U.S. Economy Mid Year Economic Forecast 2010

Economics / US Economy Jun 28, 2010 - 06:16 AM GMTBy: Money_Morning

Don Miller writes: Most textbook economists say that the U.S. economy is engaged in a broad-based recovery. But while there's a consensus that there's no "double-dip" recession on the horizon, the evidence suggests the nation's economy is headed for a slowdown in the second half of 2010.

Don Miller writes: Most textbook economists say that the U.S. economy is engaged in a broad-based recovery. But while there's a consensus that there's no "double-dip" recession on the horizon, the evidence suggests the nation's economy is headed for a slowdown in the second half of 2010.

The reason: In a market that derives 70% of its growth from consumer spending, the last half of this year will be all about those consumers - and about the economy's inability to generate enough jobs to keep the nation's cash registers ringing.

If you add to that concern the end of the various government stimulus efforts, possible fallout from the Eurozone debt contagion, and oil in the Gulf of Mexico defiling the shores of four states, you end up with an economic outlook that's clouded with uncertainty.

And that uncertainty will continue to stifle hiring and will result in another round of consumer belt-tightening - and a continued economic malaise.

"The fact remains that the U.S. economic recovery stands on shaky ground and the probability for a slowdown appears real for the second half, as evidenced by the recent spate of weak economic data such as high initial jobless claims, low non-farm payrolls, and anemic retail sales figures," said Money Morning Contributing Writer Jon D. Markman.

As Consumers Go, So Goes the Economy

The U.S. economy grew at a 2.7% annual rate in the first quarter, less than previously calculated, reflecting a smaller gain in consumer spending. That's less than half the 5.6% growth in gross domestic product (GDP) the U.S. market experienced in the fourth quarter of 2009.

Economists are forecasting stronger growth - 3.8% on an annualized basis - in the second quarter, which ends Wednesday. But big questions remain about prospects for the second half of the year.

The biggest question of all is whether or not the U.S. consumer will be able to stay strong in the face of high unemployment.

Consumer spending rose at a 3% annual rate in the first quarter, down from the previous 3.5% estimate. And it's getting worse.

Retail sales plunged in May by the largest amount in eight months as consumers slashed spending on everything from cars to clothing, according to the U.S. Commerce Department. Total spending fell a whopping 1.2%, as even such discounting stalwarts as Wal-Mart Stores Inc. (NYSE: WMT) got the cold shoulder.

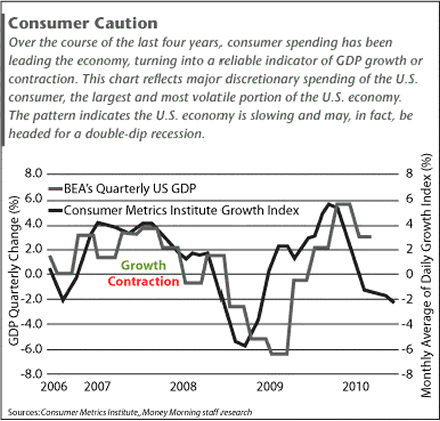

When the U.S. economy is at its strongest, consumer spending accounts for as much as 70% of the nation's growth. So there's little chance for the economy to get up off the mat until shoppers open their wallets and loosen their purse strings. In fact, because consumer spending is such a potent economic catalyst, it acts as a leading indicator of growth - similar to the manufacturing and purchasing indexes. The chart below shows how changes in consumer spending patterns often presage changes in economic growth patterns.

Right now, consumer spending is trending down, which means we're likely headed for an economic slowdown - at the very least.

Right now, consumer spending is trending down, which means we're likely headed for an economic slowdown - at the very least.

In the worst-case scenario, the United States could be headed for a dreaded double-dip recession.

GDP Growth Not Enough to Stimulate Hiring

During normal times, growth in the 3% range would be considered healthy. But the country is coming out of the longest and deepest recession since the Great Depression.

Economists say it takes about 3% growth to create enough jobs just to keep up with the population increase. Growth would have to be about 5% for a full year just to drive the unemployment rate down by one percentage point.

So economic growth needs to be a lot stronger - two or three times the current pace - to make a big dent in the nation's 9.9% unemployment rate.

A scant 431,000 jobs were added in May, according to the U.S. Labor Department. That was well below Wall Street's expectation of 513,000. Worse, a whopping 411,000 of those jobs came from U.S. Census hiring, which means that a full 95% of the jobs added in May were temp positions.

And even though the four-week average of Americans filing for jobless benefits declined slightly to 463,500 in the week ended June 18, it is still about 10,000 higher than last month.

