Palladium Surges 8% in One Day to Test Long Term Resistance; Gold Short Term Correction?

Commodities / Gold and Silver 2010 Apr 14, 2010 - 08:04 AM GMTBy: GoldCore

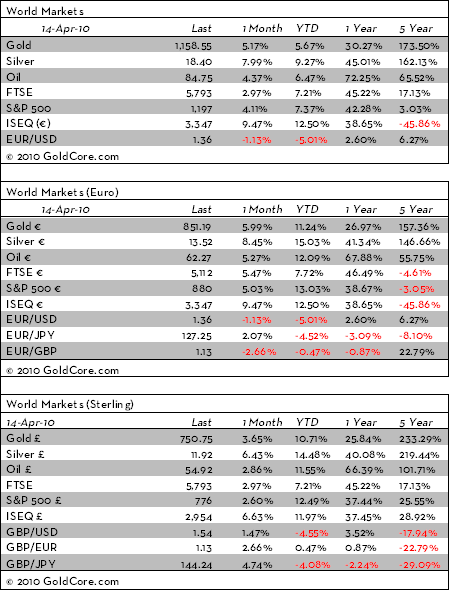

Gold fell to as low as $1,145/oz in New York, it then recovered to close with a loss of just 0.86% yesterday. It has risen from $1,153/oz to $1,160/oz in Asian and early European trading this morning. Gold is currently trading at $1,160/oz and in euro and GBP terms, gold is trading at €850/oz and £753/oz respectively.

Gold fell to as low as $1,145/oz in New York, it then recovered to close with a loss of just 0.86% yesterday. It has risen from $1,153/oz to $1,160/oz in Asian and early European trading this morning. Gold is currently trading at $1,160/oz and in euro and GBP terms, gold is trading at €850/oz and £753/oz respectively.

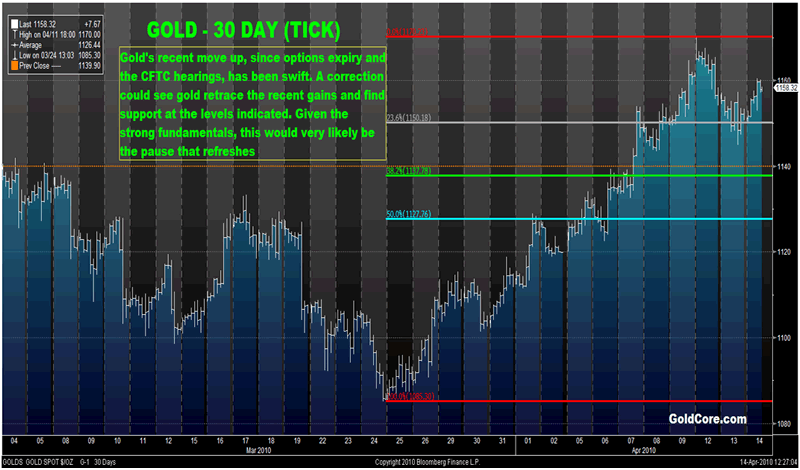

Gold has recovered from some of yesterday's losses despite the dollar rising again today. Oil prices rising above $85 a barrel after their recent falls may be leading to inflation hedging gold buys. Traders are considering whether this could be the beginning of a period of correction. Were gold to give up some 50% of the recent gains, gold could retest support around the $1,127/oz level according to Fibonacci theory (see chart below).

Palladium has surged by more than 8% since yesterday on the weaker dollar, catalytic converter demand, investment demand and depleting Russian stockpiles.

Silver

Silver has jumped from $18.20/oz to $18.43/oz this morning in Asia. Silver is currently trading at $18.40/oz, €13.50/oz and £11.94/oz.

Platinum Group Metals

Platinum is trading at $1,728/oz and palladium is currently trading at $545/oz. Rhodium is at $2,850/oz.

Palladium has surged 8% since yesterday (low of $506 per ounce to $545 per ounce now in value) on concerns about depleted Russian stockpiles of the metal and strong industrial and investment demand - especially from the recently created palladium ETF.

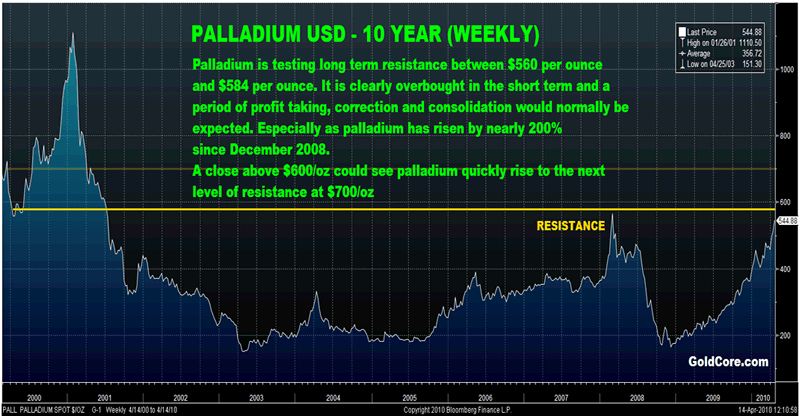

Palladium is testing long term resistance between $560 and $584 per ounce (daily and weekly highs from March 2008). It is clearly overbought in the short term and a period of profit taking, correction and consolidation would normally be expected. Especially as palladium has risen by a huge 200% in just 15 months (December 2008). Ore deposits of palladium are rare and are mostly located in Russia and South Africa. Russian resource nationalism, as has been seen with natural gas, could lead to price spikes and to palladium going higher in the coming months. Some analysts believe palladium may be in deficit for most of the next decade as Russia depletes stockpiles and industrial uses and investment demand for the metal increase.

News

The expected revaluation of the yuan will boost the appeal of gold among Chinese investors, as the move would make the metal cheaper for holders of the currency and may also fuel concern about inflation, UBS AG said. Bloomberg reports Edel Tully of UBS AG saying that gold will become cheaper in yuan terms and this should stoke additional interest in the yellow metal. "And if the yuan revaluation is interpreted as a signal of government confirmation that inflation is indeed a problem, this would likely boost gold's appeal." China may allow the yuan to appreciate by June 30 to curb inflation while avoiding a one-time jump in value that might curb exports, a survey of analysts showed. Gold consumption in China may double within the next 10 years as the nation's economy continues to expand and increase national wealth, the World Gold Council said on March 29.

China's stocks rose to a three-month high as prospects for a stronger yuan and accelerating inflation spurred a rally for gold producers, countering declines by developers according to Bloomberg. Zhongjin Gold Corp., the country's second-largest bullion producer by market value, jumped the most in four months after UBS AG said yuan revaluation will boost the appeal of gold.

Concerns about the reemergence of inflation can also be seen due to the recent surge in beef prices. The Financial Times reports that beef prices are soaring after cattle failed to fatten up during the harsh US winter and cash-strapped ranchers culled herds to cope with the recession. The FT says cattle futures have risen more than 20% since December and are again flirting with $1 a pound, a milestone previously reached during the commodity price rise of 2008.

Reuters reports that surging copper continues to flirt with the $8,000 level as a combination of fund buying and dollar weakness supported base metals ahead of eagerly awaited Chinese economic growth data.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.