.00, $29.00, and $38.00 respectively. As such, there is no time better than the present to try one of our outstanding publications.

That said, let's take a longer-term view of what is currently taking place in the financial sphere.

The Past 15-yrs in Brief:

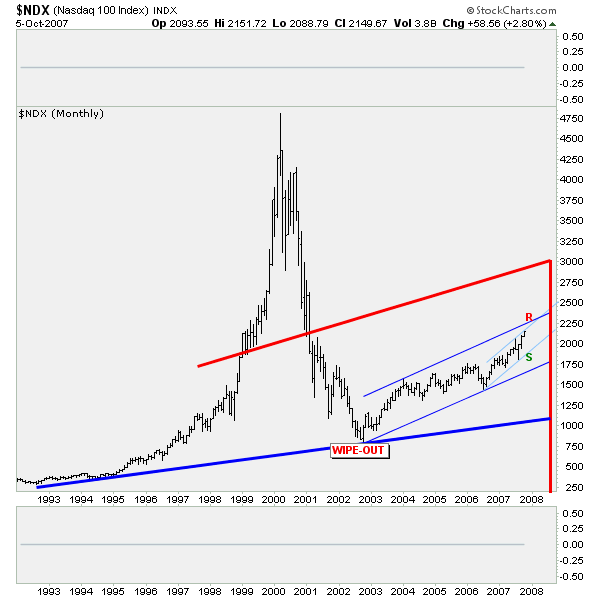

The NASDAQ 100

The NDX:

Hope marches on

As the ticker on CNBC runs those annoying orange blurbs for days-on-end stating that the Dow or S&P is so many points above or below a historic high, we often wonder why they do not include one that reflects the NDX is still 3000 points below its former peak.

Such a shout-out may bring to light one possible reason why participants appear to be chasing what they perceived to be the most undervalued, risk-free asset class - with the most upside potential.

Chants for NDX 3000 (some 40% above current levels) would somehow fail to cut the mustard considering that 5000 would be the appropriate level to chant about.

For now, the NDX appears to have its radar locked on the 2300 level, with an eye toward 3000 should the king-fiat currency devaluation really start digging in.

Breaching 15-year lows, The Dollar resides in the hyperinflationary danger zone below the 80-level. Should 80 mark a permanent ceiling, the dollar is on its way to 40, heading inevitably toward its intrinsic value of $0.00.

Not surprisingly, The Dow is a near mirror image of the dollar. Whether or not this reflection will remain consistent in the aftermath of extreme dollar devaluations is questionable. For now, “letting the dollar go” is still perceived as bullish.

Although Gold may have gotten a bit ahead of itself at the highs back in 2006, its long-term trend is overwhelmingly bullish. The five or more hugging base-line touches between 2002 and 2005 were extraordinarily bullish, and rather telling. Given Gold's tight ride along the lower trend channel boundary, the $300 dollar explosion in 2005-2006 came as no major surprise. Even though the 2006 spike-high marked an interim top, the market has now recaptured this level in 2007.

Trailing markedly behind the leadership of the Dow, The S&P is taking another crack at breaking above its 2000-2002 bear-market trading range. In contrast to the Dow, note how close the S&P came to breaching its five-year uptrend at the recent August low. Likewise, note how the Dow has broken decisively above its previous bull-market highs and has stayed there for more than a year, while the S&P continues to struggle at its similar respective crest.

Should readers have interest in obtaining access to Elliott Wave Technology's blog-page, kindly forward the author your e-mail address for private invitation.

Until next time …

Trade Better / Invest Smarter...

By Joseph Russo

Chief Editor and Technical Analyst

Elliott Wave Technology

Copyright © 2007 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.