Stock Market Rally and Economic Recovery Blowing in the Wind

Stock-Markets / Financial Markets 2010 Mar 28, 2010 - 10:56 AM GMTBy: Steve_Betts

“You’ll notice that Bush never spoke when Cheney was drinking water; check it out!" Robin Williams

“You’ll notice that Bush never spoke when Cheney was drinking water; check it out!" Robin Williams

We are seeing some interesting developments in the markets so I want to jump right into it and save all the social and political commentary for the end. I would first like to focus on the US dollar since it is the hot topic of conversation in the media, and its price movement is subject to a lot of misinterpretation. The general line of thinking espouses a new bull market for the greenback given the fact that the US economy is on the mend.

As you know by now I don’t believe the economy has bottomed and I certainly don’t buy into the idea of a new bull market for the greenback. Yes, we are experiencing a reaction and it’s one of the largest to date since the dollar topped in 2001, but that doesn’t mean it’s a new bull market. Whenever you want to see the big picture in a market, it helps to get away from the here and now, and the best way to do that is with historical weekly or monthly charts. Here I have posted a twenty-year weekly chart and I would like you to take a look at it:

The obvious thing that sticks out is the massive head-and-shoulders formation with the neckline coming in at 80.35. This is a formation that took the better part of twenty years to complete and included a bull market top in 2001. Since the top was put in we have seen a sustained move down that produced two lower highs (short horizontal blue lines) mixed with reactions of 10% or more. Today we are in the midst of a third reaction and I am convinced that it will also produce another lower high. Recently the US Dollar Index moved back above the neckline but that happened with the previous reaction as well so you shouldn’t read too much into it. A week ago the US Dollar Index also closed above strong resistance at 81.32 and closed out the week at 81.60. The dollar is not yet overbought on any chart (daily, weekly, or monthly), but it is close. I suspect that sometime within the next week or two the dollar will test strong resistance at 83.35, it will become extremely overbought as it does so, and we’ll see a top in that area. With that said there is still good resistance at 82.41 to overcome and it could also produce a top. Thursday’s intraday high at 82.24 came very close to testing the latter support level and I would look for another test this coming week.

Why is the dollar so strong? I normally don’t concern myself with the “why” behind a movement, but this is an interesting case. The world economy has been deflating for almost three years and, as a result central banks around the world have been printing obscene amount of fiat currencies in an effort to reinflate the economy. The US Federal Reserve is the leader of the pack when it comes to this printing mania. Of course this alone will not produce a rally. What produces a rally is the fact that most debt around the world is denominated in US dollars and deflation reduces income, therefore raising the cost of maintaining that debt in real terms. That’s where the demand for dollars has been coming from and it has offset the significant decline in the foreign appetite for US debt. Of course the world goes about making adjustments, and that is what is happening now. They’ll cut costs, reduce debt, cut back on the consumption of raw materials, and when they are done the dollar will roll over and fall. My guess is that we are almost done with this adjustment process.

Although the dollar has been on the rise and currencies like the Euro has been taken out to the woodshed, I would like to draw your attention to an interesting phenomenon:

The Swiss Franc has given up very little ground and both the primary trend as well as the secondary trend is headed higher. The reason for this is that in the final analysis the Swiss will always protect their principal business, money! The Swiss have been in the money business for four hundred years and will remain in the money business for the foreseeable future. That means they most maintain a strong currency in spite of all the rhetoric to the contrary. Problems within the EU with Greece, Portugal, Ireland, and Spain, as well as the staggering debt load in the US, will continue to drive investors to the Franc for a long time. That’s why I’ve always recommended it to our clients.

Perhaps the most interesting market, and certainly the most misunderstood market is the gold market. The misunderstanding is due to a blend of ignorance and emotion, and it causes investors to buy high and sell low. This type of behavior has always dominated the gold market because it is the only real store of value that exists in the world today. Below I have posted a six-year weekly chart and I would like you to take a look at it:

Aside from the obvious that we are in a bull market, there is one very important feature to grasp, and that is the fact that gold is undergoing a period of consolidation right now. We have seen this before, I have highlighted three such periods on this particular chart, and they all end the same way, with an upside breakout and the gold price moving considerably higher.

