A Rising U.S. Dollar Amidst a Currency War?

Currencies / US Dollar Oct 19, 2010 - 02:30 PM GMTBy: Marty_Chenard

Wall Street has been pointing out how a falling Dollar is good for stocks ... especially for international companies. What happens if the Dollar rises now?

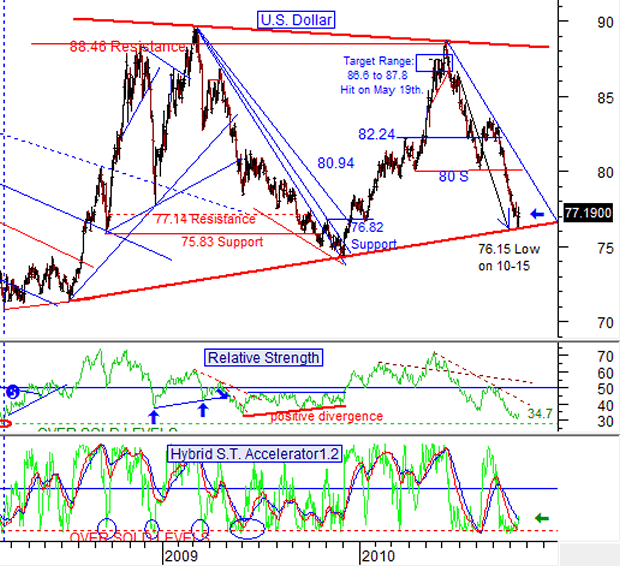

Our Advanced subscribes have been aware that the Dollar has been in a very large triangular pattern. Base on the pattern, we established a downside target between 76 to 77 last July. Our actual downside support was at 76.20. Last Friday (October 15th.), the Dollar fell to 76.15 on an intra-day basis. Therefore, the bottom support has now been reached.

So, what now?

The next real question is about whether or not we hold the 76-77 support with a currency war going on.

Right now, I think the answer is leaning toward yes for holding the support, and an abatement on the intensity of the currency fight that has been going on. We may need another week to see if this is correct, but in the meantime, the Dollar should start showing some basing attempts if it is going to hold 76-77 as a support.

Yesterday, our Accelerator moved higher and it crossed above both red and blue trend lines ... so, that should mean the Dollar moves higher today as it tries to build a base for challenging its upcoming June/October resistance line.

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.