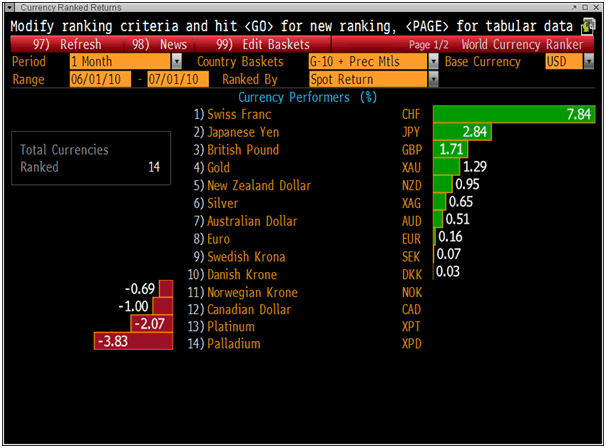

Gold 2010 YTD Up 13% in USD, 19% in GBP and 24% in EUR

Commodities / Gold and Silver 2010 Jul 01, 2010 - 07:31 AM GMTBy: GoldCore

Gold rose again yesterday in dollars and other currencies, especially sterling which fell against nearly all currencies (see chart below). Gold is currently trading at $1,244/oz and in Euro, GBP, CHF, and JPY terms, gold is trading at €1,008/oz, £830/oz, CHF 1,328/oz, JPY 109,574/oz respectively.

Gold rose again yesterday in dollars and other currencies, especially sterling which fell against nearly all currencies (see chart below). Gold is currently trading at $1,244/oz and in Euro, GBP, CHF, and JPY terms, gold is trading at €1,008/oz, £830/oz, CHF 1,328/oz, JPY 109,574/oz respectively.

The worse than expected US private sector job data saw the dollar come under pressure which led to safe haven demand for gold. Despite last week's marginal decrease, gold ended the month of June higher by 2.5%. Gold ended May higher by 3% and ended May higher by 6%. For the second quarter, gold ended up by 12%, its seventh consecutive quarterly gain. For the first quarter of this year, gold rose by 1.7%. On a year to date basis, gold is higher by 13.2%.

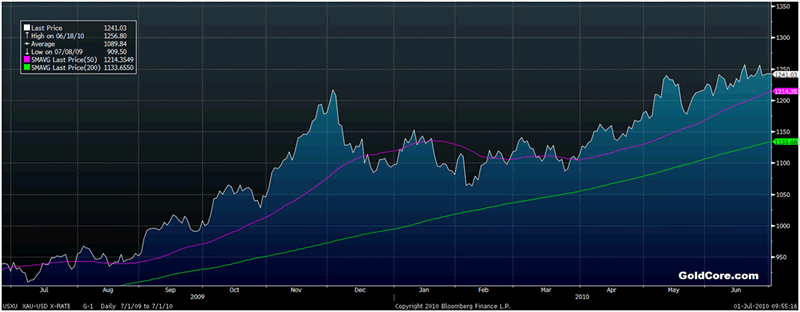

Gold in USD - 1 Year (Daily) with 50 and 200 Day Moving Averages.

Technically and from a momentum perspective the trend on gold remains up and yet gold is climbing a classic wall of worry in typical bull market fashion with skepticism and 'gold bubble' talk remaining high. Indeed, it is arguable that the technical picture and the fundamentals are as sound as ever for gold especially given the increasing concern about the fate of fiat currencies. Investors are as ever well advised to diversify and buy and hold for the long term rather than trying to 'time the market'. Market timers waiting for the perfect pull back and buy signal will likely continue to be disappointed.

Gold and silver appear to be consolidating at these levels and a period of profit taking is to be expected after their recent rise in price. Friday's Non Farm-Payrolls may give direction and another negative employment report could lead to a safe haven bid coming into the gold market. Gold usually trends lower in the first part of the third quarter and in the quieter summer 'doldrums' months when physical demand declines (particularly from India) but concerns about sovereign debt issues and about the outlook for fiat currencies should see gold supported this summer.

