Uranium Investing - A Distant Metal Thunder

Commodities / Uranium Oct 03, 2007 - 09:27 AM GMT Sean Brodrick writes: Earlier this year, uranium was on a roll, then the price swooned. Uranium mining stocks tumbled even further. What went wrong?

Sean Brodrick writes: Earlier this year, uranium was on a roll, then the price swooned. Uranium mining stocks tumbled even further. What went wrong?

Uranium users balked at the high prices, and they put off buying today what they could buy in a few months. At the same time, new supply came on the market, some from speculators and some from the government's stockpiles.

Today, the spot price of uranium is $75 a pound, down 48% from its high in June. And it seems many investors now HATE uranium with the intensity of a thousand burning suns.

So it is at precisely this moment, when the formerly white-hot metal is so unloved, that I am going to tell you why …

Uranium Might Have Cooled, But It Is Ready to Heat Up Again!

If you listen closely, you can hear a distant, metal thunder. That's the sound of stocks that were left for dead pulling themselves up, dusting themselves off, and getting ready to come charging back.

Why is this happening? First, I'll give you three short-term forces …

#1. The contract price is holding steady. At $75 per pound, the spot price of uranium is now about 21% below the long-term contract price, which is what utilities agree to pay producers. In other words, despite a big dip in the spot price, the contract price hasn't fallen that much.

Here's why: I think producers know the price will be going back up so they're not willing to lock in contracts at $75 a pound.

Remember, the typical spread between these two prices is just a few dollars. So while we could see the contract price go down a little bit, it's much more likely that the spot price will come back up.

#2. Easy money is flowing again. Central banks around the world have injected about $500 billion in liquidity into the markets to stop the global credit markets from seizing up. And the Fed's decision to cut rates by half a percentage point poured even more liquidity into the system.

This has a big impact on smaller-cap uranium stocks, especially the kind that aren't producing yet. These companies are basically living on credit, and lower rates make survival cheaper until they can get their resources into production.

Investors realize this. So as rates go down, uranium stocks will likely go up.

Plus, there's also the plain fact that the liquidity also gives investors more money … and they put it to work in areas that seem undervalued and tend to be more speculative (i.e. uranium stocks).

#3. The smart money is already buying. Uranium Participation Corp. (U on the TSX, URPTF on the pink sheets), a Canadian fund that holds physical uranium, just filed papers to sell another $50 million worth of shares. The fund will use 85% of that money to buy more uranium.

Based on this action, I'd say Uranium Participation Corp. believes prices aren't going to get much cheaper!

Early investors — what you might call the smart money — seem to agree. In fact, Uranium Participation Corp. is way off its lows, breaking a recent downtrend and headed higher.

Plus …

Longer-Term, Physical Demand For Uranium Is Strong and Growing

There are 439 nuclear power reactors around the world, according to the World Nuclear Association. Another 34 are under construction, 86 more are on order or planned, and an additional 223 have been proposed.

The World Nuclear Association goes on to say that by 2013, 48 additional nuclear power plants, producing 43.5 gigawatts of energy, should go into service. Over the next decade, an additional 100 plants will be built, with 40 of them in Asia.

And by 2050, scientists estimate the world will need about 900 more nuclear power plants to keep up with growing energy requirements.

Bottom line: There will be tremendous demand for uranium in the years and decades ahead.

Meanwhile, the supply side looks tight. Here are last year's numbers according to UX Consulting …

- Supply from mines was 103 million pounds.

- Demand was 173 million pounds.

- The gap was 70 million pounds, filled by sales from stockpiles.

Add in the 34 new plants under construction and that's more than a 7% increase in demand. Add those already on order or planned, and that's a whopping 24% increase in demand. And remember …

|

| This is yellowcake, the product of uranium extraction … and demand for this stuff is only going to increase! |

A typical 1-gigawatt nuclear reactor requires about 200 metric tonnes (440,924 pounds) of natural uranium per year. During its first year, a new nuclear plant can use TRIPLE those requirements!

Meanwhile, Cameco's Cigar Lake uranium mine — which suffered a disastrous flood — keeps pushing back its start-up date. It now expects to come online in 2011. That's 18 million pounds of uranium — more than one-tenth of total demand — missing from the market each year.

Other projects are coming online, but producers are racing to keep up with soaring demand.

