Gold Seasonal Move Starts in September. But Do Not Celebrate Yet

Commodities / Gold & Silver Sep 05, 2007 - 10:50 AM GMTBy: Donald_W_Dony

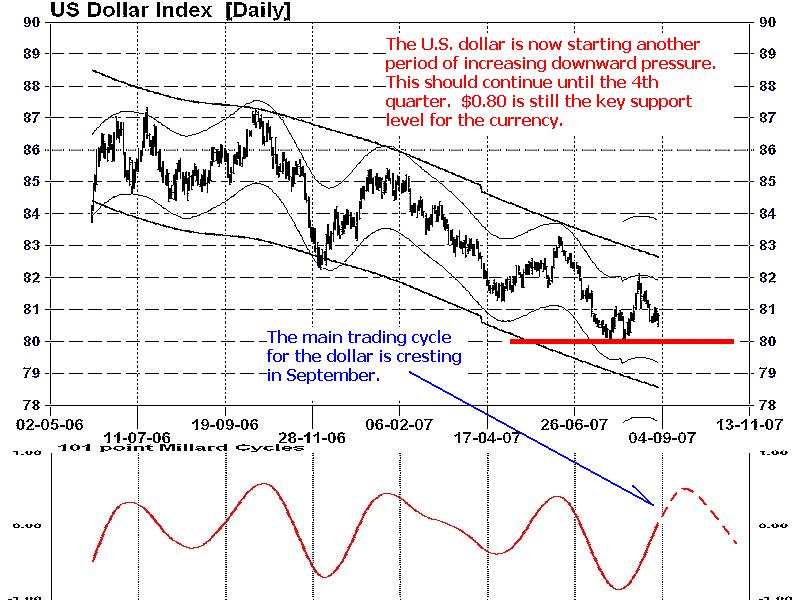

After a long and dull summer, gold is about to enter its normal seasonal strong period. Much of the increase comes from the increased demand of the Indian wedding jewelery industry in the 4th quarter. But extra momentum is also normally delivered from the declining U.S. dollar. However, as the currency is now resting on solid support at $0.80, is the near-term outlook for gold that bright?

After a long and dull summer, gold is about to enter its normal seasonal strong period. Much of the increase comes from the increased demand of the Indian wedding jewelery industry in the 4th quarter. But extra momentum is also normally delivered from the declining U.S. dollar. However, as the currency is now resting on solid support at $0.80, is the near-term outlook for gold that bright?

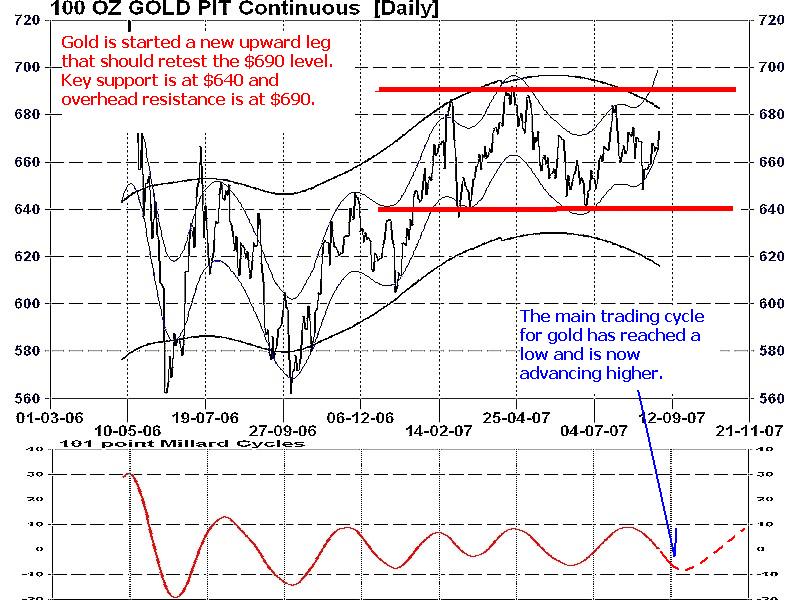

On June 10th, I wrote an article about the on-going weakness of gold and gold stocks for the summer months. This metal and equity sector was expected to trade flat to down largely due to the lack of room for downward movement because there was support for the U.S. dollar at the $0.80 level. This is exactly what has occurred. From June throughout August, the precious metal (Chart 1) has remained pinned between $640 and $685 because the dollar is not falling.

Much of the increase to gold over the past four years can be contributed to the failing fundamentals of the dollar and its declining price. Though the fundamentals are still very weak, the price has established a ledge to halt its drop (see Chart 2). This level has propped the currency seven times in the past 25 years. Without the Greenback breaking through this line, the on going upward progress for gold will be measured at best.

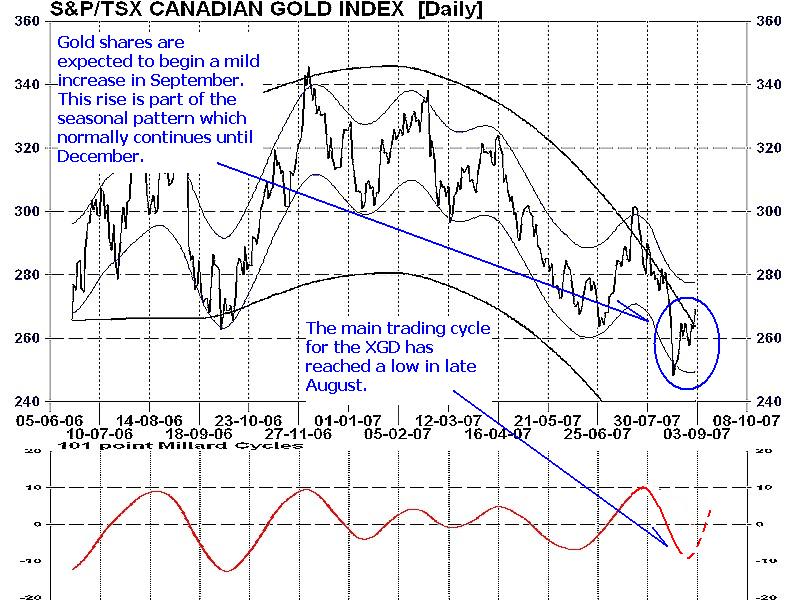

As a result, gold shares (Chart 3) have been one of the worst performing stock groups for over 18 months. Outside of gold bulls, who are eternally optimistic, the average investor still remains largely uncommitted to precious metal stocks and often this sector will be one of the first to be sold if liquidity needs arise. gold shares are anticipated to have a moderate increase from now to December.

My Conclusion: Technical models suggest that gold is beginning its seasonal upward movement in early September. This action typically continues until late in the 4th quarter. Part of any expected rise in gold can be contributed to a falling U.S. dollar. But as the U.S. dollar is expected to hold above or on the solid $0.80 support level, do not expect the seasonal rise in gold to be anything more than tempered. Gold is anticipated to stay below the upper resistance line of $690 over the next several months.

Unexpected weakness in the U.S. dollar resulting in a sub $0.80 price appears to be the only reason, at present, for gold to advance over $700.

Additional research is available in the September newsletter. Go to www.technicalspeculator.com and click on member login, then follow the links.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.