Stock Market Support Broken, More Pain Ahead SP500 at 900?

Stock-Markets / Stock Markets 2010 Jul 04, 2010 - 03:27 PM GMTBy: Richard_Shaw

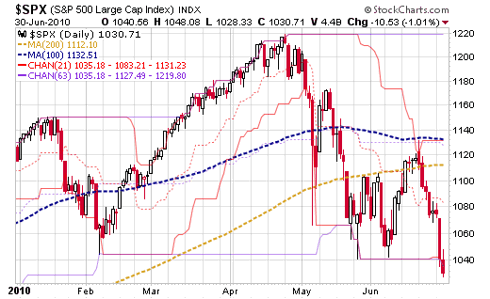

The S&P 500 (proxies SPY and IVV) clearly broke key support yesterday and today. The index also now has a pattern of lower lows and lower highs. The price has been below its 200-day average for weeks now, with only a short peak above in June.

Not much in the charts suggests other nearby support, except for some possible support at the current price level back in Q4 of 2009.

These patterns, in combination an unattractive macro-economic picture, suggest more pain ahead -- potentially as low as the June 2009 low around 900.

The index is currently down about 16% from its April high. That is well on its way to the traditional definition of a bear market at 20% down, which would be reached at about 976 (4% from here).

We have been entirely out of equities since mid-May, having exited the S&P 500 at price between 1180 and 1120, depending on client mandates. We exited European stocks in 2009, and emerging markets in early 2010.

We will re-risk capital after price trends return to an upward direction.

Holdings Disclosure: As of June 30, 2010, we do not own any securities mentioned in this article in any managed accounts.

By Richard Shaw http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.