One last thing — remember all those utilities I told you about, the ones that put off buying uranium because they thought they could get lower prices? Well, what if they see prices going back up ? What do you think their natural reaction will be? I think they'll start buying hand over fist, and that could kick off a vicious cycle of higher and higher prices.

Don't Forget About China, the Hungriest Uranium Consumer of Them All!

China's uranium needs and imports are likely to surge by 2010, as new reactors are put on stream. Beijing is also planning to build a strategic reserve of uranium to ensure its growing nuclear power industry is shielded from any sudden supply shortfall.

China has eleven working reactors totaling 8.82 gigawatts in capacity, accounting for just 1.5% of the country's total installed power capacity. It is looking to rapidly increase those numbers …

China is constructing nuclear plants with a capacity of 7.2 gigawatts. This includes two reactors in Zhejiang and two reactors in Guangdong. They should fire up around 2010. And China's latest nuclear project is the Hongyanhe power plant in the city of Dalian. It will have four one-gigawatt reactors. The first unit is due for operation in 2012; the rest will be ready two years later.

Down the road, China has three more nuclear power projects already approved with ANOTHER 7.2 gigawatts in total capacity. These projects are scheduled to come on stream in 2013 to 2015.

As you can see, China's uranium demand is going to ramp up sharply and kick into overdrive as these new plants come online.

Similar things are happening everywhere from Russia to Korea!

The U.S. Is Also Getting Back in the Nuclear Game

Here in the U.S., we generate over 20% of our electricity from 104 nuclear power plants, but a new atomic plant hasn't been built in decades. That's about to change …

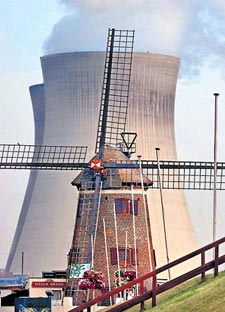

|

| Nuclear is one of the most viable alternative energy sources we have. |

New Jersey-based NRG Energy has filed papers to build a two-reactor addition to the company's existing South Texas nuclear station. NRG hopes to have the first unit operating in 2014 and the second by 2015.

What's more, the U.S. Nuclear Regulatory Commission is bracing for a flood of applications over the next 15 months, which could cover as many as 29 new reactors at 20 sites, representing a potential investment of $60 billion to $90 billion.

Southern Co., Dominion Resources and Duke Energy are among the companies that will likely get applications in quickly, hoping to qualify for potentially billions of dollars in federal incentives and loan guarantees offered as part of the Energy Policy Act of 2005.

Hey, the U.S. has a bunch of very good reasons to start building new nuke plants. Nuclear power can help us get off foreign oil and natural gas. At the same time, it might slow down climate change and lessen the poisonous pollution of coal-fired power plants.

The Nuclear Renaissance Is On! How You Can Profit …

Right now, there are a bunch of great individual uranium miners at dirt-cheap prices — in fact, I just recommended a terrific one to my Red-Hot Canadian Small-Caps subscribers.

The company has seven active uranium mines in the U.S. and Canada, and about 60 million pounds in uranium resources. Even better, you can buy those resources, after mining costs, for about 55 cents on the dollar!

More important than its mines are its mills — it owns 100% of two mills, one of which has a monopoly on its area.

This company's earnings are growing so fast that it trades at just 0.16 times projected earnings growth!

And now let me tell you the best part: This stock is based in Canadian dollars. That means as the U.S. dollar falls against the Canadian dollar, owning this stock helps buffer my subscribers against the pain of their shrinking greenbacks.

If you do some homework, you can certainly find other great uranium mining stocks out there, too.

Or, if you don't like the volatility of individual stocks, check out the Market Vectors Nuclear ETF (NLR). It's an exchange-traded fund incorporated in the U.S. and its members range from uranium producers to explorers to nuclear power plant builders.

You could also buy the Uranium Participation Corp. (U on the TSX, or URPTF on the pink sheets in the U.S.), which I mentioned earlier. It's already rising in anticipation of uranium's rally.

There's no doubt that these investments are more speculative in nature. But that distant metal thunder I'm hearing could be the harbinger of a lightning-fast rally coming in the fourth quarter.

Good luck and good trades,

By Sean Brodrick

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.