Liquidity Traps, Falling Velocity, Commodity Hoarding, and Bernanke's Misguided Tinkering

Stock-Markets / Financial Markets 2010 Oct 25, 2010 - 12:50 PM GMTBy: Mike_Shedlock

John Hussman has an interesting post this week on the misguided policies of the Bernanke Fed and how quantitative easing promotes commodity speculation and hoarding but does nothing for the real economy. Please consider Bernanke Leaps into a Liquidity Trap

John Hussman has an interesting post this week on the misguided policies of the Bernanke Fed and how quantitative easing promotes commodity speculation and hoarding but does nothing for the real economy. Please consider Bernanke Leaps into a Liquidity Trap

The belief that an increase in the money supply will result in an increase in GDP relies on the assumption that velocity will not decline in proportion to the increase in money. Unfortunately for the proponents of "quantitative easing," this assumption fails spectacularly in the data - both in the U.S. and internationally - particularly at zero interest rates.

How to spot a liquidity trap

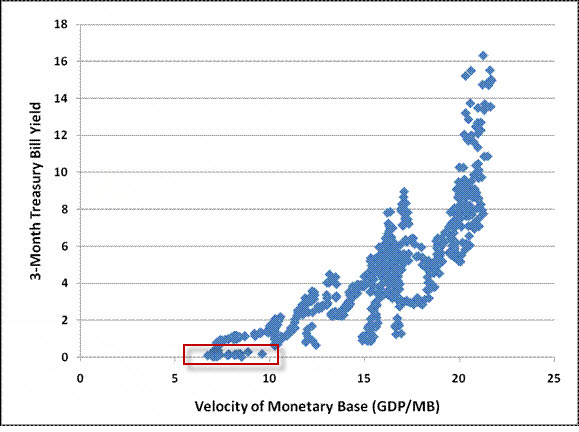

The chart below plots the velocity of the U.S. monetary base against interest rates since 1947.

Few theoretical relationships in economics hold quite this well. Recall that a Keynesian liquidity trap occurs at the point when interest rates become so low that cash balances are passively held regardless of their size. The relationship between interest rates and velocity therefore goes flat at low interest rates, since increases in the money stock simply produce a proportional decline in velocity, without requiring any further decline in yields. Notice the cluster of observations where interest rates are zero? Those are the most recent data points.

One might argue that while short-term interest rates are essentially zero, long-term interest rates are not, which might leave some room for a "Hicksian" effect from QE - that is, a boost to investment and economic activity in response to a further decline in long-term interest rates. The problem here is that longer-term interest rates, in an expectations sense, are already essentially at zero. The remaining yield on longer-term bonds is a risk premium that is commensurate with U.S. interest rate volatility (Japanese risk premiums are lower, but they also have nearly zero interest rate variability). So QE at this point represents little but an effort to drive risk premiums to levels that are inadequate to compensate investors for risk. This is unlikely to go well. Moreover, as noted below, the precise level of long-term interest rates is not the main constraint on borrowing here. The key issues are the rational desire to reduce debt loads, and the inadequacy of profitable investment opportunities in an economy flooded with excess capacity.

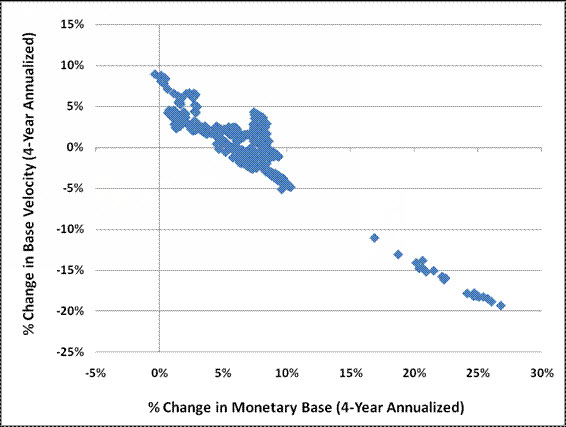

One of the most fascinating aspects of the current debate about monetary policy is the belief that changes in the money stock are tightly related either to GDP growth or inflation at all. Look at the historical data, and you will find no evidence of it.

You can see why monetary base manipulations have so little effect on GDP by examining U.S. data since 1947. Expand the quantity of base money, and it turns out that velocity falls in nearly direct proportion. The cluster of points at the bottom right reflect the most recent data.

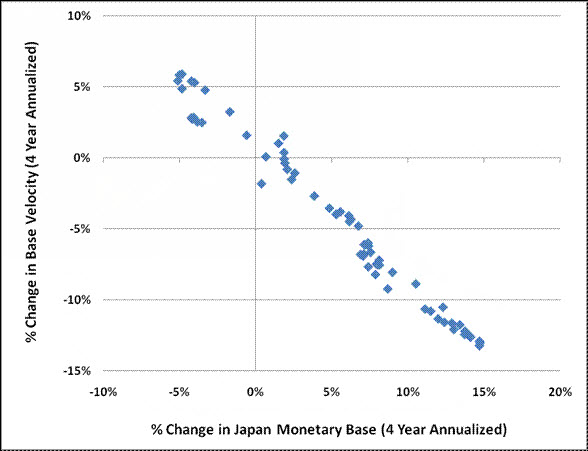

Just to drive the point home, the chart below presents the same historical relationship in Japanese data over the past two decades. One wonders why anyone expects quantitative easing in the U.S. to be any less futile than it was in Japan.

