Beware of Headline Savings Interest Rates…Over 75% Have a Sting in the Tail

Personal_Finance / Savings Accounts Aug 24, 2007 - 06:17 PM GMTBy: MoneyFacts

Rachel Thrussell, Head of Savings at Moneyfacts.co.uk – the money search engine, comments: “With the aftermath of the last interest rise rate finally over, and most providers opting for the full quarter point increase, it is pleasing to see that over 90 bank and building society variable rate accounts now pay at least 5.75% (base rate). But the rate is only part of the picture when it comes to a competitive savings account. Too many of the high paying accounts come with restrictions and conditions.

Rachel Thrussell, Head of Savings at Moneyfacts.co.uk – the money search engine, comments: “With the aftermath of the last interest rise rate finally over, and most providers opting for the full quarter point increase, it is pleasing to see that over 90 bank and building society variable rate accounts now pay at least 5.75% (base rate). But the rate is only part of the picture when it comes to a competitive savings account. Too many of the high paying accounts come with restrictions and conditions.

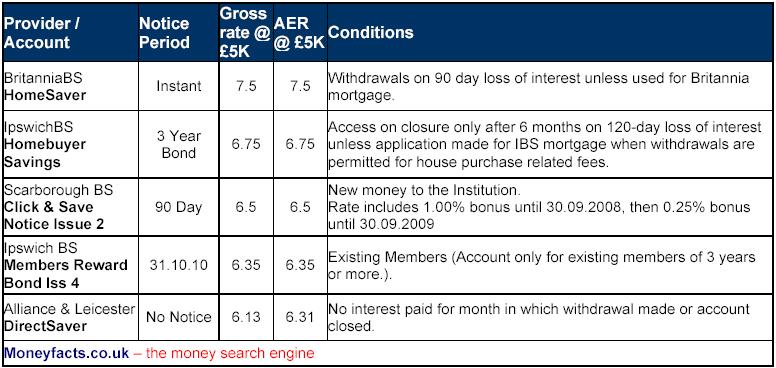

The latest Moneyfacts.co.uk survey shows that a staggering 76% of the accounts paying base rate or higher, come with restrictions, conditions or introductory bonuses. The more common conditions include: Members/existing customers only accounts, only open to new monies to the institution, introductory bonuses, limited number of free withdrawals, age restrictions, withdrawal limits, loss of interest for withdrawals, and specified uses for the funds.

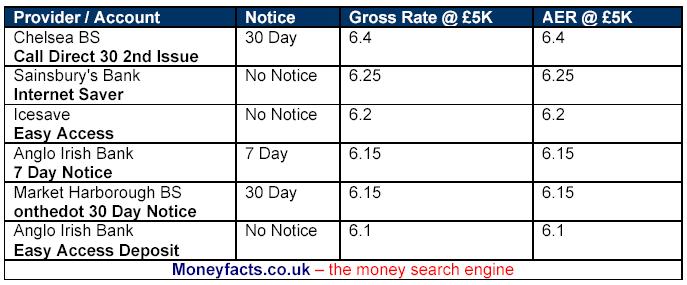

“With many accounts using a combination of these conditions, it’s no longer as simple as comparing the rates on instant access account, no notice or notice accounts, as in many cases they simply don’t do what they say on the tin.

“The table below shows a selection of the best paying accounts, but as you will see from the final column, the best rates often come with catches.

“But if you don’t want the hassle of remembering how many of your free withdrawals you have left, or knowing when your bonus rate expires, then the accounts below show examples of the rates found on no strings savings accounts. As you can see the rates are on average slightly lower, but they offer a very competitive return and more importantly you don’t have to jump through hoops to get it.

“But even more worryingly, too many savers are receiving a very poor rate of return, with a massive 51% of accounts paying less than inflation (RPI), and this statistic is based on the gross rate, so if we consider the net return after tax, this figure would be even more startling. To receive a net return in line with inflation, you would need to secure yourself a gross interest rate of at least 4.75%.

“The average savings rates today (based on £5K) for notice and no notice accounts are a meagre 4.279% and 4.092% respectively.

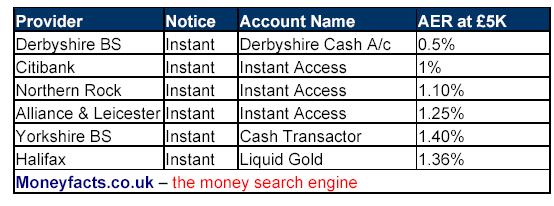

"But the hall of shame highlights some of the poorest paying accounts on the market. It’s unbelievable that some providers continue to offer accounts which pay rates of 1% or less. Any saver with money invested in any of these worst buy accounts, should dump their provider sooner rather than later. One thing is for sure, ‘treating customers fairly’ this definitely isn’t. It’s about time these accounts were phased out or rates upgraded.

"But the hall of shame highlights some of the poorest paying accounts on the market. It’s unbelievable that some providers continue to offer accounts which pay rates of 1% or less. Any saver with money invested in any of these worst buy accounts, should dump their provider sooner rather than later. One thing is for sure, ‘treating customers fairly’ this definitely isn’t. It’s about time these accounts were phased out or rates upgraded.

“Take for example a saver with £5K to invest.

The Derbyshire account this would give a gross return of just £25. Compare this with investing in the Chelsea 30 day account at 6.40% which returns almost £300 more in a year. Rather than this extra interest lining your pockets, it’s lining the coffers of the banks and contributing toward their ever increasing bottom

“Savers should vote with their feet and switch providers if they are getting a poor deal, but they need to do so with caution. Look beyond the headline rate and check with your new provider that the account will match your needs, provides you with the access you require and offers a rate you are happy with.

“On the other hand if you are happy to accept the top paying accounts that come with restrictive conditions, then make the most of the returns on offer. But I fear only too often are savers duped into these deals by the term ‘instant access’ without realising what they are signing up to, until it’s too late.

“Savers don’t want to jump through hoops to get a decent return, they just want simplicity and consistency. By all means providers should offer a comprehensive range of savings accounts, as there will be something to match the needs of all savers, but the terms & conditions must be clear and unambiguous. Don’t refer to something as instant access when withdrawals are at a 30 day loss of

interest, or include large bonuses for short periods of time but show the saver the initial rate rather than the AER.

“Savers should be treated with respect, given all the information up front and not insulted with some of the paltry interest rates highlighted above.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.