Central Bankers Stoking the Inflation Fires, Whilst Academic Economists Worry about Deflation

News_Letter / Financial Markets 2010 Aug 22, 2010 - 12:58 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

August 15th, 2010 Issue #47 Vol. 4

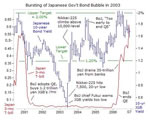

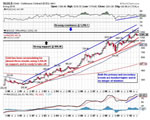

Central Bankers Stoking the Inflation Fires, Whilst Academic Economists Worry about DeflationInflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader This week the Bank of England Governor Mervyn King realised that his attempts at talking inflation down have failed and that now 8 months on he is looking rather foolish by continually stating that high inflation is just temporary, where even the mainstream press that had been lapping up the mantra are now no longer taking him seriously, so now the Governor is suggesting that inflation will remain above the 2% target level for the whole of 2011 (current CPI 3.2%, RPI 5%) which translates into watch for UK CPI to go above 4% and and RPI above 6% during 2011, in line with my expectations since early May. Meanwhile the BoE pumped out its quarterly Inflation propaganda report labeled as a forecast to try and get ordinary folks and business to buy its story so as to make the outcome of 2% inflation and trend economic growth more possible. Most people remain in denial of the Inflation Mega-trend as witnessed by a continuing debate between deflation or inflation when the facts are that of accelerating inflation. Surprised by out of the blue food price crisis? Read the Inflation mega-trend ebook (FREE Download). Deflationists remain just as delusional today as when I wrote in November 2009 (18 Nov 2009 - Deflationists Are WRONG, Prepare for the INFLATION Mega-Trend ). Instead of realising that they are wrong and do something to save themselves and their readers from going broke by holding cash and invested in bubbles destined to burst such as government bonds under the weight of ever escalating money printing or quantitative easing, 1, 2, 3, 4, quadrillion, they instead ignore CPI inflation (unless its falling) and come out with nonsense such as pricing assets in terms of the gold price to imply deflation is taking place when peoples food baskets i.e. the REAL WORLD show INFLATION is accelerating away from them , or in some cases implying that inflation is really deflation in disguise because of loss of purchasing power, which is the whole point of what inflation IS ! Where prices rise to erode the purchasing power of your savings and earnings! I hear weak economies mean deflation looms, well try telling that to Zimbabweans! Do a simple personal inflation test, dig out your credit card statements from 1,2,3 years ago and see how much your food and energy bills have gone up and then you will know how much inflation has taken place during a period of perma deflation mantra. Never mind the amount average food baskets are destined to rise in price going forward! LISTEN , protect your wealth from the inflation mega-trend by hedging in scarce resources such as Gold, Silver, Agricultural and other Foods, metals, energy, stocks of dividend cash cows, emerging markets and more as elaborated at length in the Inflation Mega-trend ebook, now 7 months on we are further along the inflation mega-trend with no signs of reversal into the phony debt deleveraging deflation mantra that we have been hearing about for several years now that has FAILED to materialise, there IS NO DEFLATION, the deflation mantra will continue right up to the point where the wage price spiral kicks in as it slowly dawns on the academic economists / perma crowd that their theories are just as bankrupt as most of the western economies actually are! But by which time your savings will have been wiped out by following the perma deflationists mantra of "cash is king". Yes I am being blunt because sometimes you have to be to knock some sense into people! Meanwhile David Cameron's government scrapped another quango, the National Audit Commission, that's 2000 bureaucrats set to disappear in a puff of smoke, most of whom will be replaced by the private sector. The next 6 months are crucial for the UK to see if the coalition government is able to deliver the promised cuts and deficit reduction targets, if not then the UK will be firmly back on the trend towards bankruptcy and hyperinflation that Labour had set it up on with sterling following the dollar to its final destination. Fingers crossed that UK official debt stabilises at 70% of GDP (and the unofficial debt and liabilities at 350% of GDP). In the U.S. the prospects for QE2 is coming as a surprise in many quarters when it has been obvious since the first print run that once started money printing cannot be stopped whilst large budget deficits exist, which where the U.S. is concerned probably means continuing for the next 10 years at least as the U.S. is going to milk its reserve currency advantage to the fullest. Germany Booming German Q2 GDP data came in at 2.2% annualised to 8.8%, another surprise for the mainstream press and analysts that had penciled in growth of between 1% and 1.2%, where even the likes of Martin Wolf of the FT has consistently been making bearish statements such as this - Financial Times, Martin Wolf is worried that the concerted austerity of Germany, Britain and other industrialised countries may "destroy the recovery". Germanys economic boom is the flip side of the PIGS sovereign debt crisis as I have been mentioning since at least early early May 2010 (05 May 2010 - Greece Economic Depression Resulting in INFLATION NOT DEFLATION Surge ) and in my last opportune newsletter (09 Aug 2010 - UK Economy GDP Growth Forecast 2010 to 2015). Bottom line - The large industrialised export orientated areas of the Eurozone such as Germany are going to BOOM! Therefore the PIGS sovereign debt crisis is old news. The U.S. looks set to experience sluggish growth. Stock Market The Dow having reached my long-standing target of 10,700 spent 7 trading days attempting to hold the level and break higher which it repeatedly failed to do, finally support giving way from the open on the 11th of August. The most recent price action has attempted to hold 10,250 with the Dow closing at 10,303. However the Downtrend from 10,700 targets 10,100 as a possible low point for the current swing so the most recent action can be seen as an attempt at working out the oversold state before another short down swing to form a base in the 10,100 region to again target a break above 10,700, my in depth analysis remains pending time. Pakistan Floods Pakistan Floods put everything into perspective, 20 million face losing everything in a disaster of biblical proportions.

