Natural Gas Shale-Shocked in America

Commodities / Natural Gas May 20, 2010 - 04:46 AM GMTBy: Dian_L_Chu

Natural gas for June delivery on the NYMEX tumbled 4.24% on Wednesday settling at $4.158/mmbtu. The flaming fuel has rallied 10% this month to an eight-week high of $4.582/mmbtu last week on signs of strengthening demand from factories and power plants as the economy recovers from the Great Recession.

Natural gas for June delivery on the NYMEX tumbled 4.24% on Wednesday settling at $4.158/mmbtu. The flaming fuel has rallied 10% this month to an eight-week high of $4.582/mmbtu last week on signs of strengthening demand from factories and power plants as the economy recovers from the Great Recession.

Gas traders have been betting heavily on falling gas prices, creating volatility in the market as traders rush to cover their positions. Indeed, prices could have fallen much lower--probably well below $3--had the nation not experienced weeks of super cold weather this winter.

At the heart of the price problem is a lack of significant natural gas demand growth coupled with a very modest decline in gas production, and moderate spring temperatures. .

Unconventional Boom

Although oil prices have risen 69% in the last year compared with a 29% gain for gas, producers are ramping up gas output even as spot natural gas prices remain depressed. (Fig. 1)

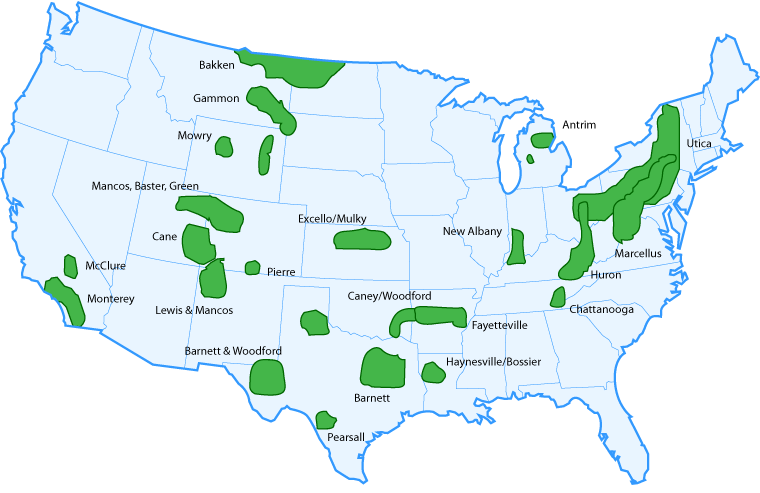

Most analysts have attributed the lack of a meaningful fall off in gas production to the increase in drilling in onshore gas shale formations. The gas shale rigs lagged the overall gas drilling count throughout most of 2008. However, as we entered 2009, gas shale drilling activity began to outperform the total gas-oriented rig count thanks mostly to the advance in drilling technology, efficiency and better economics. (Fig. 2)

Rig Count Composition Change

Shale plays, used to account for 25%, are now 40% of all gas rigs, while “other horizontal” is now 20% of gas rig count. Meanwhile, vertical/directional rigs have fallen from 75% of the total to 40% since start of 2008.

Over the first four months of this year, there has been a 26% increase in all gas-focused rig count. Rig count increase has been concentrated in highly-productive unconventional plays, evidenced by the 34% increase of the count of horizontal rig, used predominantly in unconventional gas shales.

There are three main mitigating factors prompting oil and gas companies to drill their gas shales even in the face of weak natural gas prices.

Mitigating Factor #1 - Drill or Lose Lease

Gas leases typically run five years, but in the midst of the new shale fever, many leases in the new shale areas were signed with conditions that favored sellers, and set to expire after three years if the driller does not begin production. Producers that want to protect long-term assets often chose to drill and produce rather than forfeit leases.

Up to 50% of all industry drilling for natural gas is tied to the need to retain leases, says Chesapeake Energy (CHK) CEO Aubrey McClendon. According to FBR Capital, this is a factor in several areas, including the Marcellus Shale, the Eagle Ford Shale, and it's most prominent in the Haynesville Shale.

Mitigating Factor #2 - 2010 Production Hedge

As E&P companies do not have a refining/marketing arm like the integrated oil majors to serve as a natural hedge, they typically have very aggressive hedging programs in place to protect asset and cashflow.

Chesapeake Energy (CHK), for example, has about 55% of its 2010 production hedged at average NYMEX price of $7.52 (see table). In fact, Chesapeake boasts ~$4.8 billion in realized gains from its hedging program since inception in 2001.

Mitigating Factor #3 - Favorable Joint Ventures

Independent E&Ps were the pioneers of the onshore shale plays while oil majors and national oil companies (NOCs) were sitting on the sideline. Now, eager to get in on the growth prospect, but lack the expertise and good acreage, majors and NOCs are lining up to open their check books for a non-operating interest in joint ventures with the independent.

Last month, Indian conglomerate Reliance Industries Ltd. became the latest international company to tap the booming sector in the U.S. and will spend $1.7 billion for a 40% stake in Atlas Energy Inc. (ATLS) operations in the Marcellus Shale.

In its investors presentation this month, Chesapeake reported $10.7 billion of value captured vs. cost basis of $2.7 billion through various joint ventures with BP, Total SA, Statoil SA etc.

Need for Growth & Cashflow

Meanwhile, most producers still face another constant pressure--grow production volumes at above-industry growth rates, while others will produce from existing wells just for cashflow purpose, instead of responding to market fundamentals.

Fundamental Look

Despite the growth of liquefied natural gas (LNG), natural gas remains largely region-bound within the producing basin. Right now, various data points are painting an overall bearish picture for natural gas in North America as inventories grow and the economy struggles back from the recession.

From the supply side, the Energy Dept. report showed that inventory surplus narrowed which helps boost the market optimism. However, “lower-than-expected” injection still means total gas in U.S. storage as of May 7--at 2.089 trillion cubic feet--is about 18.4% above the five-year average, and 4.9% above last year's level for the same week.

The 40% increase in gas well drilling since mid-2009 is projected to lead to significant increase in US gas production capacity by the end of 2010. The three mitigating factors discussed here most likely will not come off to significantly reduce the production rate till 2012.

Meanwhile, demand is industrial demand is improving modestly. The EIA now expects total natural gas consumption to increase by 3% in 2010 and decline by 0.4% in 2011. There are also other favorable signs including coal-to-gas switch from the power generation sector, reduced production/imports from Canada; however, the overall supply and demand is still not healthy (Fig. 3).

Technical Look

Natural gas is one commodity operates on its own unique market factors, and thus tends to be less sensitive to the international currency markets and Greece/EU debt crisis. From a technical standpoint, price should find strong support around $3.90 levels. Fig. 4)

While it is difficult to pick a top range since natural gas remains volatile and could shoot up to $6.50/$7.00 on momentum or short squeeze, for now, $4.00 to $6.00 seems a likely trading range for the next 18 months, as compared to the $6-$8 range during the previous bull cycle.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.