Indian Rupee Currency Forecast to Fall Towards $36-38

Currencies / India Sep 26, 2010 - 04:09 AM GMTBy: Dhaval_Shah

Currency movement decides the direction of the economy. In normal times, opposite statement would have been proved right. But, this time is different. Every nation is ready to wage war against their trade partners and other exporting destinations to ensure that country can continue to boast their exports and cheap currency can help them to inflate out their debt loads.

Currency movement decides the direction of the economy. In normal times, opposite statement would have been proved right. But, this time is different. Every nation is ready to wage war against their trade partners and other exporting destinations to ensure that country can continue to boast their exports and cheap currency can help them to inflate out their debt loads.

This is not the time to find the smart and strong currency but to search for the least ugly currency.

This is not the time to find the smart and strong currency but to search for the least ugly currency.

After mammoth research exercise, I have reached to the conclusion that Indian Rupee will appreciate further and will breach Rs. 40 mark per dollar in 6-10 months time period.

Let us look at Reasons:

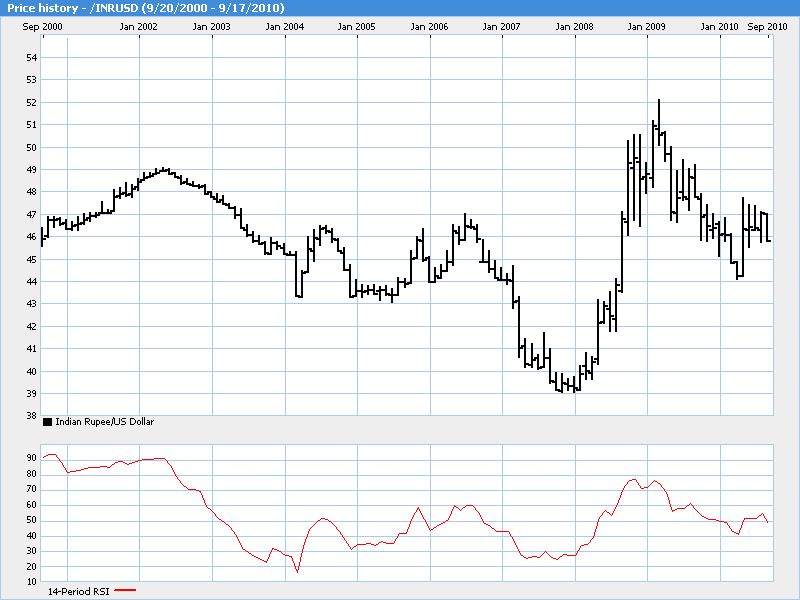

A. Equity Market: Economists and Investors agree that India’s chalked growth engine resumed in 2002-2003. With that Equity indices too resumed upside in new uncharted territory. From around 1000 in 2002, NIFTY index reached to above 6000 end of 2007. From below chart, you can observe that Indian rupee started gaining strength from same period from 2002 and appreciated full 20% till end of 2007.

Remember, I am talking about pre crisis period, when whole world was growing at rapid pace irrespective of developed or developing economies. There was no noise and chaos like sinking economies, sovereign debt crisis or even housing slump in US, and debt to GDP ratios worsening to 250% for Japan and above 100% for many European nations.

Between 2003 and 2007, there was confidence in air for investments across the world and it looked like this growth would never end.

Even in this confidence strengthening period, with the rise of Equity market, foreign capital flowed in India to unprecedented level and on account of that Rupee appreciated to the level of Rs. 39 from Rs. 49/$.

Think about the present situation, half of the world(developed nations including Japan) is still mired into recession. Sovereign crisis is still looming large on European countries.

World knows that US, UK, Europe and Japan will grow at historical low rates for years to come. The free investment capital of the of world said to be around $ 3 tn has to find its way in some assets to keep growing at least at inflation adjusted return.

