Gold Resilient on Financial Uncertainty and Double Dip Recession Concerns

Commodities / Gold and Silver 2010 May 21, 2010 - 06:25 AM GMTBy: GoldCore

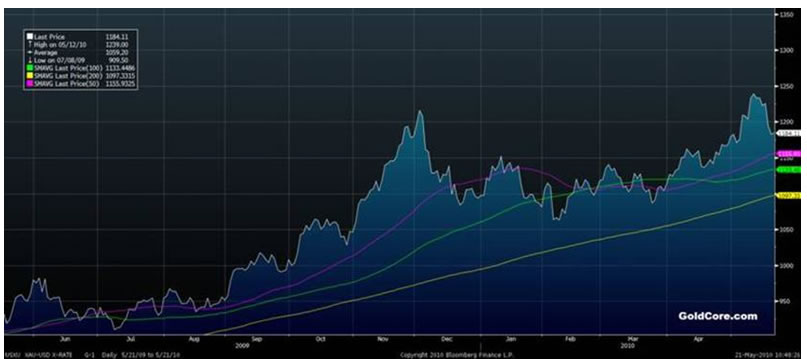

Gold is marginally lower (-0.2% in USD terms) and is currently trading at $1,180/oz and in Euro and GBP terms, gold is trading at €944/oz and £823/oz respectively. Gold has risen in sterling terms after the much higher than expected UK budget deficit (see below). Gold is only down some 4% on the week (USD - $1,230/oz to $1,180/oz) which is impressive given the sharp sell off seen in most commodity and equity markets.

Gold is marginally lower (-0.2% in USD terms) and is currently trading at $1,180/oz and in Euro and GBP terms, gold is trading at €944/oz and £823/oz respectively. Gold has risen in sterling terms after the much higher than expected UK budget deficit (see below). Gold is only down some 4% on the week (USD - $1,230/oz to $1,180/oz) which is impressive given the sharp sell off seen in most commodity and equity markets.

Gold’s recent strong performance suggests that gold is being seen increasingly as an alternative currency, as a safe haven asset and as an important diversification in uncertain times. These are the most uncertain financial and economic times in modern history and gold’s ability to reduce volatility and enhance returns, particularly in uncertain times, is finding adherents amongst even those who have hitherto been gold skeptics.

Gold 1 Year (Daily) with Moving Averages

Fears of a double recession were heightened yesterday when US jobless claims and the index of leading indicators were much worse than expected. Retail sales for April in Germany and the UK were also disappointing.

The U.S. Senate is bringing Congress to the brink of passing the most sweeping regulation of the financial industry since the Great Depression. In the EU there is a special meeting of finance ministers in Brussels today to discuss financial market regulation and draft new regulations for financial markets aimed at reducing instability and increasing risk. Some market participants are nervous that new regulations may hinder the operation of financial markets and lead to further risk aversion. There is the sense that governments are attempting to close the door after the horse has bolted.

Further signs of stress in money markets was seen yesterday as the three-month costs for banks to borrow dollars reached a fresh 10-month high. Fears the euro zone debt crisis could spread intensified investor and banks reluctance to part with cash. Compounding market anxiety has been concerns over the proposed overhaul of U.S. financial regulation, which critics say would reduce banks' capacity to lend and broadly increase borrowing costs. Those willing to lend have been demanding higher rates to compensate for the risk of contagion which has not been helped by the euro zone authorities' handling of the debt crisis. The options market benchmark VIX soared 30 percent to 45.79 yesterday, shwoing expectations for volatility are the highest in 13 months.

The unprecedented unilateral regulatory action taken by the German government is being digested but has led to fears that the German authorities have taken such drastic action as they are concerned about systemic issues facing German banks and by an existential threat to the euro itself. Angela Merkel’s warning of an existential threat to the euro and the danger that the euro may not survive is another sign of the extent of financial uncertainty.

Gold Versus the S&P 500 in last 10 Days

Britain had the biggest fiscal deficit for any April since monthly records began in 1993, underlining the scale of the challenge to come as Chancellor of the Exchequer George Osborne prepares his first emergency budget. The 10 billion-pound ($14.4 billion) shortfall compared with 8.8 billion pounds just a year earlier. Sterling looks likely to come under pressure in the coming months given the scale of the fiscal challenges and near austerity measures that will have to be implemented.

Geopolitical risk in Asia is not helping market jitters. US Secretary of State Hillary Clinton called for an international response to North Korea’s sinking of a South Korean warship, adding that “business as usual” is not possible. At a press briefing in

Tokyo Clinton said that the evidence that North Korea fired a torpedo and sank the ship is “overwhelming.”

SILVER

After sharp falls yesterday, silver is slightly higher at $17.73/oz this morning in European trading. Silver is down 9% on the week and value buyers will again buy on the dip.

PGM’s

Platinum is trading at $1,491/oz and palladium is currently trading at $417/oz. While rhodium is at $2,690/oz.

Palladium is headed for its worst weekly decline since at least 1993, on speculation that investors are profiting from this year’s rally to cover losses in other assets and on concerns of a global slow down. Palladium for immediate delivery weakened 2.5 percent to

$406.25 an ounce in Asian trading extending this week’s loss to 23 percent. Before this month, the price surged 34 percent in 2010.

Platinum also fell sharply - down 15 percent this week, trading at $1,467.70 an ounce after climbing to $1,756.25 on April 27, the highest level since July 2008.

In a further sign of risk aversion, gold’s price ratios to platinum and palladium surged to their highest levels this year. Concerns that the European debt crisis may hamper global growth, damping demand for the metals used in auto catalysts has seen the PGM’s come under pressure in recent weeks while gold rose prior to this week’s falls. Bloomberg reports that an ounce of gold bought as much as 0.8092 of ounce of platinum today, and as much as 2.9532 ounces of palladium, the most since December 2009. The gold-platinum and gold-palladium ratios reached 19-month lows of around 0.6555 and 2.026 respectively in April, on signs the global economy was recovering.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.