Gold and Silver - Will They Protect You?

Commodities / Gold and Silver 2010 Jul 07, 2010 - 06:01 PM GMTBy: Mac_Slavo

Wild predictions for the future price of gold and silver abound. For investors, watching our current crisis play out in slow motion relative to multi-year trends can be excruciatingly difficult.

Wild predictions for the future price of gold and silver abound. For investors, watching our current crisis play out in slow motion relative to multi-year trends can be excruciatingly difficult.

Take, for example, those who invested in precious metals prior to the 2008 stock market and commodities implosion. Many took the advice of gold bugs like Peter Schiff, and had they bought in the first half of 2008, by November of the same year they would have seen their portfolios diminished by roughly 30%; even worse had they bought stocks in gold miners as opposed to the physical metal. Some may have sold and taken the loss, only to see gold rebound to new nominal highs just a year later.

If nothing else, this demonstrates that the short term swings are very volatile.

Like 2008, we now have many analysts, including those like Bob Chapman and Howard Katz, who see a long-term inflationary or hyperinflationary scenario in America’s future, updating their forecasts to allow for the possibility of a serious deflationary crisis. While we closely follow their opinions and often agree with their assessments, the predictive quality of information available is quite limited, and in the case of the inflation/deflation debate, directly related to how the US Government and Federal Reserve deal with the crisis. Thus, forecasts are not predictions, but rather, as Gerald Celente often says, merely an interpretation of current events forming future trends.

The intent of this article is not to make a case for deflation or inflation, though for those interested, we recommend Sooner or Later Deflationary Depression and Purging Will Come and On the Road to Hyperinflationary Destruction. Our purpose in this article is to provide readers, those who desire to preserve their wealth and purchasing power, a basic historical perspective about precious metals like gold and silver in both, inflationary and deflationary, scenarios. If precious metals perform as they have in previous crises, then we don’t have to worry too much about which direction metals will go over the long-term.

Precious Metals During the Deflation of the 1930’s

Things were a bit different during the 1930’s then they are today, thus we cannot make an exact comparison simply because at the time we were on the gold standard. It seems, however, that the key factor for precious metals buyers during this period was not that the US was in a severe deflationary cycle, but that times were uncertain.

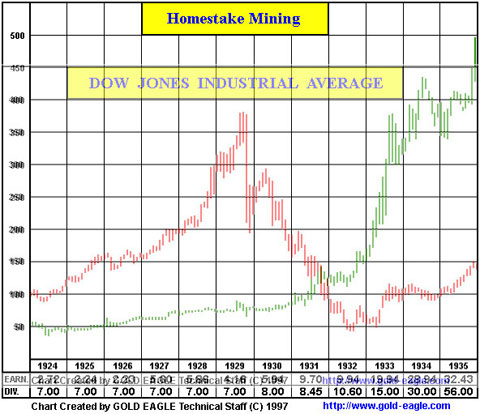

The populace in general had no real idea of where the US or the rest of the world was headed, and this may explain the green line in the chart below:

The red line is the Dow Jones, the green line is the stock price of Homestake Mining, one of the few gold miners for which charts are available.

Even after President Roosevelt’s 1933 Gold Confiscation Executive Order, the price of gold continued to rise. And though FDR did devalue the US dollar against gold shortly after his executive order was passed, the rise in the price of gold significantly outpaced the devaluation.

Since stock shares were the only way to really purchase gold on the free market because bullion sales were forbidden, one must ask: why were people buying gold during this deflationary period when millions were out of work and the price of goods and assets like real estate were falling?

Our view is that gold became the asset of choice for many because it returned to its traditional role during periods of crisis. It was a hedge against uncertainty.

The hedge paid off. From 1930 to the peak in 1935, Homestake mining shares earned over 500% in returns, and this was during deflation, a possibility many are warning us about today.

Precious Metals During the Inflation of the 1970’s

In the 1970’s, when inflation and price increases in essential goods like food, gas and real estate became a concern, we saw gold follow a similar upward pattern:

And if you ever wanted to see what the tail end of a gold bubble looks like, we recommend taking a close look at the follow chart of gold in 1980, when it hit it’s peak and subsequent bubble bursting:

During inflation, we saw the physical price of gold from 1972 to the peak in 1980 rise over 1200%. Yes, near the end there was most definitely a bubble, evidenced by the severe decline in late January 1980, but even if we were to use the March 1980 price point of $475 an ounce as our sell point, an investor holding the metal since 1972 would have earned nearly 500% returns.

Volatility and Uncertainty

When average citizens are uncertain about their future, be it with job prospects, their ability to pay their mortgage or with their retirements, it leads to volatile behavior in the markets. The action of the stock markets from 2007 through today provide evidence of this in pretty much all asset classes. Wild swings in either direction can happen on a daily basis.

This is most certainly as true for gold as it is for the Dow Jones. The difference between the two, however, is that when investors are really scared about what’s coming next, they opt for precious metals over paper stocks (in the case of Homestake mining, there wasn’t another option at the time). An example of this can be found by looking at stock markets during the inflationary period of the 1970’s. While everyone was screaming inflation and prices were rising, the 10 year period from 1970 to 1980 didn’t see stocks rise to any significant degree, especially if we compare stocks to gold.