Simply put, monetary policy is far less effective in affecting real (or even nominal) economic activity than investors seem to believe. The main effect of a change in the monetary base is to change monetary velocity and short term interest rates. Once short term interest rates drop to zero, further expansions in base money simply induce a proportional collapse in velocity.

Look at the price of gold since 1975. When real interest rates have been negative (even simply measured as the 3-month Treasury bill yield minus trailing annual CPI inflation), gold prices have appreciated at a 20.7% annual rate. In contrast, when real interest rates have been positive, gold has appreciated at just 2.1% annually. The tendency toward commodity hoarding is particularly strong when economic conditions are very weak and desirable options for real investment are not available. When real interest rates have been negative and the Purchasing Managers Index has been below 50, the XAU gold index has appreciated at an 85.7% annual rate, compared with a rate of just 0.1% when neither has been true. Despite these tendencies, investors should be aware that the volatility of gold stocks can often be intolerable, so finer methods of analysis are also essential.

Quantitative easing promises to have little effect except to provoke commodity hoarding, a decline in bond yields to levels that reflect nothing but risk premiums for maturity risk, and an expansion in stock valuations to levels that have rarely been sustained for long (the current Shiller P/E of 22 for the S&P 500 has typically been followed by 5-10 year total returns below 5% annually). The Fed is not helping the economy - it is encouraging a bubble in risky assets, and an increasingly unstable one at that. The Fed has now placed itself in the position where small changes in its announced policy could have disastrous effects on a whole range of financial markets. This is not sound economic thinking but misguided tinkering with the stability of the economy. That is a decent sized snip, but I assure you there is much more in the article to merit a complete read.

Commodity Hoarding

Commodity hoarding and speculation and credit growth is rampant in China, as noted in Massive Inflation in China, US Inflation Nonexistent

I also happen to have had an email exchange with someone in the apparel industry regarding cotton over the past few days.

"AI" Writes ...

Mish,Definition of "Factory"

As you know I work in the apparel industry. One item that the media is not discussing is the massive price increases for clothing that is coming in 2011. Retailers are beginning to feel the pricing pain as we speak. For now they and their vendors are absorbing through modestly lower margins. By early spring product shortages will become an issue. As we move into July and August we WILL see pricing for many items increase by 20% or more because of cotton shortages and hoarding in China.

I know of one "factory" that made a cash purchase of a substantial amount of "cotton"/piece goods. To their surprise only 20% was delivered along with a refund for the balance. The supplier said they plan to hold the goods longer as prices continue to increase rapidly.

"AI"

Since "Factory" was in quotes, I had to ask exactly what that meant. "AI" responds ...

A factory can be an actual production facility or it could be a sourcing agent who outsources production to various facilities. The term is often used interchangeably so I felt the quotes were needed. The same can be said for cotton as it is sometimes used when people are referring to fabric/piece goods. The hoarding example I provided was for actual fabric.

Apparel Price Increase Looms?

"AI" thinks a huge price increase looms. I am not so sure. Prices can only rise if consumers are willing to pay that price. Are they? For how long?

As for hoarding, there is always the risk of a price collapse. Given the fragile state of the economy, a sudden collapse in the price of cotton or commodities cannot be ruled out.

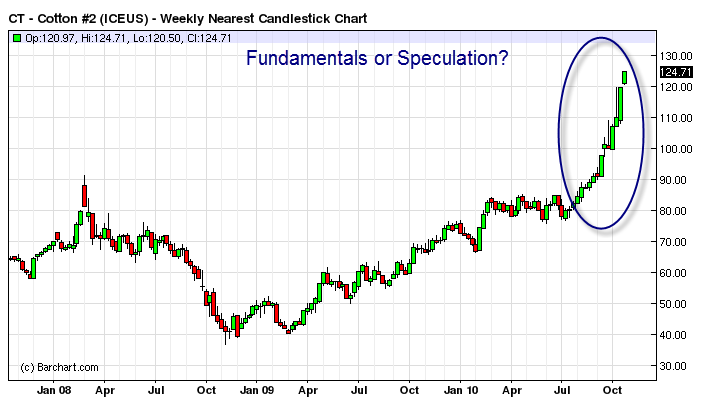

Cotton Weekly

Charts like that seldom turn out well for buyers at these prices.

Liquidity Trap?

I agree with what Hussman is saying about liquidity traps in general and how this "pushing on a string" cannot work. However, the entire notion of a "liquidity trap" is a Keynesian construct that implies "something" must be done.

In reality, the best thing to do is nothing. Eventually prices will fall low enough where real demand will pick up. The speculators (in this case the banks), would have been wiped out and the bondholders (mainly the wealthy), would have taken a hit.

Sadly that is not what we did. We did not even do the second best thing of funding genuine infrastructure needs. Instead, we bailed out the banks at taxpayer expense, paved a bunch of roads at huge expense that did not need paving, and gave money to states that squandered much of it on public unions.

In short, it would be hard pressed to find a policy response worse than what we did. QE cannot work as the charts from Hussman proves. Yet Bernanke is committed to a policy of more of the same from the Fed.

Meanwhile, Congress is apt to head the other direction (thankfully) and tighten up, even though Krugman is screaming his fool head off. Please see Krugman and the Inevitable "I Told You So" - Tim Duy "Bad Things Happen When You Fight the Fed"; Final End of Bretton Woods 2? for more detail.

The only remaining question is how big various commodity, stock market, and corporate bond bubbles get in the meantime, before things blow sky high once again. Risk is enormous and growing.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.