Debunking Paul Krugman's Icelandic Economic Miracle

Economics / Economic Theory Jul 18, 2010 - 03:10 AM GMTBy: Dian_L_Chu

With op-ed pieces such as "Budget Deficits: Spend Now, Save Later", it is of no surprise that Paul Krugman declares--Iceland--a "Post-Crisis Miracle."

With op-ed pieces such as "Budget Deficits: Spend Now, Save Later", it is of no surprise that Paul Krugman declares--Iceland--a "Post-Crisis Miracle."

In an article dated June 30, Krugman wrote: "...although Iceland is generally considered to have experienced the worst financial crisis in history, its punishment has actually been substantially less than that of other nations."

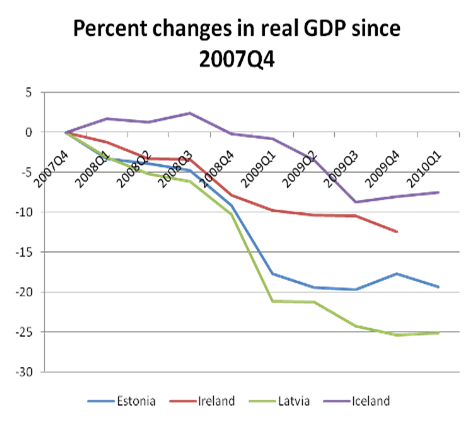

To back it up, Krugman provided a chart (below) comparing the GDP of Iceland to Ireland, Latvia, and Estonia since the 4th quarter of 2007. The chart does seem to support his view, as it illustrates Iceland appears to be enjoying much higher growth rate than the other three European Union (EU) members.

Based on this, Krugman then concluded: "The moral of the story seems to be that if you’re going to have a crisis, it’s better to have a really, really bad one."

While this NYT article probably has recruited a few newbie Keysians, it is totally screaming for a rebuff….considering Iceland pretty much went belly up in 2008 with the collapse of its three largest banks, and has been in crisis mode ever since.

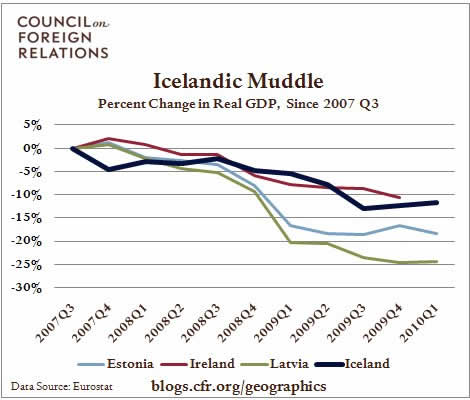

As expected, here is a rebuff by Council on Foreign Relations (CFR).

CFR finds that Krugman's "Icelandic Miracle" is "an illusion" created by simply choosing a starting date to make it fit into his "debt is good" mantra.

CFR generated the same GDP chart, but shifted the starting period by one quarter--from Q4 2007 to Q3 2007--the quarter before Latvia and Estonia’s GDP peak.

The result - Iceland’s GDP picture looks a lot less impressive.

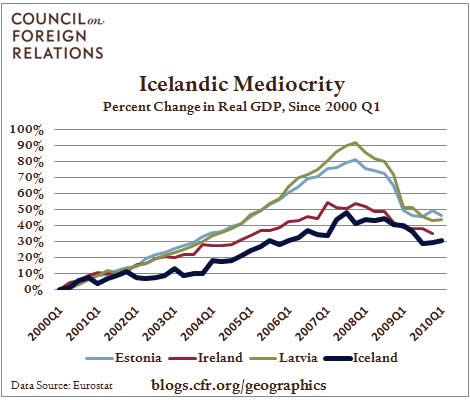

Here is another chart by CFR moving the starting date back to the beginning of 2000, which totally crushes the "miracle" story of Iceland.

Part of Iceland’s economic progress may be attributed to a massive currency devaluation and "technical defaults", which seems to be what Krugman is intimating as the “solution” to “a really, really bad crisis.”

However, in Iceland’s case, the devaluation and refusal to pay has not resolved its fiscal mess. Now, the island could face a second round of bank failures. The government, already on $4.6 billion life support from the IMF, recently warned that a second bank bailout would be a “severe blow” to its finances.

Iceland did secure a $500 million currency swap deal from China in June of this year. However, rather than a vote of confidence in Iceland’s economic recovery, this handout most likely serves as a strategic interest of Beijing amid the ongoing international squabble over the Arctic oil.

So, the moral of the story is that anyone —a nation, a state or even an individual—who does not make an effort to get spending and financials in order will face a vicious cycle -- rising borrowing costs, more debt and deficit, and worse credit risk. (Iceland currently ranks ninth in sovereign risk by CMA.)

Eventually, beggars can't really be choosers when it comes to lender of last resort. Moreover, currency devaluation and debt default will not absolve all spending sins.

Greece vowed not to be the next Iceland, other nations should take notes--including the United States.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.