Interest Rates & Investing - Investing Simplified – Part One

Interest-Rates / Learning to Invest Sep 14, 2007 - 01:17 AM GMT

If you were playing a competitive game of chess for a grand prize of a million dollars, would you ask your opponent what strategic move you should take next? No. So why do investors and analysts ridicule and blame the banks for offering poor advice on the future direction of interest rates? If a bank is going to lend you money for their profit, what is their incentive to give advice that is in your best possible interest?

If you were playing a competitive game of chess for a grand prize of a million dollars, would you ask your opponent what strategic move you should take next? No. So why do investors and analysts ridicule and blame the banks for offering poor advice on the future direction of interest rates? If a bank is going to lend you money for their profit, what is their incentive to give advice that is in your best possible interest?

Investing and economics can be very complicated and confusing so we try to focus on simplified common sense guidelines. This helps us to be less emotional about investing decisions, thereby improving our probability of profitability. We think this focused mindset is a key for success during times such as what we are currently experiencing. This article will try to clarify one strategy we use to help us keep our mind focused during these times.

For example: We regularly read analysts contrarian commentary about the foolishness of large banking institutions advice, financial policy etc. But are large banking institutions and the “establishment” really foolish? Do they really not get “it”?

Because our strategies are contrarian in nature one may expect us to agree with the above statement but we do not. Instead we believe these institutions are brilliant and run by exceptionally smart people. We believe the error is on the part of the analyst or individual assuming these institutions are operating in their best interest. Why do investors assume the advice they are receiving from a bank is in their best interest when giving the client that good advice will likely mean less profit for the bank. Does the bank have a responsibility to make you, the client profit, or is their responsibility to make their shareholders profit? Do you see this obvious conflict of interest?

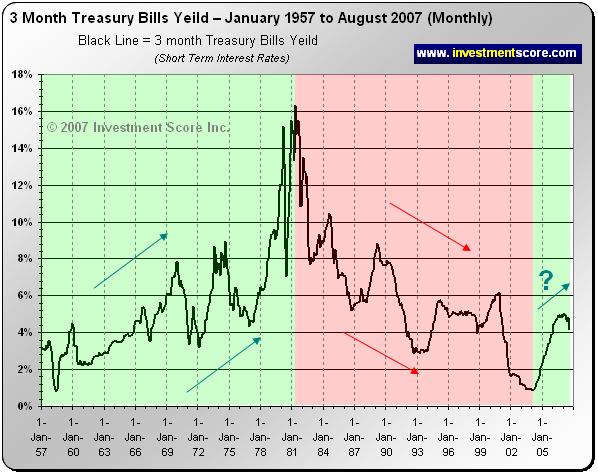

The above chart is of a short term, three month US Treasury Bill interest rate since January 1957. You will notice that rates appear to be at historically lower levels around February 2004 and have since headed higher. We recall back in February 2004 the continued promotion of floating mortgages and the benefits of adjustable rate loans from various lending institutions. Also roughly around this time we recall the Federal Reserve Central Bank of the United States suggest lenders offer a “variety of product alternatives”, suggesting mortgages other than traditional fixed rate mortgages. Knowing that interest rates have risen since 2004, should these comments be considered poor advice just because long term it was likely not the most profitable advice from the borrowers perspective?

We always try to keep in mind that institutions may not always have our best interest at heart when providing their opinion in the financial papers, on television, in person etc. We recognize that conflict of interest is simply a reality of the financial markets.

So how can we use this insight to our advantage?

First, being aware of potential investing challenges makes us better able to recognize and deal with them. The above example helps us clarify what we think is the obvious conflict of interest that exists in the world of finance. We do not believe that all professional and printed or televised advice is poor or corrupt but being aware of these problems does remind us to reconsider and challenge others opinions.

So what seems to be a generally accepted theory about current market conditions?

First, we must remind our readers that we are not economists and we are not offering financial advice but rather our opinion on recent market conditions. Generally speaking it appears to us that the current popular discussion in the financial media is all about the recent “Credit Crunch”. The popular catch phrase of the moment seems to be “re-pricing risk into the system”. The general feeling we get from this relentless message is to avoid “risky” investments.

Indirectly we get the feeling investors are generally being told through various means to avoid commodity (“risky”) investments such as precious metals and energy and pay down all debt. This may prove to be a fantastic financial strategy but we wish to illustrate an alternative perspective. If interest rates are expected to rise over the long term from their lows of 2004, this recent “credit crunch” would be a fantastic opportunity for lending institutions to have low interest rate loans minimized. Therefore we think it would make sense for banks to tighten their lending standards during the highly publicized “credit crunch”. We believe this recent “credit crunch” event may provide a fantastic excuse for banks to reduce their lending during a time when it may be the most advantageous for the public to borrow with potentially lower fixed interest rates.

This article only outlines one simple example of a contrarian viewpoint but we use many indicators and methods of drawing our final conclusions. We believe long term interest rates are heading higher as inflationary pressures build. Actions speak louder than words and reading between the lines, we think this is what the non verbal actions of the banks are telling us. We believe this will be more advantageous for commodity based investments such as precious metals and less advantageous for stocks and bonds, therefore we are more inclined to add to our precious metals investments than sell. We think commodity based investments such as precious metals are a fantastic opportunity from an intermediate, long term perspective.

We intend to write more free commentary about our opinions on “Investing Simplified”. If you wish to be notified when these articles are available please subscribe to our free newsletter at www.investmentscore.com . You may also wish to visit our website to learn about our custom built investment timing charts. We hope to see you there and good luck.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.