Stock Market’s Internals Improving; Volume Remains Light

Stock-Markets / Stock Markets 2010 Sep 16, 2010 - 11:40 AM GMTBy: Chris_Ciovacco

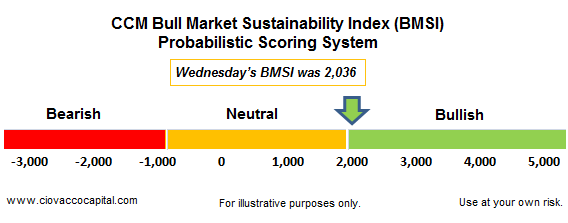

The stock market’s internals are healthier than they have been in seven weeks. The CCM Bull Market Sustainability Index (BMSI) has poked its head out of neutral territory and into the very low-end of bullish territory. Wednesday’s BMSI reading came in at 2,036. We designed the BMSI as an “it’s time to pay attention” index. It is telling us to pay attention right now as the BMSI sits on the neutral-to-bullish line of demarcation.

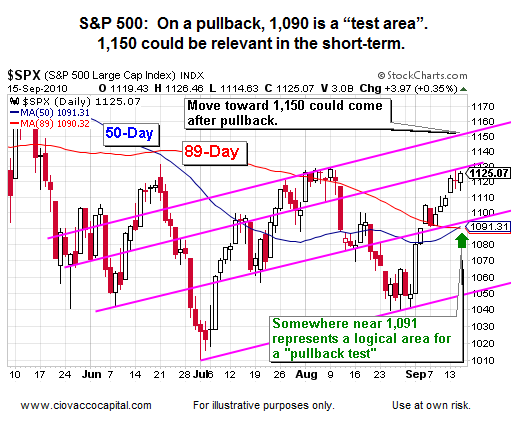

The ongoing problem with the current market is lack of buying conviction and/or tepid volume relative to what we want to see to confirm the market’s improving internals. The top end of the S&P 500’s current trading range on a closing basis is 1,127; intraday was 1,131. On a weekly closing basis, the number to watch is 1,122. If we can close above 1,122 on the S&P 500 this week, that would be another step in the right direction. In terms of possible investment strategies above and below 1,131 on the S&P 500, Investment Contingency Plans 2010-2011 outlines attractive asset class mixes based on several market scenarios.

The daily CCM 80-20 Correction Index closed yesterday at 465, which is not all that concerning. Of the 56 significant market corrections we studied to develop the 80-20 Correction Index, only one of them occurred with a daily 80-20 value lower than 465. This means 98% of significant market reversals occurred after hitting higher 80-20 Correction Index levels than what we have today.

On a pullback, we have the 50-day moving average (MA), the 89-day MA, and an upward-sloping trendline intersecting near 1,090. If we can move higher, which may come after a pullback, 1,150 is a logical area of possible resistance.

With the Bank of Japan intervening in the currency markets, we will have to keep an eye on the U.S. dollar. The research piece Yen Intervention: Impact on U.S. Dollar, Copper, Oil, Silver, and Gold looks at the last period of yen intervention (2003-2004), which may help shed some light on possible investment outcomes in the present day.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.