US Dollar Index Declines as Eurodollar Short Squeeze Ends

Currencies / US Dollar Aug 02, 2010 - 09:12 AM GMTBy: Jesse

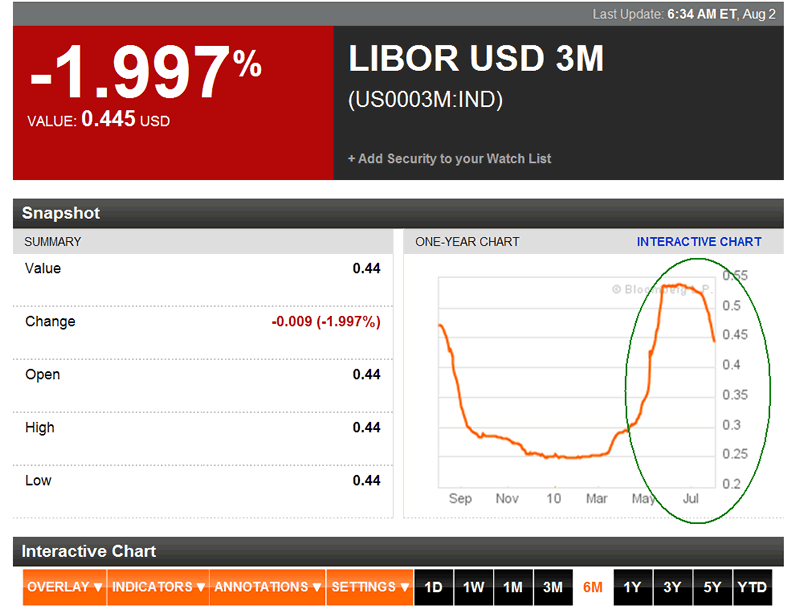

Dollar LIBOR is the 'tell' as european banks scramble to obtain US dollars to satisfy customer demand, they drive the 'price' of the dollar higher. The cause of the squeeze was the euro uncertainty based on ratings downgrades on Greece, and the hedge funds determined selling of the euro, which created a sell off in euros.

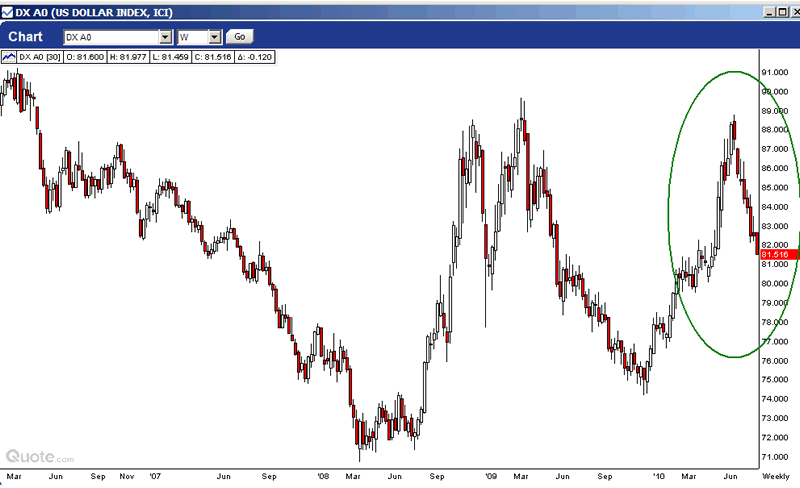

The US dollar index tracks the eurodollar LIBOR to a remarkable degree. When the BIS data comes out for this period in time I am sure we will see a repeat of the squeeze in eurodollar deposits that we had seen in the last two dollar rallies.

Why is this significant? Because it shows that there is no fundamental trend change in the US dollar, which is in a long sideways 'chop' and still likely to head lower.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2010 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.