U.S. Dollar Soars Against Crumbling Euro as Hungary Next for Debt Default Bailout

Currencies / US Dollar Jun 05, 2010 - 01:58 AM GMTBy: Mike_Shedlock

The situation in Europe is taking a turn for the worse as the Prime Minister of Hungary says Hungarian economy is in a "very grave situation and talk of a default is not an exaggeration".

The situation in Europe is taking a turn for the worse as the Prime Minister of Hungary says Hungarian economy is in a "very grave situation and talk of a default is not an exaggeration".

Please consider Hungary’s Forint Weakens to 12-Month Low; Bonds, Stocks Plunge

Hungary’s forint weakened to the lowest level in a year, the nation’s stocks plunged and government bond yields had the biggest increase since November 2008 after a spokesman for Prime Minister Viktor Orban said the economy is in a “very grave situation.”

The forint depreciated 2.1 percent to 287.73 per euro at 2:28 p.m. in Budapest, the weakest level since June 2009. The extra yield investors demand to own Hungary’s debt over U.S. Treasuries rose 93 basis points, the most since November 2008, to 4.12 percentage points, according to JPMorgan Chase & Co.’s EMBI Global Index. The BUX Index of equities tumbled 7 percent.

Hungary’s economy is in a “very grave situation” because the previous government manipulated figures and lied about the state of the economy, Orban’s spokesman Peter Szijjarto said at a press conference in Budapest today. Talk of a default is “not an exaggeration,” Szijjarto said. European equities and U.S. stock-index futures fell after the comments.

Hungary secured a 20 billion-euro ($24 billion) loan from the IMF, the European Union and the World Bank in October 2008 to avoid default as the global financial crisis spurred investors to avoid the country and sent the economy into a recession.

Orban, who took over May 29 after winning elections by pledging to cut taxes and stimulate the economy, yesterday failed to get EU approval for looser fiscal policy.

Whatever You Do, Don't Tell The Truth!

Here is an interesting quote from the article.

“The new government needs to think a bit more clearly about communication with the market. You simply cannot talk like this in these markets” said Timothy Ash, head of emerging-market research at Royal Bank of Scotland Group Plc, in an e-mailed comment.

Translation "No matter what the problem is ... please don't tell the truth!"

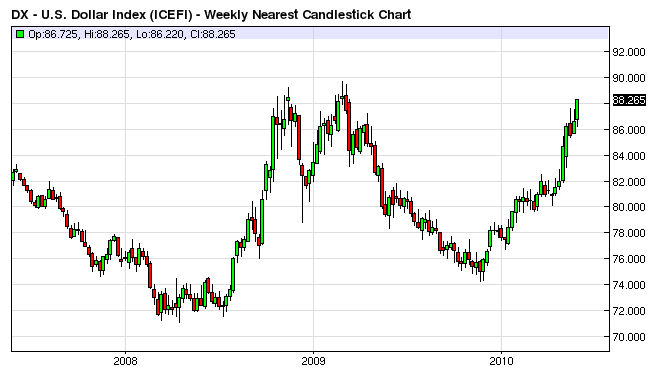

US$ Index Weekly

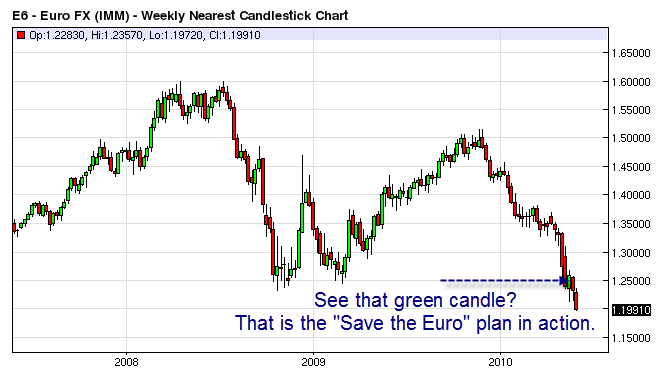

Euro vs. Dollar Weekly Chart

On news of the "Save the Euro Plan" the Euro bounced all the way up to 1.31 (see previous red candle). However, the Euro could not hold the gains for even a few days.

Now, the Euro is making fresh new lows.

