Final Freakout? Hyperinflation as the New Deflation

Stock-Markets / Stock Markets 2010 Oct 04, 2010 - 05:16 AM GMTBy: Steven_Vincent

We all know someone who seems to be in a constant state of worry and stress. If it's not one thing, it's another. They seem to have an underlying need to be worried sick about something. One way or another, they are sure that disaster is just around the corner and the worst possible result is the most certain fate.

We all know someone who seems to be in a constant state of worry and stress. If it's not one thing, it's another. They seem to have an underlying need to be worried sick about something. One way or another, they are sure that disaster is just around the corner and the worst possible result is the most certain fate.

That seems to be the current psychological condition of the markets. In August the general dread was of imminent deflationary collapse. Now that the price action in markets has disproven that thesis, the pathology of fear has swung wildly to the diametrical opposite--hyperinflation. From April through July we freaked out about Deflation. Now it appears that from September through November we're freaking out about Inflation.

The currently accepted, inevitable, disastrous outcome stems from the fear that, in response to a collapsing economy, the Federal Reserve Bank will launch a massive program of Quantitative Easing by purchasing bonds directly from the US Treasury with newly printed US Dollars. That this will come to pass is virtually religious canon, particularly for the gold bugs. That such a course of action will necessarily result in a Weimar Republic/Zimbabwean hyperinflationary depression is another inviolable article of faith in the New Religion.

Whether you tune into mainstream financial media or peruse the contents of alternative blog sites, the underlying assumption promulgated by experts and pundits is that disaster is coming, one way or another, so hunker down and get ready for it. Since fears of deflationary collapse are not being verified by a concomitant fall in prices, then rising prices must, of course, mean that the contrary disaster is imminent. Make no mistake, calamity cometh, we just picked the wrong one to believe in the last time around. Deflation? It is sooo August 2010. With the press of a few buttons on a console at CNBC and the inclusion of a mere phrase in a Fed announcement, Hyperinflation is the new preoccupation du jour.

It would be interesting to compile a book of the instances in market history when disaster was presumed inevitable and yet little or nothing of the kind resulted. It would make a great companion to Extraordinary Popular Delusions and the Madness of Crowds. And it would probably be a very big book.

Folks, let's all take a deep collective breath. It is possible that there will be no QE, no hyperinflation, healthy world economic expansion and even eventual economic recovery in the U.S. Right now, many markets (most notably gold, Treasuries and the US Dollar) appear to be building speculative price structure on a set of assumptions that may not be valid. And if they are proven not valid or even drawn into doubt (let's say at the November 2nd Fed meeting), then what do you think is going to happen to that price structure?

Yes, it is possible that we will see Quantitative Easing and a highly or even hyper inflationary result. I'm just questioning the sentiment environment of the general acceptance of disaster as inevitable. We know that the public is generally wrong headed and that the consensus view tends to be grossly wrong at turning points. Yesterday I visited some friends and when I walked into the house the conversation was of $1300 gold and hyperinflation. My contribution to the discussion was that the very fact that we were having the conversation was itself evidence that the hyperinflation play may not materialize.

I'm an anti-Keynesian, anti-Monetarist, Austrian School, Free Market Libertarian. Those are my personal, philosophical preferences. Unfortunately the world does not presently--and will not likely in any relatively near future--conform to my ideological demands.

We who hold such views yearn for the failure of Keynesian Socialist Monetarism. When the "inevitable" disastrous harvest of their erroneous policies is reaped then, we believe, finally the forces of Freedom and Markets will hold sway and things will be set right.

But we have been on the outside shaking our fists at The Man for so long we have not noticed that the pendulum has swung so substantially in our direction that the Establishment itself is propagating our unfortunate proclivity for apocalyptic doomsaying. Keep in mind that it is in the interests of Big Government, Big Finance and Big Media to perpetuate the sense of impending doom. Only if the majority are convinced that disaster lurks around the corner are they willing to accede to bigger government, more regulation, more taxes, and massive power grabs like Health Care and Financial Reform. And when the bottom is in and it is time to buy, Wall Street will work overtime to convince the majority to stay on the sidelines in "safety" until it is time to let the public chase prices higher into the inevitable top.

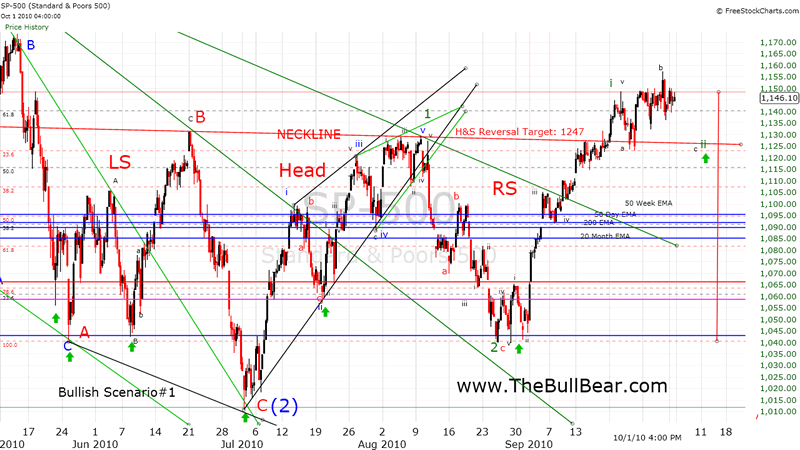

Now for sure, contrarianism can itself be carried to an extreme and in the middle of a move it does not work. In the middle, the majority held, accepted dogma can be valid. How can we tell whether we are in the middle, beginning or end? Is this the "Final Freakout" before balance is restored to the market psyche or are we launching into the maw of chaos? Technical analysis of markets allows us to gain objectivity and separate reality from opinion and probability from possibility.

Generally these reports as well as twice weekly video reports are prepared for BullBear Trading Service members and then released to the general public on a time delayed basis. To get immediate access just become a member. It's easy and currently free of charge.

Disclosure: No current positions.

By Steve Vincent

Steven Vincent has been studying and trading the markets since 1998 and is a member of the Market Technicians Association. He is proprietor of BullBear Trading which provides market analysis, timing and guidance to subscribers. He focuses intermediate to long term swing trading. When he is not charting and analyzing the markets he teaches yoga and meditation in Los Angeles.

© 2010 Copyright Steven Vincent - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.