Gold Marginally Lower as Equities Fall Sharply on Disappointing US Job Numbers

Commodities / Gold and Silver 2010 Jun 04, 2010 - 02:47 PM GMTBy: GoldCore

The US jobs number came in at 431,000, which was worse than the expected 500k, and saw safe haven buying bid the dollar, yen and gold prices higher. The jobs number raised concerns about the sustainability of the recovery especially as the employment numbers received an artificial boost from the hiring of thousands of temporary census workers.

The US jobs number came in at 431,000, which was worse than the expected 500k, and saw safe haven buying bid the dollar, yen and gold prices higher. The jobs number raised concerns about the sustainability of the recovery especially as the employment numbers received an artificial boost from the hiring of thousands of temporary census workers.

Volatility has been very high and gold's safe haven bid was short lived and it soon gave up the early gains and large sellers appeared pummelling prices lower again. There appeared to be a very determined seller around the $1,207/oz level who did not want gold higher on the day. Gold is currently trading at $1,203/oz and in Euro, GBP, CHF, and JPY terms, at €997/oz, £825/oz, CHF 1,389/oz, JPY 110,726/oz respectively.

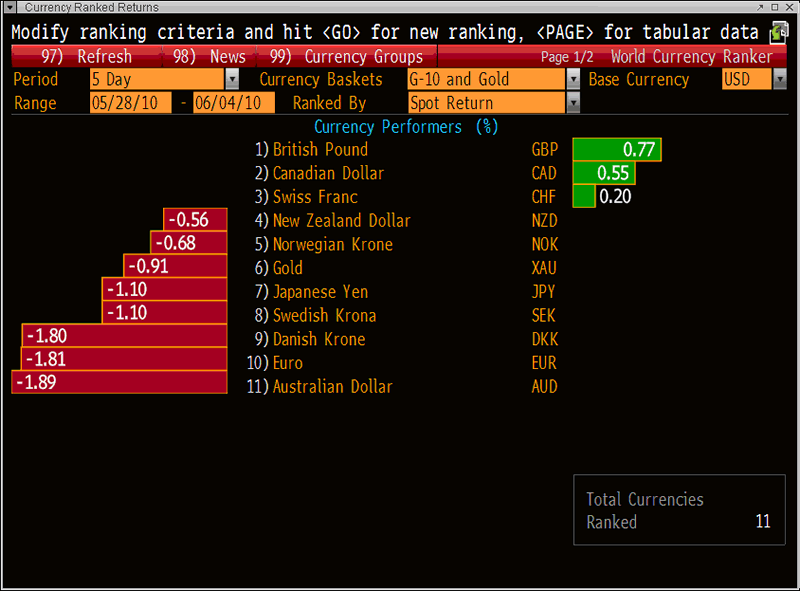

Major Currencies and Gold - 5 Day Performance. Click on image to view full size.

Sharp falls being seen in equity markets could lead to margin calls and fund liquidation of gold which is a short term factor to be aware of. But ultimately physical supply and demand will likely overcome the short term leveraged speculators in the futures market. Especially as volatility and falls in equity markets should contribute to further safe haven and diversification buying of gold.

After yesterday's fall in the US, gold fell in Asia and European trading as markets threaded water prior to the US jobs number. It then breached support at the psychological level of $1,200/oz and fell to $1,197/oz prior to rising as risk aversion picked up when the euro fell sharply leading to a drop in European equity bourses.

The euro fell to 4 year lows against the dollar, life time lows against the Swiss franc and gold surged to over €1,000/oz. The euro's fall may have been exacerbated by rumours of a large French bank having significant derivative losses, and the Hungarian Prime Minister's warning that talk of a Hungarian default "was not an exaggeration".

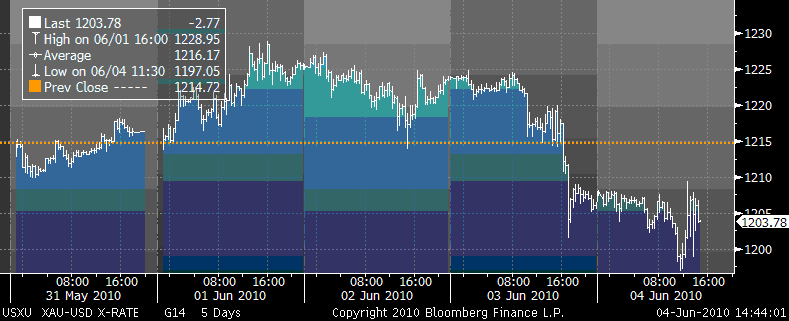

Gold USD - 5 Days (Tick). Click on image to view full size.

