Risk Aversion Rises in August as Double Dip Concerns Grow

Commodities / Gold and Silver 2010 Sep 03, 2010 - 06:54 AM GMTBy: GoldCore

August and the summer are now over and investors and savers are now focusing on the autumnal months ahead. Stocks internationally had their worst August performance since 2001 and the ISEQ fell 7.2% in the month. Mounting concerns about the health of the economic recovery in Ireland, the US and internationally saw investors move into government bonds and gold. Some respite came due to the falling price of oil - oil was down 8.9%, its first monthly decline since May.

The Dow Jones Industrial Average ended the month 4.3% lower, while the S&P 500 was down 4.7%. The weak performance of equity markets was mirrored across the world's major financial centres, with the Nikkei 225 down 7.5% and Germany's Dax down 5.8%. Mining stocks on the FTSE helped it to only fall 0.6% in the month. With the S&P 500 index down 5.9% for the year and September being historically the worst month for stocks, traders are bracing for a continued downward bias.

Gold was up 5.6% in August thereby regaining the 5% losses seen in July. Importantly, from a technical perspective gold recorded a record (nominal) monthly high close (see chart below) which should see momentum traders continue "to make the trend their friend". This could result in June's record high being breached again, possibly as soon as in September. Especially as safe haven demand for bullion internationally remains robust and Indian festival seasonal demand looks set to be healthy.

Gold - 30 days (Tick)

Gold is only a few dollars below the record daily high close ($1,258/oz)and record inter day high now ($1,265/oz) but it is important to remember that these record highs are nominal highs and gold remains nearly half the more important record inflation adjusted high of $2,400/oz. Gold is now up 14% so far in 2010 and looks set to have the 10th year of gradual appreciation (some 16% per annum in dollar terms).

The ECB keeping rates at a record low of 1% and zero interest policies in the US and in most western economies remains bullish for gold as the opportunity cost, the lack of yield, of owning gold is negligible, especially with inflation having picked up recently in many economies internationally. Further signs of burgeoning food inflation were seen in the surge in the price of global meat prices which have risen to 20 year highs.

Gold in USD - 5 Year (Monthly)

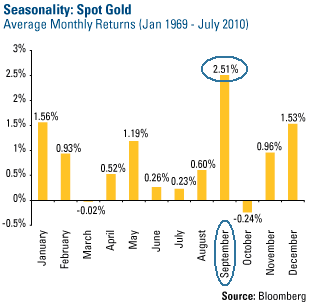

September can be the 'cruelest month' for stocks. Conversely, more years than not, precious metals prices perform well in September and many analysts reckon this year will not disappoint those owning gold. Given the uncertain financial and economic outlook, it is important that investors remain diversified with allocations to cash, short dated government bonds, international equities, and gold.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.