Colombian Gold and Alder Resources

Commodities / Gold and Silver 2010 Oct 03, 2010 - 11:35 AM GMTBy: Richard_Mills

Colombia is a constitutional republic bordered to the east by Venezuela and Brazil, to the south by Ecuador and Peru, to the north by the Caribbean Sea (home to 20% of the population and the location of the major port cities of Barranquilla and Cartagena), to the northwest by Panama and to the west by the Pacific Ocean (the principal Pacific port is Buenaventura).

Colombia is a constitutional republic bordered to the east by Venezuela and Brazil, to the south by Ecuador and Peru, to the north by the Caribbean Sea (home to 20% of the population and the location of the major port cities of Barranquilla and Cartagena), to the northwest by Panama and to the west by the Pacific Ocean (the principal Pacific port is Buenaventura).

worldatlas.com

An unprecedented mining and oil boom is taking place in Colombia because of:

- Significant improvement in the security situation

- The economic stability of the country

- Recent policy reforms - cutting capital controls, implementing legal stability contracts

- A highly-qualified Colombian workforce

- Rising commodity prices

- Investment incentives

- Diversification of the export base - new bilateral investment treaties and trade agreements

- Modernized free trade zone mechanism

The World Bank estimated the country's 2008 GDP at $244 billion, almost triple the figure from five years earlier.

In 2009 Colombia attracted US$8.6 billion gross foreign direct investment (FDI) with a full 80 per cent going to petroleum and mining - investment in the mining sector nearly doubled to US$3.1 billion.

So far in 2010, the Bolsa de Valores de Colombia (also known as the BVC, the principal stock exchange of Colombia) has surged more than 35 percent - one of the reasons for the spectacular growth could be Colombian pension funds have a lot of money to deploy and they want to deploy it in their own country.

Colombia's foreign trade ministry says it expects Colombia to attract US$10 billion in foreign investment in 2010. The government, under new President Juan Manuel Santos, is forecasting a healthy jump in gross domestic product this year - 4.5 per cent.

The countries 12-month running inflation rate is nearly 2 percent and it's very likely that the central bank will be able to maintain its current benchmark lending rate of 3 percent.

A World Bank Doing Business report said "Colombia has been one of the top 10 reforming economies for three consecutive years: 2008, 2009 and 2010." Colombia's international ranking improved by 42 positions from 2007 to 2010.

The World Bank also ranked Colombia number one in Latin America for its ease of doing business - the World Bank Ease of Doing Business Index tracks a broad cross section of indicators including:

- Starting a business

- Dealing with licenses

- Hiring and firing workers

- Registering property

- Getting credit

- Protecting investors - Colombia is rated first in Latin America and fifth globally

This author believes the major reason Colombia has seen such growth and prosperity, and is likely to continue to do so, is its supply of natural resources. Colombia is rich in petroleum, natural gas, coal, iron ore, nickel, gold, uranium, copper, salt, platinum and emeralds (Colombia ranks as the world's major source of emeralds). Colombia's natural resource exports account for nearly 13% of its gross domestic product (GDP).

Colombia is Latin America's fifth-largest producer of gold with first quarter 2010 output of 415,755 ounces - up 13 per cent compared with 367,081 ounces in the same period last year and the highest quarterly level in 20 years.

Mario Ballesteros, head of Colombian government mining regulator Ingeominas, says only about 19,000 square miles of Colombia's 440,000 square miles have been explored (40 per cent or 176,000 square miles of the country is legally off limits due to natural reserves and environmentally sensitive regions). Mr. Ballesteros told Reuters earlier this year that production could reach three million ounces by 2012.

Alder Resources TSX.V - ALR is solely focused on gold exploration in Colombia. Shares Outstanding: 39,712,381 Fully Diluted: 51,307,380 Cash: $3,800,000.00 Debt: nil

The La Montañita Gold Project:

The Project encompasses approximately 1,000 hectares, including a 30 hectare mineralized mountain that the Company understands has been the subject of artisanal gold mining for over 80 years. Historic mining consisted primarily of underground tunneling that followed high grade sub-vertical structures varying in width from 20 to over 60 centimeters.

Alder has a National Instrument 43-101-compliant technical report by an independent qualified person. Highlights of the report include NI 43-101 compliant sampling of underground gold (Au) veins with grades of up to 186.5 grams per tonne (gpt) gold, 272 gpt silver and 0.93 per cent copper. Using a price of $1244 an ounce gold, $19.77 an ounce silver and $3.42 a pound copper that's up to US$7707 per tonne rock.

Waste dump sampling conducted by the previous owners of the claims reported grades up to 12 gpt Au. This might add significant value to the project as it could be suggesting economic grades of mineralization outside of the known high grade veins.

The waste dumps are material left behind by the artisanal miners after high grading the veins - they are considered by these miners to carry no gold grade. Sampling the artisanal miners waste dumps is often an excellent way to gather information on the gold content of the host rock surrounding the high grade veins.

The Company intends to analyze the potential for a bulk tonnage open pit mine at the Project based on an understanding that the high grade veins at the Project appear to be part of a larger lower grade stock work, with four prominent fracture orientations within a granodiorite host rock.

