Commodity Markets Update - Gold Remains Undervalued Despite Current Rally

Commodities / Gold & Silver Sep 12, 2007 - 09:28 AM GMTBy: Gold_Investments

Gold

Gold

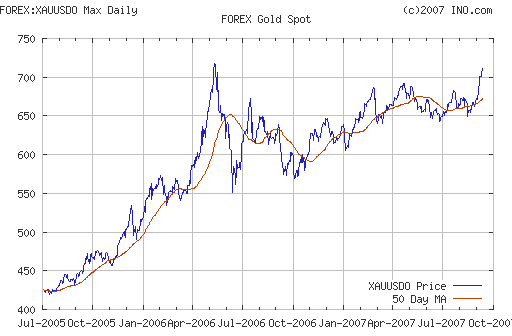

Spot gold was trading at $705.20/705.70 an ounce as of 1215 GMT after yesterday's 1.5% price increase.

It has traded sideways in Asia and Europe but remains close to new 16 month highs and is not far away from 26 year highs at $730. We believe that given the speed of the recent price surge there may be some back filling and consolidation but that the 26 year high will be challenged and surpassed in the coming days and weeks. The wise old Wall Street saying to always have 10% of one's wealth in gold and hope it doesn't work becomes more appropriate by the day.

Yesterday's surge seems was largely due to record oil prices and the record low dollar price but Ben Bernanke's serious warnings regarding the current account and trade deficits. Bernake said that the large U.S. trade deficits were unsustainable. Bernanke said that if the current account deficits persist at the current level, international investors may stop buying U.S. dollar denominated assets. "The large U.S. current account deficit cannot persist indefinitely because the ability of the United States to make debt service payments and the willingness of foreigners to hold U.S. assets in their portfolios are both limited," he said in a speech at the Brandenburgische Akademie der Wissenschaften.

Wall Street and much of the financial media have continually played down the risks posed to the dollar, U.S. interest rates and the wider U.S. economy posed by the deficits but denial of fundamental economic realities can only last for so long, as seen in the unfolding housing, mortgage and credit crisis.

The dreadful payroll numbers have led both Paulson and Bernanke to acknowledge that the credit crisis is in its early stages. Paulson said overnight that this uncertainty would last longer than previous shocks such as the Russian default LTCM crisis, the Latin American debt crisis or the Asian crisis.

The USD has fallen overnight to a new record low against the EUR of 1.3883 and seems likely to challenge 1.40. A 25 basis point cut in interest rates is guaranteed at next Tuesday's meeting but it could yet be as much as 50 basis points. This at a time when the ECB is sounding more hawkish. Trichet said yesterday the risks to price stability remain on the upside and other ECB members were even more hawkish. This is not surprising with oil and wheat back at record highs and other commodities surging close to or surpassing record highs. Gold has surged in price not just in terms of the USD but in moving up in price of all paper currencies and has been very strong in EUR, GBP, CHF and JPY terms as well. Gold easily surpassed the strong resistance seen at the pschological €500 EUR mark. Gold in EUR terms is now trading at €514.02 and in GBP at £350.02, both near 16 month highs.

Historical Gold Prices and Gold's Record High in 1980

The above chart shows how cheap or undervalued gold remains despite gold's rally in recent years from multi year lows. Today gold has only reached levels it traded at in 1980. The Dow Jones was trading at around 1,000 in 1980 and has risen 13 fold or 1300% since then to over 13,000. If you adjust for the significant inflation of the last 27 years, gold will have to trade well over $2,000 per ounce in order to be at real record highs. We are confident this will happen in the coming years of this new secular bull market.

Silver

Spot silver is trading at $12.63/12.67 an ounce (1215 GMT).

PGMs

Platinum was trading at $1300/1306 (1215 GMT).

Spot palladium was trading at $332/338 an ounce (1215 GMT).

Oil

Crude oil prices continued above $78 a barrel this morning at all time record highs.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.