Especially as investment and central bank demand looks set to remain robust due to the very uncertain financial and economic outlook. Added to the recent host of negative economic data is the fact that commodity shipping costs as measured by the Baltic Dry Index extended their longest losing streak in almost five years (the lowest since October 2009) yesterday. The 24th consecutive drop, the longest losing streak since August 2005, does not bode well for the global economy and thus for the outlook for commodities or equities.

Continuing central bank diversification into gold was seen in the news that the Russian central bank had bought a further 22.46 tonnes of gold in May - adding to their significant currency reserves again. Meanwhile the IMF which is facing fiscal challenges due to the sovereign debt crisis has continued to gradually sell its gold reserves and sold 15.25 tonnes in May (see NEWS below).

Gold in GBP - 30 Day (Tick).

Silver

Silver ended higher by 39 cents (1.4%) at $18.70 an ounce yesterday. For the second quarter, silver ended higher by 3.1%. For the month of June, silver ended marginally higher. Last week, silver ended lower by 0.4%. For May, silver shed 1.1%. For the month of April, silver ended higher by 4.1%. For the first quarter of this year, silver rose by 3%. On a year to date basis, silver is higher by 6.1%.

Silver is currently trading at $18.61/oz, €15.10/oz and £12.46/oz.

Platinum Group Metals

Platinum is trading at $1,520/oz and palladium is currently trading at $442/oz. While rhodium is at $2,500/oz.

News

The International Monetary Fund's gold holdings fell by 15.25 metric tons (490,286 ounces) in May, according to figures from the Washington-based lender. Russia's assets expanded by 22.46 tons. Reserves of gold at the IMF were 2,951.58 tons at the end of May compared with 2,966.83 tons at the end of April, data on the IMF's website show. Russia increased holdings to 703.1 tons in May, from 680.64 tons, and has added gold every month since at least February, the data show. The IMF plans to sell a total of 403.3 tons of gold. India, Mauritius and Sri Lanka bought 212 tons last year and the IMF in February said it would begin selling the remainder on the open market. The combined February-to-May sales would leave about 137.5 tons as of the beginning of last month. Central banks have been adding to reserves and gold-backed exchange-traded fund assets have advanced to a record as investors sought an alternative to currencies and a protection of wealth from Europe's debt crisis. Central banks and governments added 425.4 tons to their holdings last year to 30,116.9 tons, the most since 1964 and the first expansion since 1988, data from the World Gold Council show. Official reserves may expand by another 192 to 289 tons this year, CPM Group, a research and asset-management company in New York, said last month. China increased its reserves of gold by 454 tons to 1,054 tons since 2003, the Foreign Exchange Administration said in April last year (Bloomberg).

Silver output in Mexico, the world's largest producer after Peru, rose 46 percent in April from a year earlier, when a strike disrupted a refinery. Output of the metal climbed to 263,916 kilograms (581,835 pounds) in April, the National Statistics Agency said today in a statement on its website. Industrias Penoles SAB, the world's biggest silver miner, declared force majeure last year at its Met-Mex refinery amid a nine-week strike that ended in mid-April (Bloomberg).

Latest IMF data, which encompasses 2/3 of global foreign exchange reserves, shows that both the euro and dollar became a smaller proportion of global currency reserves in the first quarter of 2010 according to Reuters.The dollar's share fell to 61.54% from 62.17% in the fourth quarter of 2009. The euro's share dropped to 27.19% from 27.30% at the end of 2009. On a longer-term basis, the euro still remains a higher share of reserve assets than before. In 1999 it only accounted for 18.1% of assets. The yen and other currencies gained share this year, with the yen now comprising 3.14% of reserve assets and other miscellaneous currencies accounting for 3.7%. The British pound's global share held steady in the first quarter, at 4.3% (Business Insider).

Gold imports in India, the world's biggest consumer, may fall as much as 36 percent this year as higher prices and volatility slows demand, the Indian Bullion Market Association said (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.