Global Currency Market Chaos Sends Gold Soaring

Commodities / Gold and Silver 2010 Oct 13, 2010 - 05:11 PM GMTBy: Mike_Shedlock

Emerging market economies are under increasing stress as a result of the horrendous economic policies of the Fed.

Emerging market economies are under increasing stress as a result of the horrendous economic policies of the Fed.

In order to prevent unwanted strengthening of their currencies, Emerging Asia sets up controls to curb capital inflows

Thailand announced on Tuesday that it will impose a 15 percent withholding tax on interest and capital gains made by foreign investors on Thai bonds, accentuating the emerging economies' drive to put in place regulatory controls to curb capital inflows that contribute to a surge in currencies.

A persistent low interest rate regime in the developed world is pushing global investors to tap into the high-yielding markets, leading to currency worries in most of emerging Asia.

Export-dependent economies like Japan, China and Brazil have been in a race to rein in their currencies of late as huge amounts of money flowed from anemic western economies to their systems. China has maintained a tight leash on the yuan to ensure their export competitiveness, while Japan intervened in the markets to stem the yen's gains. Brazil last week raised a tax on foreign portfolio inflows into bonds and some other financial instruments to 4 percent to contain the rise of its real currency.

Traders believe South Korea has intervened repeatedly in the currency markets to rein in the won. In the Philippines, government officials have said the rise of the peso is a matter of concern.

Analysts say the afflicted Asian countries are addressing the problem in three ways.

In countries like South Korea, Australia, the Philippines and Indonesia policy rate hikes are either being scaled-back or delayed. "Less monetary tightening in Asia will help to contain interest rate differentials, thereby reducing the incentive for capital inflows," say the analysts.

Secondly, currency market intervention has increased and foreign reserves are going up, providing the countries a cover against further shocks in the financial system.

The third route, the analysts say, is the imposition of capital controls.

"For now the restrictions are mild and targeted toward speculative inflows. This will probably stay the focus. Draconian measures were introduced in Thailand in late 2006 but these are widely-recognized across Asia as having been a disaster."Japan's Vows Decisive FX Moves

It's not just emerging markets feeling huge stress as Japan's Noda vows decisive FX moves after G7 meeting

Japanese Finance Minister Yoshihiko Noda said on Tuesday that Japan will continue to take decisive steps against excessive currency moves, including intervention, helping the dollar to recover further from a 15-year low against the yen.

Noda's reiteration of Japan's currency stance highlighted the risk of another round of intervention to weaken the yen after Japan weathered a flurry of weekend Group of Seven and IMF meetings with no overt criticism of last month's yen selling -- its first in six years.Forex Market In State of Disarray

Rosenberg discussed Forex stress in Tuesday's Lunch with Dave.

Meanwhile, the foreign exchange market is in a state of disarray and while everyone gazes at every nuance coming out of the Fed, a really big story is unfolding in this increasingly unstable currency backdrop. Thailand, following in Brazil’s footsteps, imposed a 15% tax on foreigner bond income. The Korean won is falling from its lofty heights on FX intervention concerns. The BoJ has already aggressively moved twice in the past month to weaken the yen to no avail — Japanese consumer confidence was released overnight and it fell for the third month in a row in September — as has been the case with the Swiss National Bank, which has tried with futility to weaken the Swiss franc.

China is printing money at nearly a 20% annual rate to prevent a yuan appreciation even in the face of intense global efforts to encourage the country to strengthen the unit. (The last thing China wants to do is buckle to U.S. pressure like Japan did following the 1985 Plaza Accord, which strengthened the yen and sent the country into a 25-year deflationary stagnation period.)

The Bank of England is talking about QE as well … these beggar-thy-neighbour money printing exercises to stimulate local economic conditions increasingly look like a zero-sum-game. Only the euro has held steadfast because Trichet refuses to cut interest rates or embark on quantitative easing — though the fiscal problems in the periphery are worrisome and will continue to cloud the future of the currency; however, don’t worry, owners of German bunds think they will ultimately get repaid in D-marks.

Of course, gold could be the only asset class that makes sense here. If the bond market is right then we get deflation and gold is a hedge against the uncertainty such an environment would entail. If the equity market is right, then we get gobs of liquidity out of the Fed and then we go off to a new reflationary credit cycle — gold benefits here too. And, if the commodity complex is right, then we are heading towards a new inflationary cycle and of course gold is a classic way to play this scenario. So in response to Mr. Tepper, it’s not the equity market that is in position for a win-win, it is the precious metals market. Gold is hugely overbought right now and long overdue for a corrective phase, which will likely pose yet another great buying opportunity.Life Imitates Art

I received an interesting email from reader "Jack B" regarding capital controls.

Jack writes ...

Hello Mish

I recall reading last week that Brazil had imposed limits on incoming capital. Now Thailand has imposed a tax on interest and capital gains made by foreign investors to Thailand.

The reason I find this so fascinating is it is an eerie example of life imitating Hollywood. In the 1983 wall street movie "Rollover," there's a great scene in which an older "statesman of Wall Street warns a young upstart that, "...first you'll see a lot of jawboning by the president, and that won't work. Then, they'll take to selling gold, and that won't work. (BIS has already done this) And then you'll see capital controls!

And that will be the end. Then you'll see a Depression that makes the thirties look like a Kindergarten!"

Bernanke & Co are just continuing the ol' Greenspan PUT: always and everywhere, coddle the Wall Street fraternity. Well, if that is the Chairman's wish, fine; but the entire global economy is at risk.

Please keep up the excellent coverage of our post-WW II-like global economy!

Jack

Message of Gold

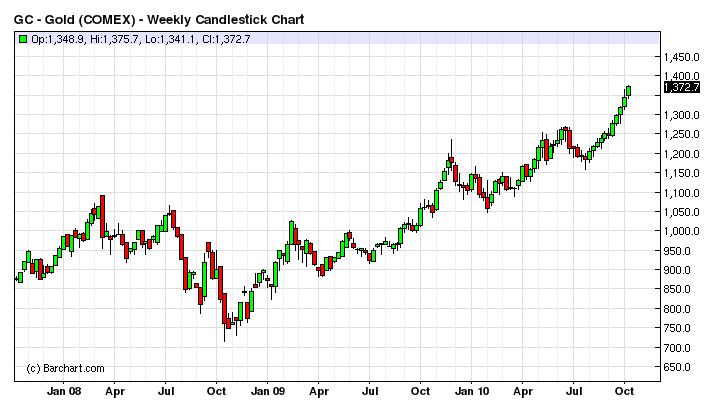

Gold is up another $25 today and has been on a tear ever since late 2008.

By now it should be obvious to everyone (including Prechter), that gold is acting like a currency for the simple reason that gold is money. Gold is performing well in these conditions because it should.

For more about why Gold is Money, please see ...

By the way, those articles were penned under the name "Trotsky" who is also my friend "HB", who now has his own fine blog on Austrian economics: Acting Man

As money, one should expect gold to perform well against all the other currencies that every country is in a mad race to debase.

Finally, please note that Gold is not rising because of inflation in the US, but rather because of the Fed's foolish attempt to defeat deflation. For more on this line of thinking, please see Inflation Expectation Noise

Because all the central banks have joined in on competitive currency debasement, gold is rising in terms of every fiat currency, again, just as one should expect.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Bob Bbq

16 Oct 10, 06:36 |

usd gold

Most likely, the rise of the USD price of gold is inversely proportional to value of the USD ivs other currencies. |