Gold Supported by Spectre of Double Dip Recession

Commodities / Gold and Silver 2010 Jul 05, 2010 - 06:02 AM GMTBy: GoldCore

Gold has had a quite start to the week trading in a tight range between $1,210/oz and $1,215/oz so far in Asian and early European trading. With the US out for the Independence Day holiday it looks set to be a quite day although low volumes could result in volatility. A close below $1,200/oz could see gold fall to support at $1.185/oz and strong support at $1,165/oz.

Gold has had a quite start to the week trading in a tight range between $1,210/oz and $1,215/oz so far in Asian and early European trading. With the US out for the Independence Day holiday it looks set to be a quite day although low volumes could result in volatility. A close below $1,200/oz could see gold fall to support at $1.185/oz and strong support at $1,165/oz.

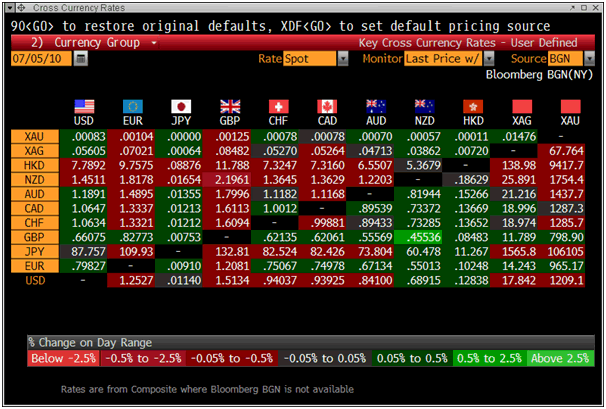

Gold is currently trading at $1,210/oz and in euro, GBP, CHF, and JPY terms, at €966/oz, £800/oz, CHF 1,285/oz, JPY 106,249/oz respectively.

Gold in USD - 3 Month (Daily)

Gold's second consecutive weekly lower close is short-term bearish technically, but it has again outperformed most other markets - particularly equity markets which fell sharply last week. Indeed many leading equity indices are looking very vulnerable technically with many having "death crosses" (where the 50 day moving average falls below the 200 moving average and both averages are falling). Poor technicals and the spectre of a double dip recession has markets on edge.

With a lack of financial and economic data being released this week, markets will focus on interest rate decisions in the EU, UK and Australia. As long as interest rates remain near zero, which they look set to for the foreseeable future, gold is likely to remain in a bull market as the opportunity cost of owning gold remains minimal. Also it is important to remember that gold prices only fell towards the end of the interest rate tightening cycle in the 1970s and thus gold is likely to continue to increase in value until savers and bondholders get much higher yields than the miniscule yields currently. Not only are yields miniscule but the risk of default has never been higher meaning that investors are not being compensated by higher yields for the extra risk. This makes gold, which cannot default and has no counterparty risk, a prudent diversification.

Cross Currency Rates at 1030 GMT - EUR and GBP Under Pressure Versus Gold

Physical demand for gold at the $1,200/oz level has been noted internationally (especially in India and Asia) from both jewelers and investors buying the dip. This shows that physical buyers are gradually becoming accustomed to the continued rise in the gold price. This is particularly the case with investors who continue to diversify into gold due to continuing macroeconomic risk. Most investors continue to have little or no allocation to gold despite the volatility and uncertainty of recent years. With uncertainty in property, equity, bond and currency markets set to continue in the coming months, safe haven demand for gold will continue. Growing concerns of a global double dip recession could exacerbate this trend.

Silver

Silver is currently trading at $17.84/oz, €14.21/oz and £11.78/oz.

Platinum Group Metals

Platinum is trading at $1,513/oz and palladium is currently trading at $432/oz. Rhodium is at $2,475/oz.

News

Fresh fears over a global economic slowdown were raised on Saturday after Goldman Sachs' chief economist warned that data from China and the US revealed that any recovery was facing a "challenging period" and that evidence from America was "troubling". As Britain enters a self-imposed period of austerity to deal with an historically large budget deficit, Jim O'Neill, one of the world's foremost economists, said that events beyond our shores could pose more of a problem than any domestic economic problems. Writing in The Sunday Telegraph, Mr O'Neill, head of global economic research at Goldman, said: "What is clear is that a persistently struggling US, in addition to a major disappointment in China, would not be good news for the rest of us" (Daily Telegraph).

Gold futures prices rose by Rs 17, or 0.09 per cent, to Rs 18,708 per ten gram today on fresh buying by speculators in tandem with a firming global trend. At the Multi Commodity Exchange platform, gold for December contract gained Rs 17, or 0.09 per cent, to Rs 18,708 per ten gram, with an open interest of 594 lots. Similarly, the metal for delivery in August contract traded marginally higher by Rs 7, or 0.04 per cent, to Rs 18,543 per ten gram, with an open interest of 18,554 lots. Marketmen said fresh buying by traders and a firming global trend mainly led to a rise in gold prices at futures trade (PTI).

The rand strengthened for a second day after a strike at South Africa's state-owned power utility that had threatened to hobble industrial output was averted and as commodity prices increased. The currency of Africa's biggest economy appreciated as much as 0.7 percent to 7.6794 per dollar, before trading 0.1 percent higher at 7.7315 by 10:37 a.m. in Johannesburg, from a previous close of 7.7364. The National Union of Metalworkers of South Africa welcomed a decision by Eskom Holdings Ltd., the company that supplies about 95 percent of the country's electricity, to lift its pay offer to 9 percent to avert a strike during the World Cup. Platinum for immediate delivery rallied as much as 1 percent to $1,515.75 an ounce, while gold increased for a second day, gaining as much as 0.3 percent to $1,214.60 an ounce. The two precious metals are South Africa's biggest exports (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.