Liquidations & Devaluation Nations, BIS Data Points to Currency Collapse 2011

Currencies / Fiat Currency Jul 14, 2010 - 02:23 AM GMTBy: GoldSilver

Hey Mike, what would you do if you were elected the head of the U.S. Federal Reserve today?

Hey Mike, what would you do if you were elected the head of the U.S. Federal Reserve today?

"The first thing I would do is quit the second I got elected! I wouldn't want to be in charge of the Federal Reserve right now."- Mike Maloney

For release at 9:15 p.m. EDT

In response to the re-emergence of strains in U.S. dollar short-term funding markets in Europe, the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, and the Swiss National Bank are announcing the reestablishment of temporary U.S. dollar liquidity swap facilities. These facilities are designed to help improve liquidity conditions in U.S. dollar funding markets and to prevent the spread of strains to other markets and financial centers. The Bank of Japan will be considering similar measures soon. Central banks will continue to work together closely as needed to address pressures in funding markets.

Federal Reserve Actions

The Federal Open Market Committee has authorized temporary reciprocal currency arrangements (swap lines) with the Bank of Canada, the Bank of England, the European Central Bank (ECB), and the Swiss National Bank. The arrangements with the Bank of England, the ECB, and the Swiss National Bank will provide these central banks with the capacity to conduct tenders of U.S. dollars in their local markets at fixed rates for full allotment, similar to arrangements that had been in place previously. The arrangement with the Bank of Canada would support drawings of up to $30 billion, as was the case previously.

These swap arrangements have been authorized through January 2011. Further details on these arrangements will be available shortly.

Bank for International Settlements - BIS Quarterly Review, June 2010

Currency collapses and output dynamics: a long-run perspective

This article presents new evidence on the relationship between currency collapses, defined as large nominal depreciations or devaluations, and real GDP. The analysis is based on nearly 50 years of data covering 108 emerging and developing economies. We find that output growth slows several years before a currency collapse, resulting in sizeable permanent losses in the level of output. On average, real GDP is around 6% lower three years after the event than it would have been otherwise. However, these losses tend to materialize before the currency collapse.

Worldwide GDP has and continues to lag showing little signs of real recuperation to pre-crisis levels. The BIS's longterm data leaves little doubt, economic output growth has fallen off a cliff, it seems indeed we are headed towards global currency devaluations.

The worldwide financial crisis took firm hold in 2008 and given the Bank for International Settlement's three-year timeline for currency collapses, it looks like 2011 will be anything but financial heaven.

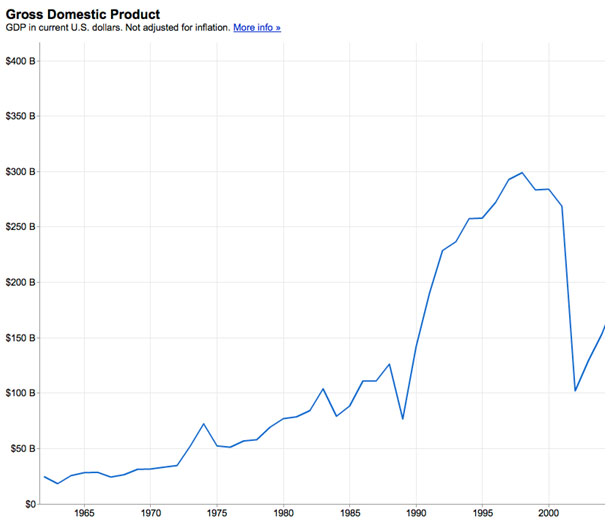

Remember history: below is a chart of the Argentine GDP from 1998 to the end of 2001:

It was three years after the Argentine GDP peaked in 1998, when in late 2001 and early 2002 the Argentine peso's purchasing power fell through the floor wiping out the middle class, pensioners, and savers.

Everyone needs to understand that we are being supported by government life support.

For example, last year the U.S. economy shrank by 2 percent, but the budget deficit was 10 percent of GDP — so had it not been for this ... budget deficit... The economy would have contracted by 15 percent, unemployment would have gone above 20 percent, and it would have been a complete replay of the Great Depression.

I think gold is the surest bet. I believe that gold is likely to go up 10 percent a year, on average, for the rest of our lives.

- Richard Duncan

More liquidations and devaluations are to come, ultimately there will be a dollar crisis that will shake the world. When the crisis hits, it will be too late for the unprepared.

Those who hold physical precious metals stand the chance to benefit in what we believe will be the greatest wealth transfer ever. Those who don't hold physical gold and silver stand the very real chance of giving away all they have worked for throughout their lives.

We implore you dear reader, take action while time remains.

- Mike Maloney

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2010 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.