India received around $17 bn FII inflow in 2009 and around $16 bn in year 2010 till date. Put together $33 bn FII inflow from March 2009 till date could drive sensex from below 8000 to above 20000 mark. This leads me to draw a very important conclusion that Indian Equity market is very shallow in terms of depth of the market in absorbing liquidity. Remember, $ 33bn FII inflow, which gave 2.5 times return to FIIs is just 1.1% of free investment capital.

Even if India gets just 2-3% of free investable surplus of world, it is staggering 60 to 90 bn dollars.

I believe, you can imagine where it ($90 bn)can drive the rupee?

But, does FII inflow drives sensex only? No,

Inflation:

We have seen historically that due to shallow depth of Indian Equity Market, FII inflow spills over from Equity to other asset classes and drives inflation higher.

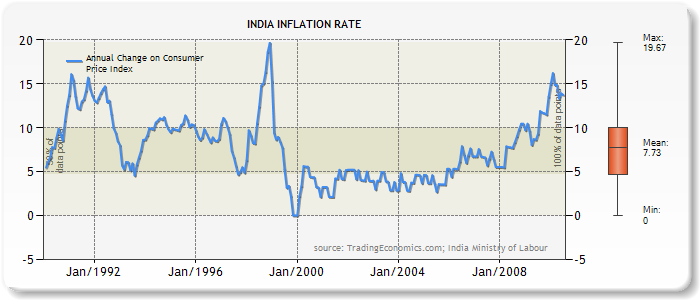

NIFTY index was around 850 in Dec 1998 and went up to 1800 in 1 short year in Jan 2000. With that inflation also jumped up. Inflation was around 5% in Dec 1998, from there it went up to 15% in Jan 2010. Look at below chart.

Also, look for recent evidence, from around 2003 till date Nifty has climbed 6 fold and with that Inflation also rose from around 3% in 2003 to 15% in recent times.

This establishes relationship between Equity Market performance and Inflation.

But, why does this relationship mean to rupee?

Well, India is still a nation wherein 20 crore people leave on the daily income of just Rs. 20. And, around 40 crore people leave on the income of around $2 a day.

Politically and Fundamentally, Indian Government and Central Bank can not afford to foster inflation, allowing it to go up out of control.

Historically, measures used by Central Bank focuses on raising interest rates to curb the demand. Yes, we know that prices go up not because of demand but because of wastage or lack of storage or lack of infrastructure which can facilitate smooth transportation across the nation.

But, RBI tool kit is limited and only powerful arsenal is jacking up interest rates.

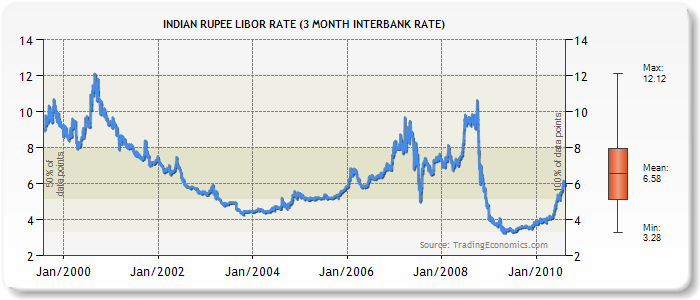

Interest Rates: We have repeatedly experienced higher FII inflow and higher inflation drives up the cost of money. Look at below chart.

Between, 1998 and 2000 cost of money for bank went up substantially. And, again between 2003 to 2008-09, cost of money for banks went up from around 4% to around 11% by end of 2008.

Higher interbank rates indicates higher deposit rates and Higher deposit rates attracts huge capital inflow from NRIs and from Financial Institutions.

Game squares here. With higher inflow, rupee strengthens further scaling new highs against capital exporting nations.

Look at Chart, it clearly shows upside potential for interest rates.

Make no mistake, Interest Rates will still rise further. At least 100-150 basis points before fiscal year ends.

Let us explore other factors.

