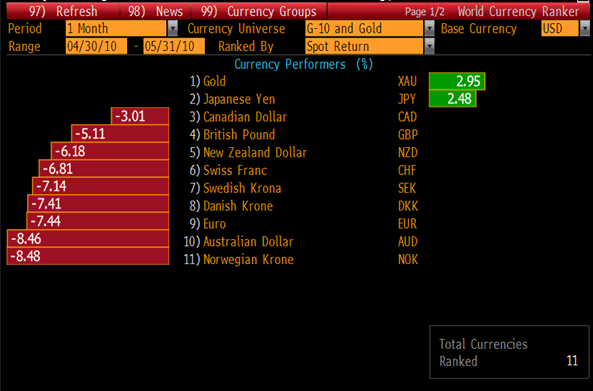

Gold Up 3% in May as Commodities and Stocks Fall Sharply

Commodities / Gold and Silver 2010 May 31, 2010 - 07:19 AM GMTBy: GoldCore

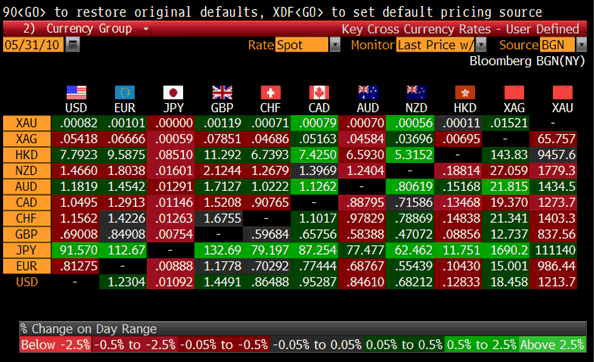

Gold is marginally lower and threading water in most currencies today with markets subdued as the London Stock Exchange and Wall Street are closed for a national holidays. It range traded from $1,210/oz to $1,214/oz in Asian and early European trading this morning. Gold is currently trading at $1,213/oz and in euro, GBP, CHF, and JPY terms, at €987/oz, £837/oz, CHF 1,043.64/oz, JPY 110,897/oz respectively.

Gold is marginally lower and threading water in most currencies today with markets subdued as the London Stock Exchange and Wall Street are closed for a national holidays. It range traded from $1,210/oz to $1,214/oz in Asian and early European trading this morning. Gold is currently trading at $1,213/oz and in euro, GBP, CHF, and JPY terms, at €987/oz, £837/oz, CHF 1,043.64/oz, JPY 110,897/oz respectively.

Markets await the key US monthly employment report on Friday for signs that the economic recovery is still on track. Analysts expect the US economy added about 500,000 jobs in May and the unemployment rate fell to 9.7 percent from 9.8 percent in April. A disappointing number could lead to further risk aversion on concerns of a double dip recession.

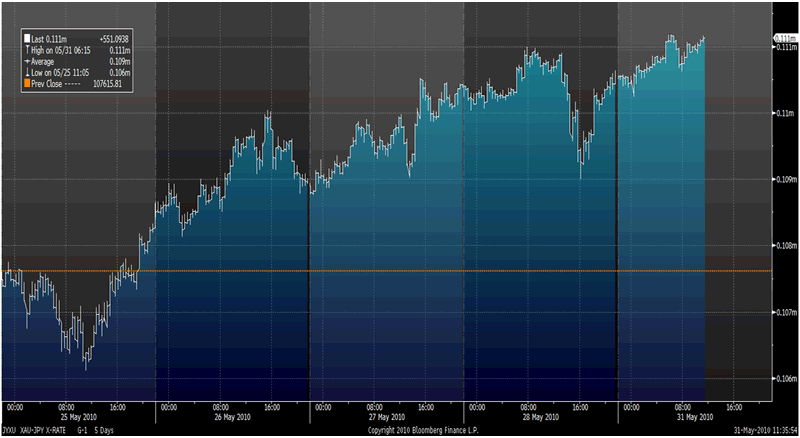

Gold in JPY - 5 Day (Tick)

The Japanese Yen has fallen and weakened against 15 of 16 major counterparts after Japan's Social Democratic Party quit the coalition government seeing gold in JPY terms.

Cross Currency Rates at 1145 GMT - JPY Falls on Political Uncertainty

The Israeli attack on the Gaza aid ship with the deaths of more than 15 protesters on board will likely contribute to an escalation of geopolitical tension in the region. Moderate Turkey has warned Israel of 'irreparable consequences' to bilateral ties, and the United Nations said Monday it was shocked at the loss of lives and urged Israel to refrain from further steps that could endanger civilian lives.

Gold's outperformance of other asset classes in May could continue given the continuing sovereign debt and currency concerns, geopolitical risks and the growing concerns of a double dip recession. These concerns look set to continue for the foreseeable future making having an allocation to gold a prudent strategy. The benchmark MSCI benchmark had its biggest monthly decline since October 2008. Stocks tumbled in the US on Friday, capping the worst May for the Dow Jones Industrial Average since 1940.

Silver

Silver rose from $18.36/oz to $18.46/oz this morning in Asia and Europe. Silver is currently trading at $18.45/oz, €15.00/oz and £12.73/oz.

Platinum Group Metals

Platinum is trading at $1,563/oz and palladium is currently trading at $466/oz. Rhodium is at $2,675/oz.

News

A growing number of Singaporeans are turning to gold as an investment vehicle with banks in Singapore reporting increases in gold coin and bar sales of up to 70 per cent as more investors look to the precious metal, Channel NewsAsia reports. One-ounce gold coins and gold ingots weighing 100 g are proving particularly popular among buyers, while some Singaporeans are looking to gold savings accounts and certificates. The rising price of gold means that a typical 1 kg gold bar now costs in the region of 50,000 Singapore dollars (£24,693). Investors around the world are flocking to gold products as economic uncertainty continues in Europe, with a number of mints reporting high sales of physical gold.

The Times recently reported that some buyers in Greece - which has been particularly badly affected by the financial turmoil - are seeking to purchase gold British sovereigns as a safe haven investment. Persistent worries that Greece could default at least partly on its debts are emptying the Bank of Greece's vaults of at least 700 gold coins a day, giving a whole new meaning to the term sovereign debt. Gold coins soar in popularity in Greece Greek buyers have been queuing up to purchase gold coins as fears over the country's economic future persist. According to the Times, the Bank of Greece is selling at least 700 gold coins every day as a result of concerns about whether the nation might default on its debts.

British gold sovereigns in particular are proving popular among buyers looking for a physical hedge against economic uncertainty. It is estimated that over one billion gold sovereigns have been minted since the first was made in 1489 for Henry VII. The Royal Mint still produces gold sovereigns at its facility in Llantrisant, south Wales. Greek daily paper Kathimerini said: "The public's renewed interest in sovereigns as an asset started with the collapse of Lehman Brothers." Gold investments in general have surged in popularity since the credit crunch began. A number of mints around the world - including the Royal Mint in the UK, the US Mint and the Royal Canadian Mint - reported significant increases in sales of gold coins and bars during the downturn.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.