Investors Don’t Get Trapped by Market Micro-Bubbles, the Silent Wealth Killers

Stock-Markets / Financial Markets 2010 Aug 29, 2010 - 11:33 AM GMTBy: Jared_Levy

Today's article is about market bubbles. Right now, you're probably wondering why I am talking about market bubbles when the S&P 500 is trading down 6.5% since the first trading day of January this year, and down 33% from the 2007 highs. On top of that, home prices have fallen 30% (on average) to 2002-2003 levels, and unemployment is nearly 10%. Frankly, most of the globe is struggling to pay its bills. So doesn't all of this mean any kind of market bubble has burst? Well, the answer is, not all of them.

Today's article is about market bubbles. Right now, you're probably wondering why I am talking about market bubbles when the S&P 500 is trading down 6.5% since the first trading day of January this year, and down 33% from the 2007 highs. On top of that, home prices have fallen 30% (on average) to 2002-2003 levels, and unemployment is nearly 10%. Frankly, most of the globe is struggling to pay its bills. So doesn't all of this mean any kind of market bubble has burst? Well, the answer is, not all of them.

Even in tough economic times, when everything seems (and maybe should be) cheap, investors will always find investments to pile into, even if they are short-term bursts, which can easily cause micro-bubbles. I call them micro-bubbles because these market bubbles probably won't be on the front page of every newspaper or the focus of your nightly newscasts, and they may not even last that long, but they are out there and can hurt you if you buy near the top. What is most interesting is that these micro-bubbles are formed by investors who are sometimes looking for "safe-haven" investments, because they are fearful of corrections in the major markets like the S&P 500 and housing. Even safe havens can be a dangerous place to lurk sometimes.

I'm going to offer you a couple examples of possible micro-bubbles and how to spot them, so you can maybe save yourself some money if they do indeed correct. Also keep in mind that just because a bubble or micro-bubble is forming, it doesn't mean it can't get bigger, or it may not even be a market bubble at all. Every market is determined by supply and demand and bubbles can occur if these two factors get way out of balance.

Micro-Bubble #1: Cotton & Wheat

Most of you probably are not hoarding your cotton undergarments and boxes of cereal for fear of inflation, although with cotton and wheat both being U.S. dollar-denominated commodities they do tend to have a contra-dollar relationship, meaning that when the dollar is weakening (inflationary), that would put upward pressure on prices, but that is not what has driven these daily life necessities to micro-bubble status this time.

Daily Cotton Chart

Cotton's price jump can be attributed to last year's reduced U.S. production of 12.2 million bales, which was the smallest crop in 20 years. If you compound this with the ever-increasing populations (increased demand) of countries like China and India along with a shift in crop selection to more food and less cotton, you get a recipe for higher prices. Analysts believe that the 50% jump in cotton prices over the past year will be impetus enough for farmers to ramp up production, hopefully driving prices down. Not to mention cotton, like many other commodities, is also driven by global demand. When we humans are happy and making money, we are probably going to feed and clothe ourselves well; right now the world still has some tough times to overcome. Some experts in cotton are calling for a price correction in the coming months.

So What About Wheat?

Wheat might be an example of a micro-bubble that has already partially burst. If you look at the extreme price run-up in wheat from early June to August, it's pretty easy to see. Now, of course there was at least some reasoning for the 65% monthly run-up in wheat prices, namely the Russian ban on wheat exports. According to LiveMint.com, this phenomenon called "agflation" was essentially created out of thin air and completely overdone. The analysts there believe that the run-up in prices wouldn't stick and they were right; wheat has come sharply off its highs and some expectations are for further correction as well into early next year.

Wheat was up slightly yesterday on news that global wheat production will be 1.1% smaller than was previously forecast a month ago. Also keep in mind that these high prices helped many American wheat farmers, who were able to sell futures to lock in those multiyear highs.

Daily Wheat Chart

The lesson here is that, as with cotton, higher prices beget more planting, and more supply may lead to lower prices. In the near term, there are still issues with drought and the ongoing ban on exports in Russia and the Ukraine. Experts believe that the drought will have minimal impact on the 2011 crop, which is planted in September.

Micro-Bubble #2: U.S. Treasury Bonds

The 10-year note is a known safe haven and as much as I believe this country has a serious debt-to-income problem, the debt is still deemed by many experts as manageable at 40% of our gross domestic product. I am concerned with the fact that even with the slew of supply (our government has issued 3.3 trillion dollars in debt over the past two years), bond prices have continued to rise, which pushes the yields on those bonds lower.

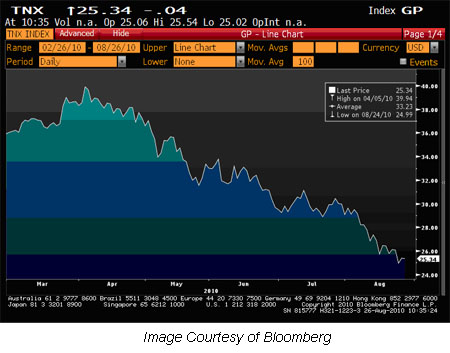

And yields have gone lower -- 10-year T-note yields fell to a 19-month closing low of 2.49% on Tuesday, then moved slightly higher to end at 2.54% on Wednesday.

There are analysts out there calling a top in bond prices (which would be a bottom in yields). The question is how quickly economies can improve, at which point the waterfall of safe-haven investors will stop piling into already crowded U.S. Treasury bonds. I personally wouldn't be a buyer of Treasuries at these levels.

Daily 10-Year Note Yield

(If you move the decimal one place to the left, this gives you the 2.53% yield)

Lesson Learned

If you look at a chart and see some amazing price action or you hear about a security that is making big moves, do your homework before jumping in! Of course there are plenty of trades that may look like a bubble but continue to run. Make sure that your reasoning for putting a trade on is viable and sustainable.

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source : http://www.taipanpublishinggroup.com/tpg/smart-investing-daily/smart-investing-082710.html

By Jared Levy

http://www.taipanpublishinggroup.com/

Jared Levy is Co-Editor of Smart Investing Daily, a free e-letter dedicated to guiding investors through the world of finance in order to make smart investing decisions. His passion is teaching the public how to successfully trade and invest while keeping risk low.

Jared has spent the past 15 years of his career in the finance and options industry, working as a retail money manager, a floor specialist for Fortune 1000 companies, and most recently a senior derivatives strategist. He was one of the Philadelphia Stock Exchange's youngest-ever members to become a market maker on three major U.S. exchanges.

He has been featured in several industry publications and won an Emmy for his daily video "Trader Cast." Jared serves as a CNBC Fast Money contributor and has appeared on Bloomberg, Fox Business, CNN Radio, Wall Street Journal radio and is regularly quoted by Reuters, The Wall Street Journal and Yahoo! Finance, among other publications.

Copyright © 2010, Taipan Publishing Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.