Gold Forecast - Four ways to profit as gold is set to shine in 2007

Commodities / Forecasts & Technical Analysis Dec 28, 2006 - 11:37 AM GMTIt's been a wild year in the markets, and if recent events are any barometer, 2007 is going to be even crazier. Right off the bat, let me reaffirm my most important point: Gold is going to be the asset to own in 2007. The yellow metal posted an impressive return in 2006 — almost 22% for spot gold through yesterday. But I consider that move to be just the prelude to much higher levels. Indeed, gold's action so far is just an indicator of things to come ... rising inflation ... a falling dollar ... and insurmountable debts in Washington.

More on that in a moment. First, let me take you back in time ...

How Gold and the Dollar Got Irrevocably Separated

|

It's 1947 at the London office on St. Swithin's Lane. Inside are six members of the London Gold Committee. A bullion expert from N. M. Rothschild & Sons says, “Gentlemen, it is eleven o'clock. We begin.”

Each member immediately calls his office on a special direct telephone line to determine how much gold is available for sale and how much is bid for.

All heck is breaking loose because there's not enough gold for sale to meet demand. Reason: Investors around the world have been jittery for weeks. They've been watching the U.S.'s financial position deteriorate. In fact, America's balance sheet is in such terrible shape that Treasury Secretary John Snyder has been forced to announce new bond offerings to help cover the worst budget deficit in U.S. history ($45 billion of red ink), not to mention the national debt of $247 billion.

The official price of gold is $35 an ounce and climbing. It seems like everyone wants the metal. Investors are worried about the lingering costs of World War II. They're worried that the value of the U.S. dollar will plummet in the international currency markets. So they're hanging onto the gold they have, making the market even tighter. Over the next several months, the buying pressure mounts, driving gold's price up to $43.25, a gain of 23.5%. There are frequent rumors that the U.S. Treasury's stockpiles of gold are dwindling. The squeeze is on!

The bull market in gold lasts until 1951, when Washington announces the so-called Treasury-Federal Reserve Accord. It stipulates that the Treasury Department and the Federal Reserve will act separately with respect to “dollar policy” and “monetary policy.” The agreement effectively begins the process of cutting the link between the dollar and gold.

Twenty years later, the prior accord on currencies — the Bretton Woods Agreement — is dismantled. Then, in 1973, all ties to gold are officially cut by President Richard Nixon. The moral of the story — authorities will always opt for a weaker currency when they smell financial trouble. And boy is there trouble now ...

Three Major Financial Threats to Your Wealth

Inflation is running rampant: You can see inflation in nearly every major asset — stocks, bonds, and commodities. You can see it in the plunging dollar, an undeniable signal that inflation is bursting at the seams. And you can see it every time you go to the grocery store, buy clothes, or pay for gas.

Washington and Wall Street keep trying to convince us that inflation is “benign.” But don't believe them or their manipulated Consumer Price Index (CPI), which leaves a number of everyday living expenses and fudges many other prices.

The Federal Reserve no longer controls interest rates: Twenty years ago, the Fed had some real say regarding interest rates. But these days, the overwhelming pile-up of debts has changed everything. The U.S. government and other federal agencies owe trillions and trillions of dollars to the rest of the world.

These are huge debts in large, difficult-to-control markets. Add it all up, and you'll see that the markets control interest rates — not the Fed. The Fed's rate decisions merely mimic market rates, rubber stamping them time after time.

The dollar is weak in the knees: The dollar's major trend since early 2002 has been relentlessly down. And there's nothing on the economic horizon right now to change that direction. In short, I don't expect the dollar's pain to stop anytime soon.

What does all this mean?

Why Gold Is Poised to Rocket Much Higher

|

For centuries, gold has maintained a basically stable value in terms of purchasing power. That's why investors pile into the yellow metal whenever other markets look shaky. Gold is real money. Unlike stocks or bonds, gold has no debts, no earnings, no boards of directors, no funny accounting statements, and no obligations to anyone but itself. Gold is the purest investment in the world. While paper money can be printed or devalued at will, the same cannot be said for gold.

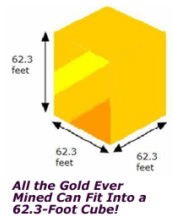

Of course, there isn't much gold to go around. All the gold ever mined in the history of the world (about 151,000 metric tons) can fit into a cube measuring only 62.3 feet on each side. And gold production is declining despite today's elevated prices.

Just one example: Over the last ten years, gold production in South Africa has plummeted 50%!

So, the way I see it, plunging production, rising demand, surging inflation, and a lack of investor confidence in the U.S. dollar all add up to one thing — much higher gold prices to come.

I don't know if gold will blast off to new highs today, tomorrow, or next month. But I can tell you this: You're probably looking at the last chance to buy gold in the $600 range. A few months from now, we could easily be staring at $750 gold. And that will just be the start. Everything indicates the yellow metal is in a long-term bull market and headed much higher. In terms of the purchasing power of today's dollars, gold reached $2,176 in 1980. But right now, it's trading a fraction of this inflation-adjusted high.

Even if gold got halfway to its inflation-adjusted price, it would zoom to more than $1,000 an ounce, a huge gain from current levels. That's why, for me, gold is absolutely the asset to own in 2007.

Here are four ways to get your stake in the yellow metal ...

First, you can buy bullion. For small amounts, a convenient vehicle is 1-ounce and 10-ounce gold ingots. It might be a good idea to own some physical gold this way, but don't go overboard. It's too much of a pain in the neck to transport and store it.

Second, use the streetTRACKS Gold Shares (GLD) exchange-traded fund. Each share represents 1/10 of an ounce of pure gold. And all the costs of storing and insuring the metal are covered for you.

Third, consider gold mutual funds like DWS Gold & Precious Metals Fund (SCGDX) and Tocqueville Gold (TGLDX). You can pack them away, with a view toward holding them for at least a couple years. In my view, these funds could double, triple, even quadruple, over that timeframe.

Fourth, you can invest in individual gold stocks. But be careful here. The irony of today's bull market in gold is that some gold mining companies may actually go out of business as the price of gold soars. Reason: They still hedge too much of their gold production and/or reserves. As I always remind my Real Wealth Report subscribers, you need to be selective.

Best wishes, and happy New Year!

by Larry Edelson

P.S. If you're interested in getting all of my specific gold recommendations, subscribe to my Real Wealth Report for just $99 a year. I'll let you know when and what to buy the moment I pull the trigger. You'll even get flash alerts by e-mail if need be.

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

From time to time, The Market Oracle publishes articles from third parties. We cannot guarantee the accuracy of these articles. In addition, these articles do not necessarily express the viewpoints of The Market Oracle or its editor NOTE - From time to time, The Market Oracle publishes articles from third parties. These articles do not necessarily express the viewpoints of The Market Oracle or its editorial team.© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.