Real Estate and Property Bubble, The Next Dubai?

Housing-Market / Singapore Apr 29, 2010 - 03:09 PM GMTBy: GoldSilver

The Singapore Flyer is the largest Ferris wheel in the world.

The Singapore Flyer is the largest Ferris wheel in the world.

Quick Trivia Question: Where is the largest property bubble in the world continuing to inflate?

Not the United States.

The U.S. housing bubble continues to deflate. The data shows demand has very little chance of catching supply over the next several years. Each month that passes, more and more shadow inventory and foreclosures are brought to market.

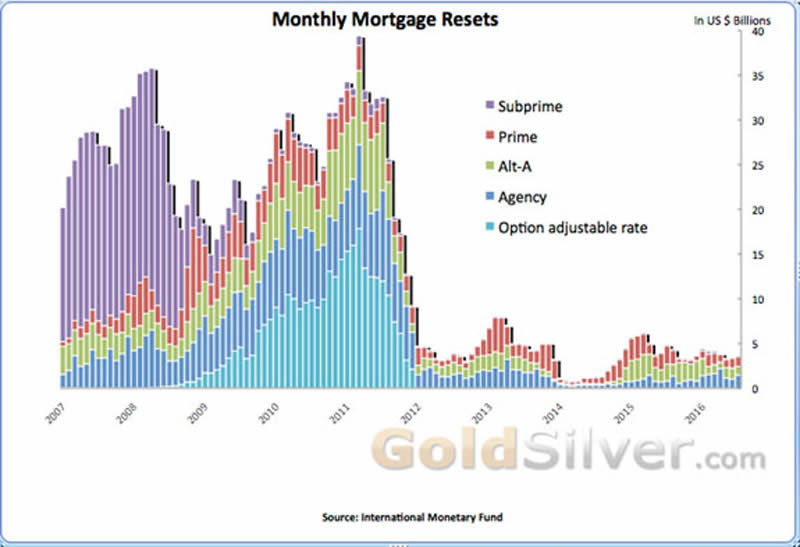

Note the dramatic increase in Option ARM, Agency, and Alt-A Monthly Mortgage Resets through 2012.

These are the dates when the original mortgage rates, sometimes called teaser rates, are reset usually to a significantly higher payment (often times making it very difficult for the borrower to continue to afford their payments).

What about Asia?

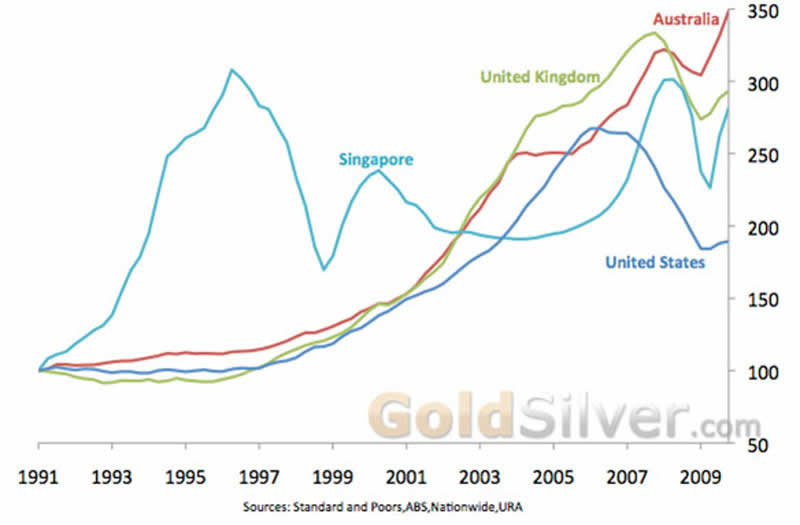

Many of the Asian-Pacific housing bubbles have yet to burst:

April 21, 2010

BEIJING (Reuters) - China must tackle its property bubble for the sake of economic health and social stability, even if the market feels some short-term pain in the process, an official financial newspaper said on Thursday.

The government has repeatedly warned of the dangers of China's red-hot property market, which it has described as one of the country's most pressing economic problems, and has tried to get banks to rein in property lending.

Urban property inflation rose to 11.7 percent in the year to March from February's 10.7 percent pace. Economists believe the official figures seriously understate the extent of price rises, especially in major cities.

Is Singapore the next Dubai?

If the amount of construction cranes in a skyline are any indication, perhaps it is:

Housing Price Indices

"This is just happening all over the planet. Something is going to give, and it's going to give in this coming decade. Anybody that doesn't get prepared, wealth will be transferred right out of their pockets and bank accounts, to governments... to the holders of precious metals. The people that do get prepared and get on the right side of this thing are going to see amazing wealth."

- Mike Maloney

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2010 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.