Most will attribute gold’s rise to inflation fears. And, when those fears subsided post-1980 gold bubble, the price of the metal dropped to as low as $250 in the 1990’s even though during the period between 1985 to 1999, gold stayed around the $300 range, while inflation stayed around 3% annually. So, inflation wasn’t necessarily the driving force behind gold’s rise.

If one looks at the price of gold stocks during the Great Depression and the inflation of the 1970’s, seeing a rise during both periods, we can ascertain that the rise in price is attributed not to inflation (or deflation) but uncertainty.

When governments around the world lose the confidence of the public, few asset classes, one of them being precious metals, will retain their value. In the case of gold and silver, they did much more than just maintain purchasing power - they showed a profit.

You’ll Want to Spit on Your Precious Metals

If our assertions about deflation, inflation, public sector uncertainty and volatility are correct, then we can expect similar things from precious metals going forward.

One thing that must be made absolutely clear to those holding precious metals assets is that you can expect massive swings in both, the upward and downward direction.

Take a look, for instance, at the Gold chart above for the 1970’s period. In late 1974, gold peaked at nearly $200 an ounce. But, much like the investor who bought gold in early 2008, by late 1976 an investor would have seen nearly 50% shaved off his portfolio.

While we are not necessarily forecasting a 50% price decline in gold or silver going forward, precious metals investors must be aware that it could happen.

If the possibility of a deflationary cycle being forecast by some of our favorite analysts like Karl Denninger, Bob Chapman, Marc Faber, Mike Shedlock and Howard Katz does come to pass, we may see gold take a significant hit.

It will be up to you, the investor, to determine if it’s time to sell or if you will continue to hold. An old friend and long-time metals investors told me recently, that if you own gold, you will come to hate it. “You’ll want to spit on your gold and throw it in the trash, because that’s the nature of gold during times likes this,” he said.

The historical evidence suggests he may be right.

Gold and Silver Prices in the Future

Again, we will shy away from making our own predictions for the price of gold. We will also avoid providing “timing signals.” Because, if the historical charts tell us anything, it’s that precious metals movements are anything but predictable and that the moves they make don’t occur over periods of days or weeks, but months and years.

The United States, UK, Europe, China, Russia, Japan and every other global player is going through crisis. The people understand this. Times are uncertain.

Like previous period of uncertainty, we expect precious metals to perform well, regardless of inflation or deflation. Because when the Shit Hits the Fan, like it did in Greece recently, the people know what is going to preserve their wealth and that’s why Greeks were willing to spend as much as $1700 for an ounce of gold.

In addition to wealth preservation, it’s human nature to also want to turn a profit. While we believe this can be achieved with gold, one may also want to consider silver as a serious wealth preserver and builder. We recently published a piece titled Silver Price Projection: $1000 per Ounce This Decade. Admittedly, we were also surprised at the $1000 price projection, but after reading Lorimer Wilson’s recent piece Gold Ratio Suggests Parabolic Top For Silver of Over $100 per Ounce! we’re convinced that any move in gold will be met with an even stronger move in silver.

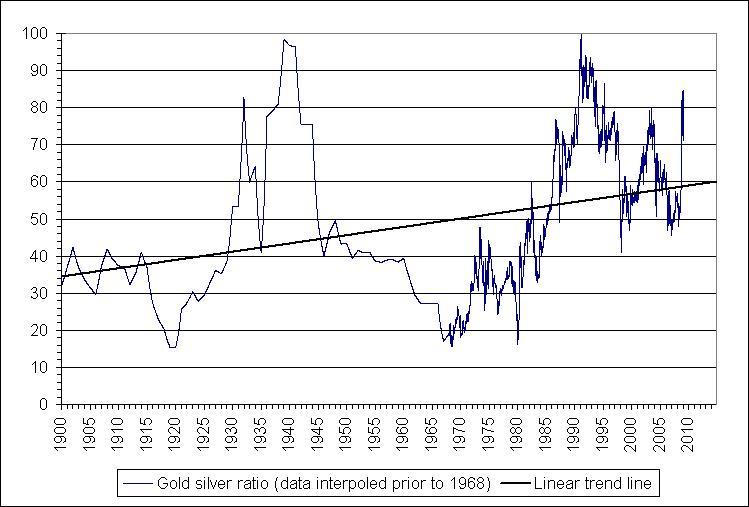

Assuming we will continue to see a longer-term up trend in gold, what can we expect from an industrial and precious metal like silver? First, we need to understand the Gold/Silver ratio, described by Wilson:

Based on silver’s historical correlation r-square with gold of approximately 90 - 95% silver’s daily trading action almost always mirrors, and usually amplifies, underlying moves in gold. With significant increases in the price of gold expected over the next few years even greater increases are anticipated in silver’s price movement in the months and years to come because silver is currently seriously undervalued relative to gold as the following historical relationships attests.

Let’s look at the silver:gold ratio from several different perspectives:

- Over the past 125 years the mean silver:gold ratio (i.e. 50% above and 50% below) has been 45.69 ounces of silver to 1 ounce of gold.