Management believes the host rock, scope and mineralization style are comparable to B2/Ashanti Gold's nearby Gramalote deposit also located within the same batholith.

The Gramalote deposit is held by a joint venture between Anglogold-Ashanti and B2Gold and hosts a NI 43-101 compliant estimated inferred mineral resource of 74.4 million tonnes at an average grade of 1.00 g/t gold for a total of approximately 2.4 million ounces of gold. The Gramalote property is less than 40 km from the La Montañita Project.

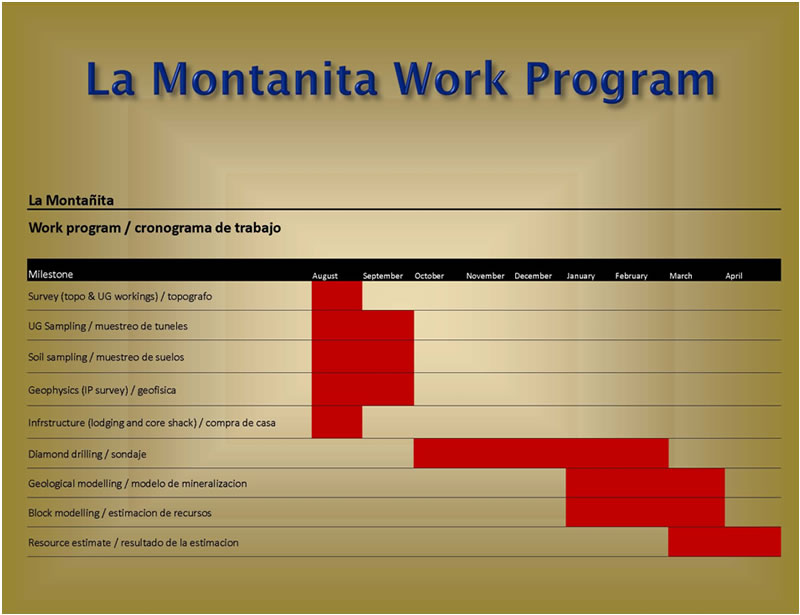

Alder is currently sampling more than 500 meters of tunnels and will start a drill program at the end of September.

Management

Rene Bharti, President CEO & Director - has held roles in several public and private companies, including those in the resource, and other sectors. Mr. Bharti holds a Bachelor of Commerce (Honours) degree from Queen's University, Canada. Mr. Bharti's experience in the mining industry will be important for the company's development of its projects in Colombia.

Bruce Ford, CA, Chairman & Director - has been involved with Alder Resources for 3 years. Prior to the last 6 years of merchant banking ventures such as Alder; Bruce was the Vice President FX & Commodities at Ontario Teachers' Pension Fund responsible for global macro strategy of the currency and commodity exposure for the fund.

Will Randall, PGeo, VP Exploration & Director - experience includes management roles in both mineral exploration and production. During his career he has run, or participated in, exploration programs responsible for numerous discoveries and has taken deposits from the resource stage through to feasibility and production. Mr. Randall has recently served as VP Exploration for Rodinia Minerals, Liberty Mines and is Manager of Exploration at Forbes & Manhattan. Mr. Randall has worked extensively in South America throughout his career.

Honorable Pierre Pettigrew, p.c. - Mr. Pettigrew has had a distinguished career with success in both public and private sectors. From January 1996 to February 2006, he served as a Member of Parliament. Most notably, he led a number of senior government departments in his ten years as a minister in successive federal Canadian governments. Among other positions, he has served Canada as the Minister of Foreign Affairs, Minister for International Trade and the Minister for International Cooperation. He is now with Deloitte & Touche LLP in the role of Executive Advisor, International. Prior to entering national politics, Pierre Pettigrew was the Vice President of Samson Belair Deloitte & Touche International (Montreal), where he acted as an international business consultant.

Mr. Pettigrew states, "I've been very impressed over the last few years by the progress Colombia has made toward significant political stability and substantial economic progress. Mining in Colombia, as it has been in Canada is at the heart of its future. I'm delighted to join Alder's board as it is poised to take advantage of its good mining code and contribute to a stable development of a country in our hemisphere."

Conclusion

Declining confidence in government, markets and paper money is pushing gold toward a front and center mainstream media position.

"The gold story has been around for millennia, but is now attracting investment for thoroughly modern reasons...none of the three major tradable currencies will regain its role as a prized store of value. Gold is moving from the shadows, where economists and politicians had consigned it, to center stage." ~ Don Coxe, founder Coxe Advisors

Gold junior companies reporting good to great results regarding project acquisitions, sampling results and drill assays and having experienced management with tightly held, low, outstanding share counts should do well for their investors.

There has long been a Colombian discount - due to past violence - and most of the country has yet to be explored by modern exploration methods. Colombia definitely is a country of "low-hanging fruit" in regards to potential discovery of mineral resources.

Alder Resources is still a relatively unknown, but high potential junior currently focused on gold in Colombia.

Is gold in Colombia and Alder Resources on your radar screen?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about our junior markets please visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Richard is host of aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 200 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor and Financial Sense.

Copyright © 2010 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.