Making Money In a Supercycle Bear Market Without Margin Or Trading Or Paying Commissions

Stock-Markets / Investing Oct 02, 2007 - 12:29 AM GMTBy: Bob_Bronson

If you are a money manager, or professionally advise investors, you may be interested in a market commentary showing some of our latest economic reasoning, which an investment advisor client of ours has been using to make money for their managed accounts during this Supercycle Bear Market – and with extremely low downside volatility.

If you are a money manager, or professionally advise investors, you may be interested in a market commentary showing some of our latest economic reasoning, which an investment advisor client of ours has been using to make money for their managed accounts during this Supercycle Bear Market – and with extremely low downside volatility.

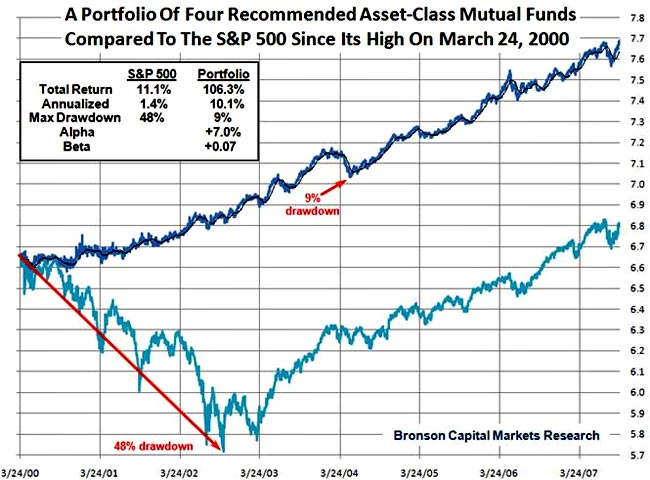

For example, since the stock market top on March 24, 2000 each of their clients has double-digit gains without any interim drawdown exceeding 10% -- with drawdown measured on a daily (not monthly) basis!

The 24-page report is available on request to members of our private e-mail list. To join, simply send an email .

See the chart below of a simple buy-and-hold portfolio (no interim rebalancing) using our recommendations of eight years ago for four mutual funds implementing our continuously bullish positions on bonds (VBLTX) and gold (VGPMX) and bearish positions on the US dollar (ICPHX) and stock market (RYAIX) through today, Sep 24, 2007. Based upon balancing their relative volatility, the initial allocations were assumed to be 25%, 10%, 40% and 25%, respectively.

By Bob Bronson

Bronson Capital Markets Research

bob@bronsons.com

Copyright © 2007 Bob Bronson. All Rights Reserved

Bob Bronson 's 40-year career in the financial services industry has spanned investment research, portfolio management, financial planning, due diligence, syndication, and consulting. At age 23, he and his partner founded an investment research firm for institutional clients and were among the first to use mainframe computers for investment research, especially in the areas of alpha-beta analysis and risk-adjusted relative strength stock selection. Since 1967, he has served as an investment strategist and consultant to various investment advisory firms and is the principal of Bronson Capital Markets Research. If you wish to read more, read his BIO

A note to visitors ~ We do not have a website, but we maintain a private e-mail list. I'm also often asked why we provide research and forecast information for free. Since we are not looking for new business from the internet, I periodically post some of our research and forecasts in exchange for feedback from others. And since we don't publish in academic or industry trade journals, such internet discussion gives us as much peer review as we want and can conveniently assimilate at this time.

Also, the few archiving discussion boards in which I have the time to participate give us new ideas and allow us to establish and maintain intellectual property copyrights for our proprietary research, and to establish a verifiable forecasting record. At the same time, we are able to publicly document our forecasts and help others who otherwise don't have access to our work.

To be added to our private e-mail list, we only ask that you periodically provide feedback: questions, comments and/or constructive criticism to keep our research work and forecasts as error-free, readily comprehensible and topically relevant as possible. If you would like to be added, please explain, at least briefly, what you do, since our e-mailing list is categorized by the backgrounds of the recipients.

Robert E. Bronson, III Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.