Are Gold Stocks Worth the Effort?

Commodities / Gold and Silver 2010 Aug 16, 2010 - 01:41 AM GMTBy: Bob_Kirtley

We recently posed this question while while re-assessing our silver portfolio and concluded that we were currently not getting the leverage to the metals that investing in the stocks should return given the inherent risks associated with mining operations.

We recently posed this question while while re-assessing our silver portfolio and concluded that we were currently not getting the leverage to the metals that investing in the stocks should return given the inherent risks associated with mining operations.

We kick off with the following probe:

Question: What is it that we are trying to achieve?

Answer: Exposure to the Gold Bull Market.

Which vehicle will give the best returns and enable us to maximize our profits?

1.Physical metal

2.Funds

3.Silver producers

4.Options and/or futures trades.

The physical metal in your very own hands negates any third party risk and from time to time does perform better than the stocks as it has done recently, for instance.

The funds, some of which may or may not have the physical metal, track gold prices and are liquid for those who wish trade on a frequent basis.

The gold producers suffer from the numerous inherent risks of mining but do offer leverage to gold prices, but not on any consistent basis.

The options and/or futures trades can provide wonderful returns but they are risky and can also wipe you out completely.

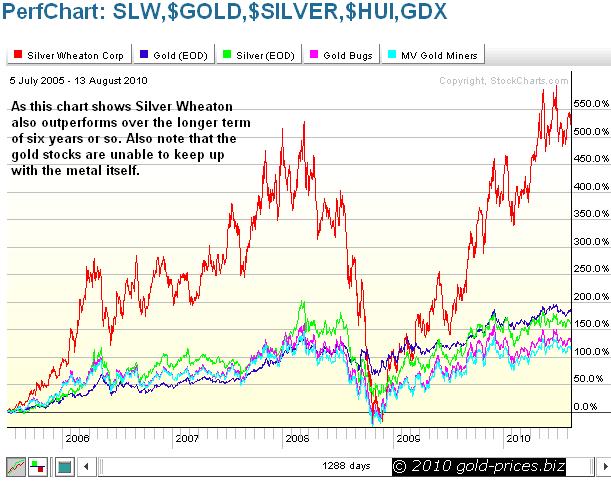

For a pictorial view of this situation we have plotted some of the investment vehicles available on the chart above and have also thrown in Silver Wheaton as it was the outright winner when we performed a similar exercise over at www.silver-prices.net over a six year period. The first observation that sticks out like dogs balls is that Silver Wheaton (SLW) has outperformed both gold and the gold producers by a long way and the gold producers have not.

The other point to note is that the leverage of the producers to gold and silver, which was evident when the bull market began in 2001 has now diminished considerably. This lack of leverage calls into question the use of gold stocks as an investment vehicle.

If we now fast forward and take a look at the chart below covering the past year, we can see that SLW has still outperformed gold itself and the other asset classes once again. Also note that the gold producers have been unable to keep up with gold prices suggesting that investors don’t want to expose themselves to the risks that come with mining.

So far, the obvious move would appear to be that we avoid the stocks and redeploy our cash into the metal itself and SLW as it has performed incredibly well.

Many of our peers are calling for the precious metals stocks to rally and perform like gladiators and we agree that they should head to higher ground. However, we want the best bang for our buck not merely an improvement on our account statement.

The ignition for these stocks is a dramatic move in gold prices. So we can profit from holding the metal itself and hopefully from holding the stocks. In choosing stocks we are now leaning to being overweight on SLW and reducing our exposure to the producers. Going forward SLW has the price of silver pegged at around $4.04/oz with the overall cost running at around $8.00/oz, as it is a silver streaming company and not a miner. So any improvement in gold prices will have a knock on effect on silver prices and have an immediate impact on their bottom line.

On the other hand the miners do not have such a luxury and are subject to rising costs such as the price of oil, labour, taxes (note the recent proposed 40% tax by the Australia) political change, transport costs, management issues, etc. The list goes on and on with any one of these reasons having the potential to hit their bottom line and at times can be a show stopper.

In conclusion we are now doubting the wisdom of investing gold and silver producers and are seriously considering avoiding them completely.

Disagree! Good, please tell us why.

As a special offer, if you sign up to a 12 month OptionTrader subscription before September 1st 2010, we will refund your $179 fee if gold prices do not make a new all time high in 2010! Visit www.skoptionstrading.com to sign up now.

Stay on your toes these are treacherous waters and have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

The latest trade from our options team was slightly more sophisticated in that we shorted a PUT as follows:

On Friday 7th May our premium options trading service OPTIONTRADER opened a speculative short term trade on GLD Puts, signalling to short sell the $105 May-10 Puts series at $0.09.

On Tuesday the 11th May we bought back the puts for just $0.05, making a 44.44% profit in just 4 days.

Silver-prices.net have been rather fortunate to close both the $15.00 and the $16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

Got a comment then please add it to this article, all opinions are welcome and appreciated.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.