China U.S. Investing Strategy After Unocal

Stock-Markets / Investing 2010 Aug 22, 2010 - 02:57 PM GMTBy: Dian_L_Chu

After state-owned CNOOC was blocked from the Unocal acquisition in 2005, China has instead turned toward other countries such as Australia, Canada and Brazil for its natural resource strategic investments.

After state-owned CNOOC was blocked from the Unocal acquisition in 2005, China has instead turned toward other countries such as Australia, Canada and Brazil for its natural resource strategic investments.

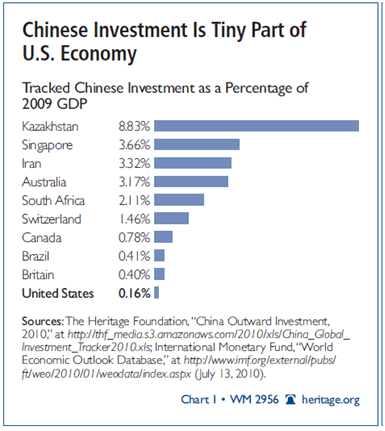

While China is the top U.S. debt holder in the world, percentage-of-GDP-wise, the U.S. receives relatively very little non-bond investment from China, based on data tracked by The Heritage Foundation. (See chart) Part of this “allocation difference” could be attributed to the long existing tensions over various issues including, but not limited to—trade imbalance and currency--between the world’s top two economies.

The increasing frictions have prompted the U.S. to scrutinize China-related domestic acquisitions with an extra pair of magnifying glasses. And the resource and infrastructure sectors appear to be the most politically sensitive. Even as recent as last December, a Chinese mining company had to back out of a deal to invest in Nevada gold mine after security concerns cited by the U.S. government. (The mine is about 60 miles from a U.S. naval base.)

China - Investing Strategy Shift

However, Chinese companies have become much more aggressive and savvy in their approach to deal making, and have adapted to the political environment through joint ventures with local companies and small stakes instead of ambitious, high-profile large acquisitions.

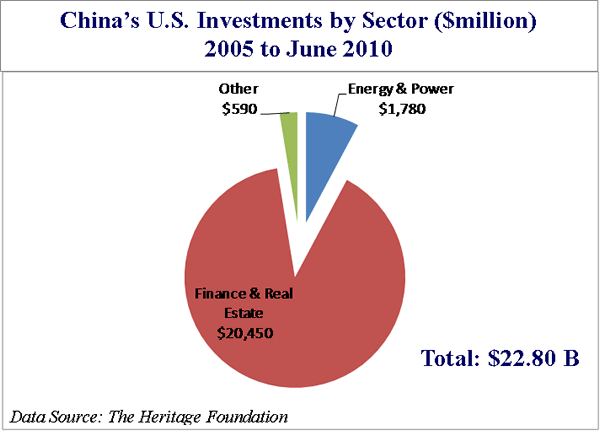

Based on the data from the Heritage Foundation, the bulk of Chinese investment in the U.S. since 2005 has been in the financial and real estate sectors. (see graph) Nevertheless, the shift in approach has helped the Chinese enter into the U.S. energy and power market through the following major deals:

- In Feb. 2007, Sinopec agreed to provide Syntroleum with $100 million to support a Joint Gas-To-Liquid (GTL) technology development.

- Last October, Norwegian energy group Statoil sold some of its US Gulf offshore oil assets to CNOOC for an undisclosed amount.

- Last November, China Investment Corp. (CIC) agreed to buy a 15% equity stake in Virginia-based power company AES Corp. for $1.58 billion

- In May of this year, Hopu Investment Management Co., a Chinese private equity firm, invested about $100 million for around 1% stake in Chesapeake Energy

Meanwhile, a subtle change is also taking place on the U.S. side.

Reuters reported that China state-owned Anshan Iron & Steel Group, the parent of Angang Steel Co. has agreed to pay $175 million for about 14% stake in a rebar plant that Steel Development Co.--a U.S. private startup-- is building in Mississippi.

Despite a previous report of shelving the project due to congressional opposition citing national security concern (we are talking about a relatively small base-metal rebar plant here), Anshan now says it is still planning to invest in the U.S. And according to Steelorbis.com,

"The Angang official recalled that the US Department of the Treasury had affirmed that the US Overseas Investment Office would deal with any national security concerns in relation to the issue and would seek to maintain an open investment environment.”

This investment reportedly would create about 1,000 construction jobs and more than 200 permanent manufacturing jobs in the U.S. once the facility is complete.

Union’s Also Warming Up to China...Sort of?

Separately, the United Steelworkers (USW), which has backed a myriad of trade cases against China, announced in early August that it had signed agreements with Chinese power generation companies A-Power Energy Generation Systems Ltd., (AAPWR) and Shenyang Power Group (SPG) to supply wind turbines to the SPG-owned 600-MW Texas wind farm set to begin construction soon.

Apparently, the initial criticism that U.S. stimulus money will be funding jobs in China was quelled by A-Power’s plan to purchase up to 50,000 tons of steel from American mills and set up a facility in Nevada, thus creating perhaps 1,000 American jobs.

The USW is calling this “vision for win-win relationships between manufacturers and workers,” but indicates it will not back off its trade cases against China.

A Japanese Evolution

These two deals in the metals sector took place in the context of high unemployment and job losses caused by the global financial crisis, which most likely has somewhat softened the opposition to Chinese investment.

On the other hand, Chinese firms seem to have embarked on an evolution similar to that of the Japanese firms. Back in the 1980s when Japanese companies burst onto the world market, there was a global widespread defensive reaction, particularly in the United States. Then, Japanese firms began to change their investing approach by setting up assembly and full production facilities in the U.S. and eventually found acceptance.

Foreign Investments Contribute To U.S. Growth

The U.S. has the advantage of being one of the most politically stable and attractive regions with rich intellectual and natural resources. Meanwhile, with good cash-flow, strong balance sheets and the implicit support from Beijing, the Chinese state-run as well as private enterprises will continue their overseas expansion.

Most importantly, foreign investment inflows-- including China’s—contribute to the economic growth and development of the United States, and could potentially help the trade imbalance.

Politics aside, given the size and relative competiveness of its economy, the U.S. should be able to handle a few more billions from China or other trading partners without raising the risk to national security. Otherwise, by alienating allies, the United States could find itself isolated in an increasingly interconnected world, while potentially putting employment, competitiveness, and innovation at a disadvantage.

On the other hand, although the increasingly multi-faceted approach by the Chinese is expected to continue evolving, managing PR, host country perception, political environment and developing relationship could prove to be a greater challenge than anything for Beijing, partly because much of China’s overseas investments are still going through state-owned companies. From that perspective, it would be to China's benefit to speed up its privatization process in order to truly transform its economy.

A Crash or Collision Course?

Foreign investment in US companies and assets has long been controversial since World War I, but this financial crisis has pushed both China and the U.S. on an accelerated learning curve of cross-border investments. However, taking a crash course--instead of a collision course--will require some give and take from both of the world's top countries.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.