Fiscal Deficit:

After 2008 crisis, Indian Govt took unprecedented steps and decided to spend out of its way allowing fiscal deficit to rise as high as 9-10% of GDP.

| Year | Gross fiscal deficit | % rise YoY |

| 2002-03 | 232591 | |

| 2003-04 | 232062 | -0.23 |

| 2004-05 | 233238 | 0.51 |

| 2005-06 | 239560 | 2.71 |

| 2006-07 | 230432 | -3.81 |

| 2007-08 | 203922 | -11.50 |

| 2008-09 | 473947 | 132.42 |

| 2009-10 | 597414 | 26.05 |

Indian Finance Minister decided to widen the fiscal whole 132% more from previous year in 2008-09 and 26% more in 2009-10.

Fiscal Deficit means, Govt decided to spend money on several schemes to sustain the demand, to help spur economic activities in country borrowing from market. Like in 2008-09, Govt earned around 6.0 lac crore through tax and other sources of revenue, borrowed 4.73 lac crore from market and spend entire around 10.5 lac crore on different schemes to boost economic activities.

But,since Govt has to repay the borrowed money with interest. And, higher Govt borrowing leads to higher interest payment. In year 2008-09, Govt spent 2.5 lac crore to pay just interest on borrowed money in previous years.

But, higher Govt spending means higher liquidity of currency in market and that helps drive currency lower.

Like higher Govt spending through deficit drived rupee lower to Rs. 52 level/$ from Rs. 39/$ in 2009.

But, Govt can not continue to spend like this. Greece, Ireland, Portugal, Spain, Iceland chose path of spending through deficits. Today, these nations are facing difficulties in raising money. People are unwilling to lend them and those who are lending, demand 4-5% higher interest rates then prevailing in world market. These nations were close to bankruptcy last year if IMF and European Union had not intervened.

Hence, India can not continue spending @10% fiscal deficit of GDP.

Our finance minister has vowed to shrink fiscal deficit and bring it back to around 3% of GDP in next few years.

With lower liquidity of currency in market, rupee hardens.

Hence, beware Govt has no option but to contract fiscal spending in years to come and that will drive rupee higher.

Post Crisis Fundamentals:

There is 180 degree shift in fundamentals now between West and East excluding Japan. Policy makers, Investors and smart money know that West will grow at subdued rates for many years to come. Not only because of 2008 crisis but demographics too are not supportive to higher growth rate. Median age of Western nations nations are now reaching to 40-45 bracket and that drives productivity on lower side.

Average age of India is now 26 and hence there is a lot of demand potential, productivity growth, huge labour force and most important lots of new inventions, ideas and resultant lots of new entrepreneurs and businesses.

This is driving Global Capital to India, China and South Asia.

More the western economies sink, more capital will flight to Asia in search of higher return.

For long long period, this strategic shift post crisis will build constant pressure on rupee.

Currency Devaluation by US, Europe:

As I have written number of times, the only way out for US and Europe is to sink their respective currencies. You have constant spat between US and China, US and Japan on front pages of newspaper where Presidents and Prime ministers are accusing each other for not allowing their currency to appreciate.

US President and Treasury secretary are building constant pressure on China to allow Yuan to appreciate further. When US says Yuan is undervalued against dollar. It means US is saying that Dollar is overvalued against China and other developing exporting economies and they should allow their currencies to harden and thus ensuring much depreciated dollar.

This is happening right in front of our eyes everyday.

Conclusion:

Make no mistake, Rupee will remain under constant pressure of appreciation in time to come.

Rupee should test 44.70 mark in coming weeks, then will consolidate around 45-46 for short period before it dives to 40 against dollar.

Stay tune my reports for continuous update on currency trends.

You can subscribe to my currency report wherein I update clients on future currency movements with specific levels. Subscription charges are Rs. 10000 per quarter.

Regards,

Dhaval Shah

Blog: http://investmentacademy.wordpress.com

E-mail: investmentacademy@yahoo.com, academyofinvestment@gmail.com

© 2010 Copyright Dhaval Shah - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.