Claims at a level of roughly 450,000 are consistent with private companies adding about 100,000 jobs a month, JPMorgan Chase & Co. (NYSE: JPM) chief economist Bruce Kasman said in a note to clients. That is fewer than the 116,000 a month average growth in the five years to December 2007, when the recession began.

Initial claims would have to average 425,000 to 430,000 each month for private payrolls to rise by the 175,000 a month that JPMorgan economists are forecasting for the second half of the year, Kasman wrote.

It takes 150,000 jobs to the plus side just to tread water.

"The labor market is not improving," Steven Ricchiuto, chief economist at Mizuho Securities USA Inc. (NYSE ADR: MFG) in New York told Bloomberg News. "If you really are going to have a sustainable recovery, you need the labor market to improve."

High Unemployment Hamstrings Moribund Housing Market

Along with consumer spending, the housing market is another one of the main drivers of the U.S. economy. Construction jobs, lumber and other materials account for about 6% of GDP.

In fact, the housing-market bubble was directly responsible for the economic expansion of the early part of the decade - when loose lending overextended credit for questionable home loans. Homeowners used their houses as virtual ATM machines, cashing in their home-equity lines to buy cars, furniture, clothes, swimming pools and expensive vacations, such as cruises.

But weakness in that same housing market has now given the economy a migraine headache that's impervious to such typical remedies, including low interest rates and government-stimulus programs.

Simply put, the country has too many houses and too many homeowners in trouble.

Consider:

•Foreclosures are expected to climb to 4.5 million this year from 2.8 million in 2009, according to RealtyTrac Inc., an Irvine, California-based research firm.

•An alarming total of 11.2 million homes are underwater, and an additional 2.3 million mortgages have less than 5% equity.

•And there are now 2 million vacant homes for sale - double the historical level, according to the U.S Census Bureau.

About 7 million homeowners are behind on their mortgages, and that number is on the rise. The delinquency rate for mortgage loans on residential properties increased to 14% of all loans outstanding in the first three months of the year, according to the Mortgage Bankers Association (MBA).

The serious delinquency rate - the percentage of loans that are 90 days or more past due or in the process of foreclosure - was 9.54%. The cure rate for these loans is less than 1%.

So, out of a total U.S. mortgage debt of about $10 trillion, there is a contingent liability of nearly $1 trillion hanging over the U.S. banking system like a financial sword of Damocles.

No wonder the banks aren't that eager to lend money...

And, if not for the nationalization of the mortgage market, housing literally could have gone over the cliff by now.

Instead, the Federal Housing Administration (FHA), Fannie Mae (NYSE: FNM), and Freddie Mac (NYSE: FRE) have financed more than 90% of U.S. home mortgages since the market for mortgage bonds without government-backed guarantees collapsed.

For the first time ever, the FHA backed more loans than Freddie and Fannie combined. That is especially troublesome, given that the FHA backs loans with down payments of as little as 3.5%.

"This is a market purely on life support, sustained by the federal government. Having FHA do this much volume is a sign of a very sick system," FHA Chief David Stevens told a conference at the MBA.

After the Federal housing credit for mortgages expired at the end of April, mortgage applications plummeted 40%, leading some analysts full circle to the only solution.

"Ultimately, you're going to need job growth to see a sustainable recovery in housing," Scott Brown, chief economist at Raymond James & Assoc. Inc. (NYSE: RJF) in St. Petersburg, Florida, told Bloomberg.

Tepid Economic Growth For Second Half of 2010

At this point in the economic cycle, it's all about jobs.

After a two-decade debt binge, U.S. consumers have basically reached the exhaustion point. And since more than two-thirds of U.S. GDP revolves around consumers making purchases, it'll be nearly impossible to grow the economy out of this mess as long as employers hold back on hiring.

Top it off with troubles in Europe and an oil spill that could cost upwards of 80,000 jobs in the U.S. Gulf-region states, and you have an economy that will do well to crank out 3% growth for the rest of 2010.

For now, a lack of job creation will continue to put pressure on U.S. housing prices, the nation's banking sector, and the U.S. economy.

"There had been too much enthusiasm that the recession was over," Stanley Nabi, New York-based vice chairman of Silvercrest Asset Management Group, which manages $9 billion, told Bloomberg. " It's very noticeable that there has been a scale-back in expectations. The vigor of the recovery has moderated."

Source : http://moneymorning.com/2010/06/28/u.s.-economy/

Money Morning/The Money Map Report

©2010 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.