China Interest Rate Hike, Once Is Never Enough

Interest-Rates / China Economy Oct 20, 2010 - 03:09 AM GMTBy: James_Pressler

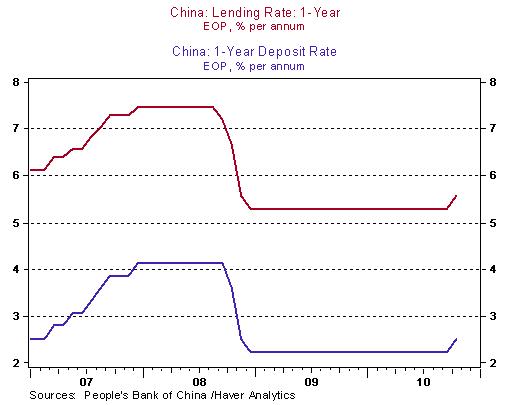

In a move that caught international markets flatfooted, this morning the People's Bank of China (PBoC) tightened two key interest rates by 25 basis points, its first rate hike since December 2007. Few analysts expected a rate hike any time before Q1 2011, so such a sudden hike - that lacked any accompanying discussion or explanation - triggered a wave of uncertainty as everyone scrambled to explain the move. So, along with the mob, we offer our own interpretation of today's events.

First, we recognize this rate hike is long overdue, but like many others we did not believe the PBoC wanted to implement it just yet. (We are also surprised that the central bank opted for a very western 25 basis point hike as opposed to its usual 27- or 18-bp moves, but that is a discussion for another time.) Throughout the year the government has tried to keep lending under control through broader controls - raising bank reserve ratios, tightening lending conditions and requirements for real estate purchases, etc. - to marginal effect. The central bank wanted to contain the growing domestic real estate bubble, but not cool down other sectors of the economy through higher lending rates. Today's rate hike suggests the government is giving up this strategy, perhaps because it has a renewed confidence that the economy is on firmer footing and can withstand some monetary tightening. However, there is another consideration that is at least worth investigating.

We find it quite interesting that a bundle of economic data comes out this Thursday, including the first public look at Q3 GDP and September CPI. The consensus placed these figures at 9.5% and 3.6%, respectively, versus 10.3% and 3.5% during the previous periods. Today's sudden action might suggest that officials see growth running higher than expected, or worse, inflation on the boil. Even though senior officials in the PBoC and in the government insist prices remain contained, we suspect that pressures are rising to the consumer level. If this is true - and Thursday's indicators may well confirm this - then today's rate hike will be the first of many over the next few months. We will discuss the indicators upon their release.

James Pressler — Associate International Economist

http://www.northerntrust.com

James Pressler is an Associate International Economist at The Northern Trust Company, Chicago. He currently monitors emerging markets in sub-Saharan Africa, as well as several European and Asian countries.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.