- In the last 25 years (since 1985) the mean silver:gold ratio has increased to 66.9:1

- The present silver:gold ratio is range-bound between 63:1 and 70:1 (66.77:1 at the end of June 2010).

- Interestingly, during the build-up to the parabolic blow-off in 1979/80 silver outpaced gold going up 732.5% vs. gold’s 289.3% causing the ratio to drop from 38:1 in January 1979 to 13.99:1 at the parabolic peak for both metals in January,1980.

Here is a chart trending the gold/silver ratio since 1900:

The current gold/silver ratio is sitting around 66. And though nothing is set in stone, take a look at the gold/silver ratio during the most uncertain periods in recent US history when gold peaked according to charts published above (1935 and 1980) and you’ll notice that the ratio declined significantly. This suggests that silver does, in fact, amplify gold’s moves, and if we have yet to reach gold’s ultimate “bubble” price, silver may see very significant moves as well.

Lorimer Wilson provides some specific numbers based on gold projections from some of the top metals analysts in the world:

Let’s look at the various price levels for gold and the various silver:gold ratios mentioned above one by one and see what conclusions we can draw.

First let’s use the mid-year (June 30th, 2010) price of $1243 for gold and apply the various silver:gold ratios mentioned above and see what they do for the potential % increase in, and price of, silver.

Gold @ $1243 using the current 66.77:1 silver:gold ratio puts silver at $18.61 (June 30/10)

Gold @ $1243 using the above 45.69:1 silver:gold ratio puts silver at $27.20 (i.e. +46.2%)

Gold @ $1243 using the above 13.99:1 silver:gold: ratio puts silver at $88.85 (i.e. +377.4%)

Now let’s apply the projections made above by the various economists, academics, gold analysts and market commentators listed above to the silver:gold ratio and see what that suggests is the parabolic top for silver.

;@ $10,000 Gold

Gold @ $10,000 using the silver:gold ratio of 66:1 puts silver at $150

Gold @ $10,000 using the silver:gold ratio of 45:1 puts silver at $222

Gold @ $10,000 using the silver:gold ratio of 14:1 puts silver at $714!!

(For what it is worth Jim Sinclair’s projection of $17,000 gold might well mean that silver would reach a parabolic top of $1,215 per ounce based on a 14:1 silver to gold correlation.)

;@ $5,000 Gold

Gold @ $5,000 using the silver:gold ratio of 66.1 puts silver at $75

Gold @ $5,000 using the silver:gold ratio of 45:1 puts silver at $111

Gold @ $5,000 using the silver:gold ratio of 14:1 puts silver at $357

;@ $2,500 Gold

Gold @ $2,500 using the silver:gold ratio of 66:1 puts silver at $38

Gold @ $2,500 using the silver:gold ratio of 45:1 puts silver at $55.50

Gold @ $2,500 using the silver:gold ratio of 14:1 puts silver at $178.50

From the above it seems that, any way we look at it, physical silver is currently undervalued compared to gold bullion and is in position to generate substantially greater returns than investing in gold bullion.

source: Kitco

Conclusion

Though we cannot predict for sure what will happen in the future, historical evidence and some of the brightest contrarian minds in the business suggest that gold and silver are not yet done with their upward move.

The current economic and political climate in the United States, Europe and the rest of the world implies that we are nowhere near the end of this crisis. In fact, it is our belief that we have already entered the Depression that President Obama and others have said that we avoided.

In terms of wealth preservation, especially if that includes you owning gold and/or silver, we must understand that we are seeing events play out in slow motion. The crisis will not take a few months to work out. If this is truly a depression as we believe it is, we have many years, perhaps as much as a decade or longer, before we begin to emerge from the depths of economic catastrophe.

While we do not advocate investing all of one’s assets in gold and silver, keeping your eggs in separate baskets is a strategy that may prevent a total loss of all of the wealth you have built up over your lifetime. Gold and silver should be one of your baskets. Many financial advisers, at least the contrarian ones, recommend a 15% - 30% precious metals alotment. We’ll leave each of our readers to decide what’s best for them.

Given the above information, however, we feel strongly that precious metals will be one of the very few global assets that will preserve, protect and potentially build net worth during this time of uncertainty and crisis.

For those of our readers who are concerned with not just a recession, depression, debt crisis or currency crisis, but what is often referred to as SHTF or TEOTWAWKI (The End of the World as We Know It), a well diversified “portfolio” might include gold, silver and a host of other commodities and assets. For more information, we recommend taking a look at some or all of the following articles:

Wealth Preservation, Investing, and Prepping in 2010

What is Money When the System Collapses?

Surviving Economic Collapse: Tips, Tactics, And Gear

We wish you the best of luck navigating the waters of global crisis and potential meltdown going forward.

By Mac Slavo

http://www.shtfplan.com/

Mac Slavo is a small business owner and independent investor focusing on global strategies to protect, preserve and increase wealth during times of economic distress and uncertainty. To read our commentary, news reports and strategies, please visit www.SHTFplan.com

© 2010 Copyright Mac Slavo - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.