U.S. and China Playing Currency Manipulation Kabuki

Currencies / Market Manipulation Sep 21, 2010 - 05:09 AM GMTBy: Dian_L_Chu

In his testimony before the U.S. Congress last Thursday, Treasury Secretary Tim Geithner accused China of "very substantial" currency intervention, and the U.S. will use every available tool to urge China to let the yuan rise more quickly, including taking it up in front of the G20 Summit and WTO. President Obama quickly followed up with some more tough rhetoric on Monday, while U.S. lawmakers are weighing new legislation against China.

In his testimony before the U.S. Congress last Thursday, Treasury Secretary Tim Geithner accused China of "very substantial" currency intervention, and the U.S. will use every available tool to urge China to let the yuan rise more quickly, including taking it up in front of the G20 Summit and WTO. President Obama quickly followed up with some more tough rhetoric on Monday, while U.S. lawmakers are weighing new legislation against China.

In June, China pledged to relax its grip on yuan. Since then the currency has risen 1.53%, but economists estimate the yuan is undervalued by 12% to 40%. This makes yuan an effective political diversion of the high U.S. unemployment in an election year.

Yuan & American Jobs

The prevailing argument in Washington for taking a hard line against China is that a yuan appreciation would bring manufacturing jobs back to America, as preached by observers including Paul Krugman and C. Fred Bergsten from the Peterson Institute for International Economics (PIIE).

Nevertheless, I believe this is overly hyped, exaggerated, and mostly politically motivated. Besides, not everyone is as certain about how large a role the RMB's value would play in the U.S. economy.

For example, Bergsten from PIIE said in his testimony to Congress that "every $1 billion of exports supports about 6,000 to 8,000 [mainly high-paying manufacturing] jobs in the U.S. economy."

However, a recent research by Joseph Francois, and Simon J. Evenett indicates quite the opposite. Dr. Francois found that the majority of China's exports to the U.S. are not destined for American consumers, but for firms in the form of components and other unfinished goods.

Since imports from China and elsewhere feed into the overall cost structure of the U.S. economy, roughly 420,000 U.S. jobs could be lost if the RMB is revalued by 10%, based on the calculation by Evenett & Francois.

U.S. Manufacturing Already Lost

The fact is that America has been evolving into an economy that’s more service and high tech oriented and gradually losing its manufacturing base along the way for more than 10 years. A yuan revaluation might improve the trade imbalance and gain some jobs back to the U.S., but it is not going to totally reverse the economic course set in motion over a decade ago.

In addition, China’s lower cost advantage has more to do than just an undervalued yuan. A rising yuan will just take one element out of the equation, and thus will unlikely make as dramatic difference to the US manufacturing sector as people may expect. Even if it does, companies would just seek out other lower-cost countries such as Vietnam, Indonesia or Africa, instead of moving operations back to the U.S.

And there’s the “Wal-Mart Effect” that cheap imports from China actually help the U.S. consumer's pocketbook, increase companies’ profitability, thus encouraging more hiring and jobs.

A Free Pass for Japan?

The yuan issue is also further complicated by Japan’s first unilateral yen intervention in six years-- estimated at more than 2 trillion yen ($23.32 billion). Japanese officials already indicated the government will continue the yen intervention if necessary. And judging from its last intervention in 2004--Y35+ trillion in 15 months—Japan’s got a long way to go.

U.S. lawmakers conspicuously didn’t address this new act of Japan during last week’s congressional hearing. In light of recent heightened tensions between China and Japan, giving Japan a free pass to intervene would only infuriate Beijing. That means zero chance for China to even consider curtailing such activity, if just for the sake of “saving face”.

Forex Management - A Group Sport

On the other hand, addressing it with both China and Japan would open a whole new can of worms, since they are hardly the only countries engaging in exchange rate management

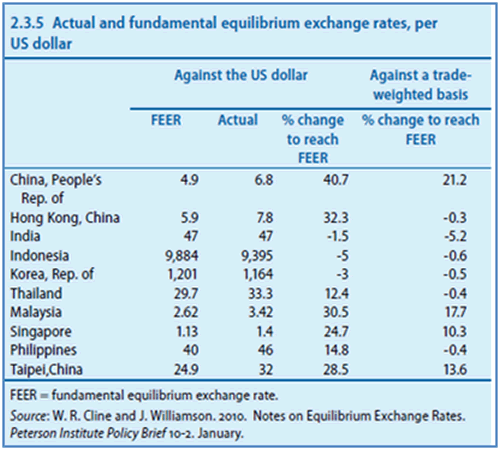

In its 2010 annual outlook report, Asian Development Bank quoted studies suggesting that the currencies of Hong Kong, Malaysia, Taiwan and Singapore--in addition to China--were more than 20% undervalued against the dollar, while the currencies of the Philippines and Thailand were also about 12-15% undervalued. It said that only Indonesia, South Korea and India had currencies that appeared to be slightly overvalued (See Table).

Reacting to Japan’s latest intervention, Columbia, joining Brazil and Peru, became the latest Latin American economy to intervene in the currency market. And there are many more likely candidates.

As the U.S. is on the verge of calling China a “currency manipulator”, and slapping on heavy tariffs, expect a dramatic global rhetoric exchange around the subject of “How about Japan and others?”

International Support?

Since the financial crisis, the pace of accumulation of U.S. dollar by all central banks has increased reflecting a flight to the perceived safety of U.S. treasuries.

As such, any currency movement, even a gradual one, causes a significant change in the value of a country’s reserves. Supporting America’s yuan cause could put other countries' currency under question and reserve value at risk as well.

And don’t forget China’s growing financial and investment clout in many parts of the world. So this planned global yuan campaign by the U.S. (and Europe), will unlikely gain that much international support.

Yen & The Plaza Accord

Despite renewed yuan criticism, those speculating that China would yield to increasing political pressure from the U.S. will be greatly disappointed. As outlined in my previous post, a rapid rising yuan would post major risks to China’s export, employment and national wealth.

And thanks to the Plaza Accord of 1985, China gets to observe and learn from the Japanese yen. Yen appreciated against the dollar and Germany's deutsche mark complying with the Accord, which eventually left Japan facing a dramatic asset bubble burst. China is not about to walk down that same fateful path.

Currency Kabuki Continues

As discussed here, China has no incentive to cave in and deviate from the current yuan course—gradual and modest ascend over time--which has been working for them since the global financial crisis. And truth be told, in today's global structure, the U.S. needs a healthy, growing Chinese market for its own wellbeing (and vice versa for China).

If China's wants to take it slow on yuan to maintain growth, it is not necessary such a bad thing for America either. Meanwhile, the U.S. would probably do better to look for self-prosperity by focusing on many other more serious economic and financial issues, instead of pinning hopes on a rising yuan.

While it is nice to see President Obama and Mr. Geitner talking tough right before the mid-term election, the topic of yuan is going to be a long and drawn out international debate. So, we could expect to see the currency kabuki between the U.S. and China continue playing ..... with a new supporting role by Japan.

Disclosure: No Positions

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.