It’s Not Too Late To Buy Gold!

Commodities / Gold and Silver 2010 Sep 17, 2010 - 01:55 PM GMTBy: Sy_Harding

Gold is at a new record high, and there’s a lot of talk about it being time to take profits, to expect a serious decline, in fact the end of its 10-year bull market.

Gold is at a new record high, and there’s a lot of talk about it being time to take profits, to expect a serious decline, in fact the end of its 10-year bull market.

Gold is up 16% so far this year. If it ends up for the year it will be its 10th straight year of gains, and the longest bull market for gold since 1920. So yes, by that measurement gold’s bull market is aged.

Those claiming gold’s bull market is ready to top out have sound arguments. Unfortunately, they’re the same arguments we’ve heard several times over the last ten years.

1. Gold is a traditional hedge against inflation, and the threat of inflation has gone away this year. (This year the threat is so gone away it’s been replaced with concerns that deflation is the more likely upcoming problem).

2. Unlike oil or corn, gold is a commodity that doesn’t get consumed. Every ounce of gold ever mined in the history of time is still in existence on the planet. It’s in the hands of central banks, investors, jewelry-makers, and the jewelry already stashed away in vaults and households. Yet still more gold is coming out of the ground every day. Why should it become more valuable?

Sound reasoning. But it’s still a case of supply and demand.

The demand side still has considerable potential. For instance, central banks have always held significant amounts of gold as part of their reserves. However, as gold was declining in the 1990’s central banks sold considerable amounts of gold from their reserves for various reasons. In fact, that central bank selling near the lows drove gold down to levels it may not otherwise have seen at its low in 2001.

There are rumors that central banks plan to bring the levels of gold in their reserves back up again over the next year. It makes sense given the losses they’re seeing on the paper they replaced the gold with (primarily dollars), and the potential bubble in treasury bonds.

Demand for gold as a traditional safe haven by investors should also continue as uncertainties in currencies, markets, and economies are likely to be with us for some time yet.

But I prefer technical analysis as a better guide to the direction of gold than the always conflicting opinions regarding surrounding conditions.

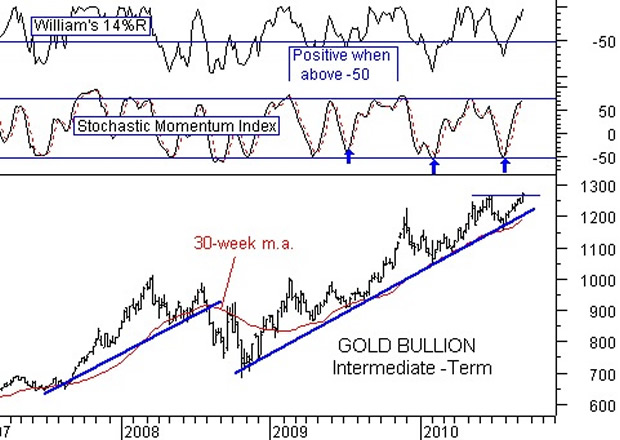

And the consensus of our technical indicators remains on our latest buy signal for gold.

Gold lends itself quite well to trend following, and support/resistance levels. Its 30-week moving average continues to prove itself as important support, while the breaking of trendlines to the downside are negatives.

Currently, the support at the 30-week moving average and the trendline have been successfully tested again, and gold has rallied off those support levels and broken out above the previous resistance to a new high, a technically bullish event.

I’m not saying you can buy gold and forget about it. It will need watching. But it looks to us like another leg up for gold is underway.

Sy Harding is president of Asset Management Research Corp, publishers of the financial website www.StreetSmartReport.com, and the free daily market blog, www.SyHardingblog.com.

© 2010 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.