Economic Coin Flips and WikiLeaks Catching Up With Market Truths

Stock-Markets / Financial Markets 2010 Aug 09, 2010 - 03:20 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

August 1st, 2010 Issue #45 Vol. 4

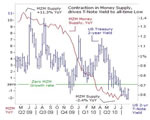

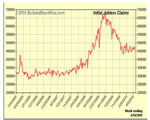

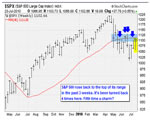

Economic Coin Flips and WikiLeaks Catching Up With Market TruthsInflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader Many market analysts were left scratching their heads as the stock market ignored bad news the whole week from ECRI recession data to worse than expected U.S. GDP data by closing up on the week at 10,466 (10,425), with the Dow continuing its meandering trend towards a target of 10,700 which will more than likely be achieved this coming week. Last weeks newsletter (Stocks Bull Markets Generate Economic Growth) proved an opportune reminder to readers to remember asset prices drive economic growth which is contrary to the consensus view. The graph below from the Inflation Mega-Trend Ebook (FREE DOWNLOAD) continues to illustrate my overall trend expectations for the year. We still have to get through the seasonally toughest period of the year for the stock market so at this point I can't envisage a breakout to new bull market highs this side of October. The bottom line - the stock market has so far not doing anything to negate the stealth stocks bull market scenario that continues to play out where many if not most investors remain too afraid to invest. Unfortunately the BlogosFear is full of so much bearish commentary right from the birth of the stocks bull market in March 2009 ( Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 ), so it is highly likely that the bull market will remain in stealth mode all the way to new all time highs and probably beyond. My recommendation is always to do your own research into what the analyst you may be reading has said before at least during the past 12 months to gauge against what has actually transpired, and then you will know if someone is perma-clueless that espouse the virtues of some voodoo methodology when all they really have is something that has no more value than a coin toss, which applies to all technical tools and economic theories. Gold - Bounced from a new early week low of $1155 to close at 1181, down by $8 on the week. Despite Fridays strong rally, Gold continues exhibit a trend that targets $1140, though now there is not much distance between $1155 and $1140. Economic Coin Flips Economic analysis is not a science or an art but the calling of a series of coin flips (as is stock market analysis), the actual determining item that flips into a final conclusion may be something inconsequential on its own, realising this will put analysts ahead of the curve. The Grand Media Star Wizards that propagate the press and academic institutions use formulae's and theories as smoke and mirrors to try and persuade you otherwise, but still at the end of the day come out with statements such as there is a 50/50 chance of a double dip recession, 50/50 chance of deflation, 50/50 of..... However without firm actionable conclusion such statements are pretty much worthless. WikiLeaks Disintegrating Government Control of Information First we had a U.S. Fed Board Member telling the masses to ignore bloggers on economic theory that was contrary to their own propaganda. Now we have had wikileaks releasing 91,000 pages of the actual facts on the War on Afghanistan. This is a continuing manifestation of the disintegration of the mechanisms of government to exert control over the thoughts of masses by means of security services and the mainstream press with much overlap between the two. For decades if not centuries, the only real source of truth as to what is actually going on has been the markets, as the governments cannot hide the truth from the markets. If you want to know what is really going on with an economy, a war, then always look for the truth in market trends. Which is now being increasingly supplemented by the likes of the blogosphere and sites such as wikileaks. Whilst wikileaks may not survive being targeted by U.S. security agencies, the internet being what the internet is, it will likely be replaced by a 100 similar sites. Your analyst glad he does not have to sleep with one eye open. Comments and Source: http://www.marketoracle.co.uk/Article21547.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Martin_D_Weiss In his testimony before Congress last week, Ben Bernanke lifted the Fed’s skirt and gave us a glimpse of the disasters now sweeping through the U.S. economy. But there are four bombshells he did NOT talk about:

By: Webster G. Tarpley Webster G. Tarpley writes: After about two and a half years during which the danger of war between the United States and Iran was at a relatively low level, this threat is now rapidly increasing. A pattern of political and diplomatic events, military deployments, and media chatter now indicates that Anglo-American ruling circles, acting through the troubled Obama administration, are currently gearing up for a campaign of bombing against Iran, combined with special forces incursions designed to stir up rebellions among the non-Persian nationalities of the Islamic Republic.

By: Gary_North Two widely respected economic commentators, Harvard's Niall Ferguson and Nassim "black swan" Taleb, have offered highly pessimistic assessments of what lies ahead for the American economy.

By: Bob_Chapman The talk of recovery pervades insider thinking. The major media worldwide plays the same refrain. This is a desperate attempt to befuddle the public with misdirected propaganda to preserve confidence in a system that is in a state of collapse. As CNBC leads the charge, loss of faith in the system grows with each passing day. In spite of control of the major media by elitists, talk radio and the Internet hammers away incessantly with the truth influencing more and more 24/7 worldwide. As a result of the success of the alternative media a good many investors realize we have a systemic credit crisis that has turned into a debt crisis as well.

By: Jim_Willie_CB Double Dip used to pertain to ice cream cones, but now to dreaded return to economic recession. Green Shoots used to refer to gardening projects, then to deceptive economic viewpoints. My favorite is the second half recovery mantra, indicative of totally clueless. This year's promised recovery in the second half of the year will feature a return to recession instead, thus stripping mainstream economists of any remaining credibility. The endless links in the chain are impressive by the clueless cast of economists that disgrace the US landscape.

By: Steve_Betts "What a cruel thing is war: to separate and destroy families and friends, and mar the purest joys and happiness God has granted us in this world; to fill our hearts with hatred instead of love for our neighbors, and to devastate the fair face of this beautiful world" --- Robert E. Lee, letter to his wife, 1864

By: Gary_Dorsch Of ten people who hear the same story or speech, each one might understand it differently. Perhaps, only one of them will understand it correctly. On July 21st, Federal Reserve chief Ben Bernanke was speaking in riddles, as central bankers are apt to do, while delivering his testimony before Congress. Each word that’s uttered by the Fed chief is scrutinized by anxious speculators, who try to interpret the message correctly, before quickly placing bets in the marketplace.

By: Nadeem_Walayat The UK economy is booming! 1.1% growth for Q2 2010 annualises to 4.4%. The academic economists that populate the mainstream press were caught off guard again! with growth expectations ranging from 0.3% to 0.5%. As is usually the case the excuses button was pressed to try and mask the fact that they to all intents and purposes remain clueless on the direction of UK Economy with much press chatter focused on an non existant double dip recession.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.