UK Donations USA Donations Your analyst. Comments and Source: http://www.marketoracle.co.uk/Article21899.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Nadeem_Walayat This analysis is a continuation of the UK Debt Forecast article (UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt ) on the impact of the new coalition government having effectively hit the reset button on the UK economy to now primarily target a reduction in the £156 billion annual budget deficit which aims to suck £113 billion a year out of the economy by 2015-16 by means of swinging public sector spending cuts and tax rises. The government has now clearly reversed the Labour governments policy of continuous fiscal expansion and set the country on a course for severe fiscal contraction for at least the next 3 years.

By: Michael Snyder Today there is a horrific derivatives bubble that threatens to destroy not only the U.S. economy but the entire world financial system as well, but unfortunately the vast majority of people do not understand it. When you say the word "derivatives" to most Americans, they have no idea what you are talking about. In fact, even most members of the U.S. Congress don't really seem to understand them. But you don't have to get into all the technicalities to understand the bigger picture.

By: Marc Faber "Investors should've listened to me already six months ago, when I wrote that the Fed will continue to monetize, and this is my view ... they will print and print and print, until the final crisis wipes out the entire system," Marc Faber, editor & publisher of The Gloom, Boom & Doom Report, told CNBC. David Bloom from HSBC joined the discussion, adding, "I think we're not quite at those draconian points."

By: PhilStockWorld Very nice reading in the Financial Times this week.

By: Dr_Tom_Termotto THE COMING OF THE BLACK WAVE Nothing in our shared cultural experience will prepare us better for the oncomingBlack Wave throughout the Gulf of Mexico than the Exxon Valdez Oil Spill in Prince William Sound, Alaska. And yet even this environmental catastrophe falls far short of what is coming around the corner in the Gulf. Alaska is not Florida, or Louisiana, or Texas. The Deep South summer here in Tallahassee, FL has been as hot and humid as any we’ve seen. This weather pattern is what will distinguish the BP Gulf Oil Spill from the Exxon Valdez just as the total volume of the spill and use of dispersants have.

By: Richard_Daughty There was an editorial power struggle at Mogambo News Service over whether it was Big, Big News (BBN) or if it was Big Freaking News (BFN), or even if it was The Biggest Freaking News Of Your Life (TBFNOYL) that China has, officially through the People's Bank of China, said that they have "seen the light" as concerns gold, and they see how gold is the only true money, and how worthless paper monies and computer blip monies are the Wrong Way To Go (WWTO), as evidenced by the Chinese merely looking at us Americans and what happened! Hahaha!

By: John_Mauldin Sadly, I find myself with more than enough time to compose yet another Thoughts from the Frontline in an airport, as a flight booking error has me at JFK for six hours instead of fishing in Maine. Details for those interested or amused at the end. But it does allow me to offer you a peek into a very sobering report on how badly underfunded public pension are.

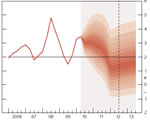

By: Nadeem_Walayat The Bank of England released their latest quarterly inflation report this week that again sought to revise the forecast for UK inflation to converge towards 2% in 2 years time. However one major change accompanying the forecast was that the mantra of UK inflation being above the 2% target and the 3% upper limit as only temporary has now been dropped, this after repeatedly claiming month in month out for the past 7 months that Inflation would magically fall that the academic economists and mainstream press had swallowed up until quite recently.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.