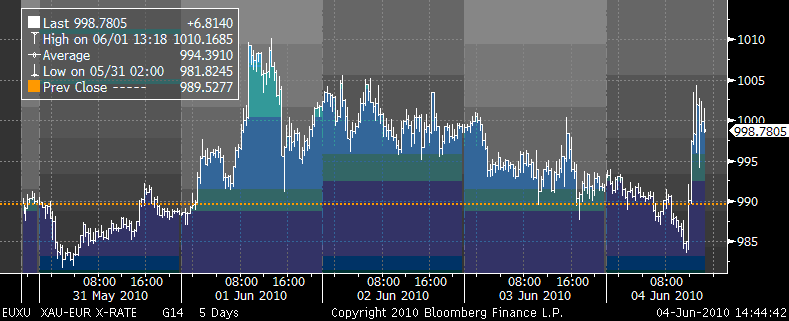

Gold EUR - 5 Days (Tick). Click on image to view full size.

Gold looks set to finish the week marginally lower which would be bearish technically. A close below $1,197/oz could see gold quickly to fall to support at $1,165-$1,175/oz. Should gold rise from here and close higher on the week it would be a very bullish move. Especially as equity markets are now lower for the week and may struggle to get higher for the week.

A positive jobs number in conjunction with the other positive US economic data this week would allay fears of a double dip recession. Oil fell some 2% on the weaker than expected jobs number but may still have its second weekly rise and this should be supportive of gold.

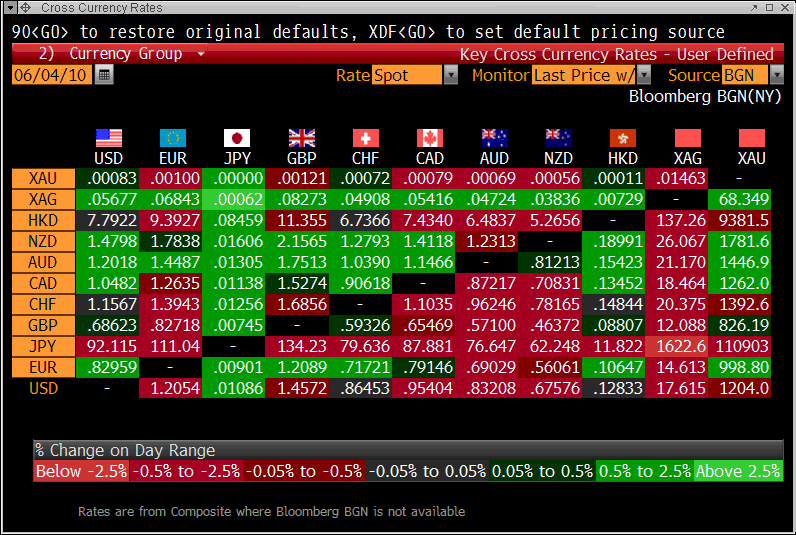

1 Day Relative Performance (USD). Click on image to view full size.

Silver

Silver is currently trading at $17.67/oz, €14.65/oz and £12.20/oz.

Platinum Group Metals

Platinum is trading at $1,517/oz and palladium is currently trading at $438/oz. Rhodium is at $2,600/oz.

News

In an all too familiar announcement in recent years, the South African Chamber of Mines reported the country's first quarter gold production fell 15% quarter-on-quarter, extending the downward slide in output. South Africa has fallen quickly from the top of the perch as the world's largest gold producer. It is now behind China, the United States and Australia. Its mines are becoming deeper and more expensive to mine and grades, which is the measurement of the amount of gold in each tonne of ore hauled to the surface for treatment, is dropping. The latest gold output data shows no signs of arresting the fall in production. South Africa produced 43,927.8kg of gold in the first three months of 2010, which is 15% less than the December quarter and 12.4% down on the same period a year ago. "Gold mining companies lost an average of about 18 days of production during the quarter as the impact of the latter part of the Christmas holidays affected production," the chamber said in a statement. Companies are grappling with steeply rising input costs, particularly on electricity, which is a big expense on mines. Harmony has shut down seven shafts because the ore bodies have run out or they're just not making money. AngloGold Ashanti is practically putting its South African mines into intensive care in a process designed to cut costs and boost productivity to ensure they cope with escalating costs (Mining MX).

