Gold Correction Continues as G20 Meet to Discuss Currency Wars

Commodities / Gold and Silver 2010 Oct 22, 2010 - 09:25 AM GMTBy: GoldCore

Gold is lower today as the dollar has continued to eke out gains ahead of the G20 summit where competitive currency devaluations and currency wars are set to be discussed. Gold is down 0.3% in dollars and has fallen in most currencies except for the Swiss franc which is under pressure today.

Gold is lower today as the dollar has continued to eke out gains ahead of the G20 summit where competitive currency devaluations and currency wars are set to be discussed. Gold is down 0.3% in dollars and has fallen in most currencies except for the Swiss franc which is under pressure today.

The G-20 finance ministers meeting will be dominated by discussions on trade imbalances and disputes over currency valuations. Gold has been supported by the growing concern that countries are pursuing weaker exchange rates as a route to stronger economic growth, either by limiting currency gains with interventions like Japan, China and other countries or by extremely accommodative monetary policies, as the U.S. and U.K. are doing. US Treasury Secretary Geithner will have his work cut out in convincing the Chinese and some other nations that the US is not attempting to devalue the dollar and inflate away the massive liabilities of the US. Actions speak louder than words and until the US attempts to return to a more conventional monetary policy, emerging market and other nations will be concerned about the devaluation of the global reserve currency.

Gold is currently trading at $1,320.60/oz, €947.47/oz, £839.83/oz.

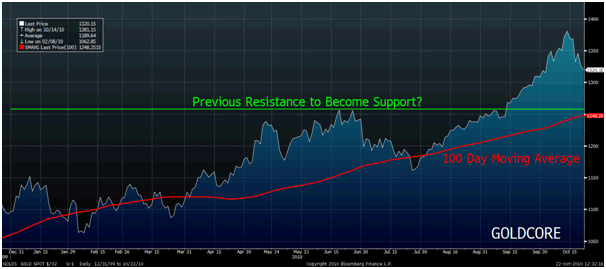

Gold is down some 3% (in dollar terms) in the week and is set to have its first weekly lower close in 6 weeks. The question is whether this may become a more protracted correction and consolidation or another short correction prior to the resumption of gold's secular bull market. Recent years have seen many corrections which have all been swift but shallow and this may be the case again. Support is at the round number of $1,300/oz and at the previous resistance and 100 day moving average between $1,248/oz and $1,260/oz (see chart above). Interestingly, a 10% correction from the recent nominal high would see gold trade at $1,242/oz. Ordinarily, gold would correct back to these levels but this is no ordinary market and with QE2 set to be embarked on and physical demand from Asia and internationally and from many large creditor nation central banks, gold could surprise to the upside as it has done in recent weeks.

Silver

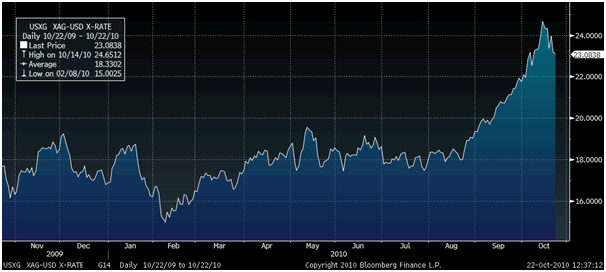

Similarly, silver is a little overbought in the short term and looks ripe for a correction back to support at around $20/oz (which was previous resistance). However, like gold the strong physical demand for silver internationally and the fact that Chinese exports (the 3rd largest producer of silver in the world) are set to plunge 40% this year as domestic investment eats up the supply. This and the very small size of the silver market versus the gold market and the fact that silver remains 1/57th the price of gold (see chart below)means that any correction in silver could be sharp but short and not as deep as precious sharp corrections.

Volatility has been low in precious metal markets, particularly gold, and has not risen significantly in recent months. This is likely to change in the coming months with volatility set to increase as tends to happen as bull markets progress and larger players enter the market. Those buying bullion as a long term diversification would as ever be best to fade out the noise and focus on the long term benefits of having a diversified investment and savings portfolio.

Gold to Silver Ratio.

Silver is currently trading at $23.13/oz, €16.58/oz and £14.70/oz.

Platinum Group Metals

Platinum is trading at $1,667.50/oz, palladium is at $580/oz and rhodium is at $2,225/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.