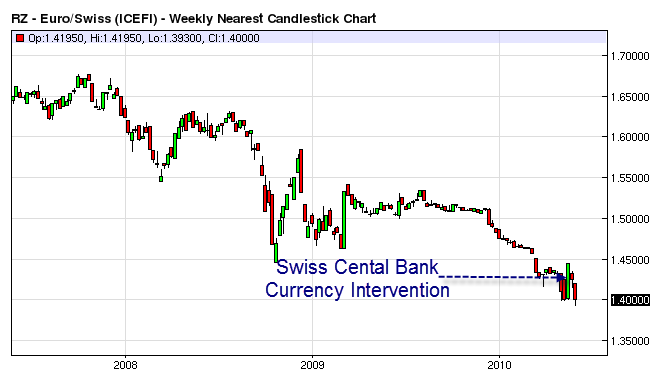

Euro Swiss Weekly

This is a chart of the Euro vs. the Swiss Franc. I think it is the most interesting of the lot because the Swiss Central Bank has openly intervened in the currency markets in an attempt to suppress the Swiss Franc.

Swiss franc intervention cost a billion a day in April

Inquiring minds are reading a May 21, 2010 Financial Times Alphaville article Swiss franc intervention cost a billion a day in April

Data just released show that the SNB increased its holdings of foreign currency by an extraordinary CHF28.5 billion in April – almost CHF1 billion a day. This means that, in the first four months of this year, Herr Hildebrand had gobbled up CHF58.9 billion of a money nobody else much wanted to own – on top of which we have to add what is likely to be a sizeable sum of flight capital ‘absorbed’ in the first turbulent weeks of May (€9.5 billion on Wednesday morning alone, according to market rumour).

Making a simple estimate that the overall intervention this month has at least matched that undertaken in April (a decidedly conservative guess), the Bank will have amassed around CHF80 billion so far this year, a total of which the mighty PBoC would not be ashamed and one, even more remarkably, equivalent to around 45% of the Confederation’s entire private national income for the period.

Not only has the SNB therefore seriously diluted its existing citizen-shareholders’ equity stake in their own country (think about it), it has gone some good way into turning the Swissy into the Hong Kong Dollar of Europe, since fast approaching 70% of the asset side of its balance sheet is currently being held in the form of forex (160% of the monetary base, 38% of M1), putting the once-proud Swissy well on track to degenerating to mere currency board status.

With Hildebrand maintaining the stance in the Swiss press that reserves were, if anything, too low, before his shopping spree – and with the ECB’s ability to create extra Euros being both essentially limitless and in inverse proportion to its Northern members’ desire to hold them – the Swiss are in danger of selling out their remaining economic and monetary independence in the name of a mercantilist desire to buffer their admittedly important exporters from the malfeasance of their neighbours’ governments.Alphaville attributed the above snip to Sean Corrigan of Diapason Commodities.

Currency Intervention Simply Does Not Work

As I have said before many times. Currency intervention simply does not work.

For a look at Japan's currency intervention in 2003-2004, and other currency intervention madness, please consider Currency Intervention And Other Conspiracies

Once again the results speak for themselves.

Swiss Franc Libor Falls; SNB May Curtail Intervention

After amassing billions in Euros in a foolish as well as losing attempt to suppress the Swiss Franc vs. the Euro, I find myself laughing at this Bloomberg headline just yesterday: Swiss Franc Libor Falls; SNB May Curtail Intervention.The rate banks say they pay for three-month loans in Swiss francs fell to a record low, potentially sparking inflation and compel the nation’s policy makers to let the currency rise, according to Citigroup Inc.

The Swiss National Bank has intervened to curb the currency’s gains by pumping francs into the market, said Michael Hart, a foreign-exchange strategist at Citigroup in London. That risks stoking inflation, which accelerated a more-than-forecast 1.4 percent in April, he said. The SNB says consumer-price growth may be 2.2 percent in 2012.

“It indicates they will need to tighten policy and stop intervention over the coming months,” Hart said yesterday in a phone interview. “The SNB has flooded the market with liquidity as a result of the interventions.”

The Swiss franc was little changed at 1.4153 per euro as of 11:50 a.m. in London.As of right now, the Euro fell to 1.40 vs. the Swiss Franc after touching a new low for the move this morning at 1.393.

I think Michael Hart, Citigroup's foreign-exchange strategist in London is off his rocker in suggesting the Swiss national Bank is about to tighten. However, if they do, the Swiss Franc will go soaring vs. the Euro.

Look at the holes central bankers dig attempting to defeat the markets. The track record of central bankers learning anything from the failures of other central bankers is a perfect zero percent.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.