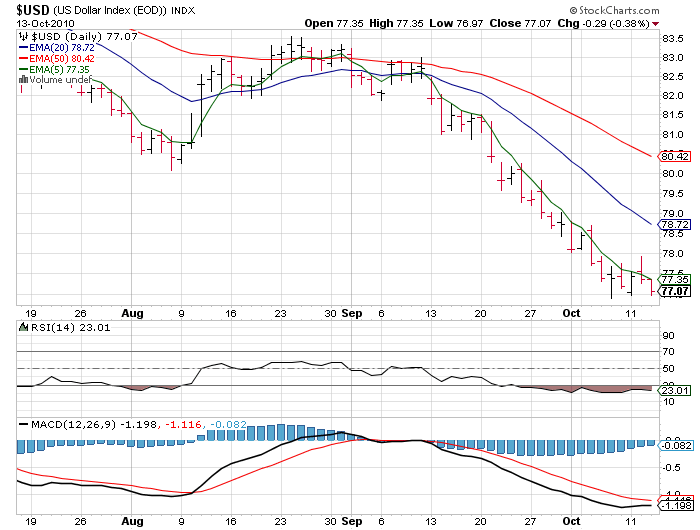

U.S. Dollar Cannot Even Hold 5 Day Moving Average

Currencies / US Dollar Oct 14, 2010 - 12:40 PM GMTBy: Trader_Mark

Dollar bulls are now showing in the 3% range which is a similar reading to Euro bulls in late spring during the Greece crisis ... the euro was roughly 1.18 to the dollar, and people were talking par (1.00). Now the euro just broke over 1.40.

Dollar bulls are now showing in the 3% range which is a similar reading to Euro bulls in late spring during the Greece crisis ... the euro was roughly 1.18 to the dollar, and people were talking par (1.00). Now the euro just broke over 1.40.

This chart has a 1 day delay but similar to the 13 day moving average support on the S&P 500, we have such dramatic weakness that the dollar cannot even break OVER the 5 day moving average on a closing basis. Today the dollar is down about -0.5% (off the worse levels of the day) but has continued the degradation.

So sentiment is in the right spot for a counter trend rally - now we need to see a technical reversal before declaring a move could be afoot. Since all my short positions have been ripped away from me, I am using this as a pseudo short vs the market...but on a day like today when the mkt is down along with the dollar, it is useless.

Long Powershares DB US Dollar Bullish in fund; no personal position

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2010 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.