Gold sales to Europe from the Perth Mint surged in May as the Greek sovereign-debt crisis triggered a flight to haven investments, draining stockpiles at the producer of 6 percent of the world's bullion. Buyers from the continent accounted for 69 percent of gold coin purchases last month compared with 51 percent a year ago, said Ron Currie, sales and marketing director. Individual German investors also bought silver, seeking to protect their wealth with "poor man's gold," Currie said from Western Australia. Greece's fiscal crisis roiled financial markets worldwide, driving the euro lower. Gold reached a record in May as sovereign-debt risks escalated. The mint is working at full capacity with 20 percent more staff than a year ago, Currie said.

"As soon as it was announced the European Commission was bailing out Greece, the German population decided they'd better hedge their euros by buying precious metals," Currie said in an interview yesterday. "We had stock before this blip in the market, then it all went." Spot gold traded at $1,205.94 an ounce at 9:54 a.m. in Singapore today compared with last month's record of $1,249.40 and $1,096.95 at the end of last year. The precious metal has gained for nine straight years. Silver, which peaked this year at $19.8275 an ounce on May 13, traded today at $17.9425.

European leaders have proposed an almost $1 trillion loan package to contain the region's fiscal crisis, including funds from the International Monetary Fund. The euro has declined against all 16 major counterparts in the past three months, dropping the most against the dollar, with a 12 percent fall. "The gold market in Europe, and particularly in Germany, has just taken off," Currie said from the 111-year-old mint, which was founded on the back of a gold rush in the state that accounts for 62 percent of the nation's mineral production. "People in Germany are buying silver, which leads me to believe it's the moms and pops stocking up on 'poor man's gold'," said Currie. "They could be storing it in their homes or burying it in their gardens."

The mint, controlled by the Western Australian government, has 300 staff and doubled capacity in the past 18 months, Currie said, declining to give a total output figure for coins and bars, or the value of the bullion stored on behalf of buyers. Investors can opt to buy and store gold at the mint, or buy coins to hold themselves. "We came off the highs of the global crisis, we were rolling along at a steady pace for a while and the Greeks changed everything," said Currie. Standard & Poor's cut Greece's rating to junk status on April 27. The rush for bullion in May at the Perth Mint was matched overseas. The U.S. Mint sold 190,000 ounces of American Eagle gold coins last month, the most since December. Rand Refinery Ltd., the world's largest gold-smelting facility, has raised weekly production of Krugerrand coins to a 25-year high, Treasurer Debra Thomson said yesterday. "Sales have come off the highs of the global financial crisis, but they haven't fallen anywhere near to where they were before the crisis," Currie said. In the 12 months to June 30, sales of the mint's 1-ounce Kangaroo and other gold coins may fall by about 16 percent to about 350,000 ounces from the year before, Currie said. Silver will match that drop even as sales of that metal spiked in the past two months, he said.

"It's a volatile market and you can't pick what's going to happen from day to day," Currie said. "The Indian market isn't what it was, jewelry sales are down, but the ETFS are up and the overall gold price is still high. Our assumption is that volatility will continue."

Holdings in the SPDR Gold Trust, the biggest exchange- traded fund backed by bullion, rose to 1,289.84 tons yesterday. India's gold imports may reach a 12-month low of 15 tons to 17 tons in May as rising prices slowed imports, the Business Standard reported yesterday, citing Suresh Hundia, president of the Bombay Bullion Association.

Western Australia produces 6 percent of the world's gold, valued at A$5 billion in the year to June 30, 2009, according to state government figures. The mint processes all the gold mined in Australia as well as imports of scrap from overseas, Currie said (Bloomberg).

The UK housing market is slowing down again, according to the latest report from the Halifax bank. Its latest monthly survey shows that prices fell by 0.4% in May, after a 0.1% drop in April, taking the average UK house price down to £167,570 (BBC).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.