Most analysts are inexperienced when it comes to gold and they miss this aspect of the yellow metal’s conduct. Actually since the bull market began back in 2001 we have seen five such periods of consolidation, and they should be appreciated for what they are, a signal of higher prices to come. The current consolidation is occurring within a range that stretches from 1,048.90 on up to 1,148.70 and is slowly shrinking, another feature that occurred in all of the previous consolidations. Unfortunately, most investors misinterpret this behavior as a sign of weakness, and having bought at higher prices, they bail out just when they should have been buy-

ing. That’s the inherent sadistic beauty of a gold bull market, you know it’s a bull market, you know the price is going higher, and yet you lose money! In the gold pits human emotions play on investors like no other market on earth. Everybody’s in for the long run and yet everybody is upside down.

On Friday the spot price for the yellow metal closed at 1,107.10 and that was a gain of thirty cents for the week. Yet if my e-mails are any indication, you would have thought that the gold price had fallen through the floor and gold bugs were being force fed to hungry lions. I warned many of you months ago that volatility would increase and that is exactly what we are seeing. As for the immediate future that has so many investors captivated, I wouldn’t be the least bit surprised to see the yellow metal fall down to the 1,048.90 area one more time before turning back up for good and that is reflected in the following Point & Figure chart:

You can see a bearish price target of 1,040.00 and that ties in nicely to the support I mentioned earlier. What happens if support at 1,048.90 fails to hold? Then we more than likely fall down to support at 925.00 which is the bottom band of the ascending primary trend, but if history repeats itself as it has on four previous occasions, gold will hold and head much higher. I will even go so far as to say that we’ll see it start the move higher in April.

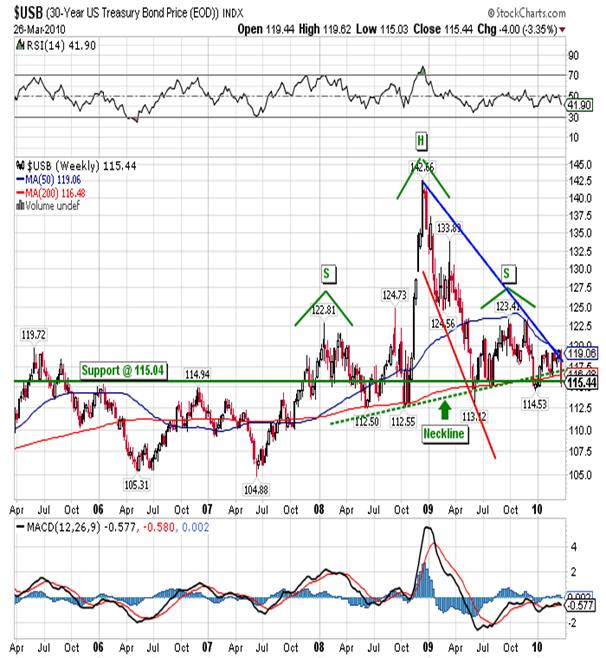

Now let’s turn our attention to the bond market as this week investors decided that US debt is not such a good deal. There were two separate auctions this week that went poorly to say the least and that drove interest rates to the highest level since December:

Like so many other markets, we can see the formation of a large head-and-shoulders pattern over a long period of time. Over the last two weeks the bond market sent an ominous signal as it broke down below the neckline and it hasn’t looked back. Most people fail to understand the consequences of such a move as higher rates mean that investors see increased risk in holding US debt and it increases the cost of doing business/servicing debt. This comes at a time when the economy teeters on the edge of a deflationary abyss and higher rates are just the ticket to push it over the edge. For people who are indebted, the rising dollar together with the rising interest rate is a double whammy that most will not recover from.

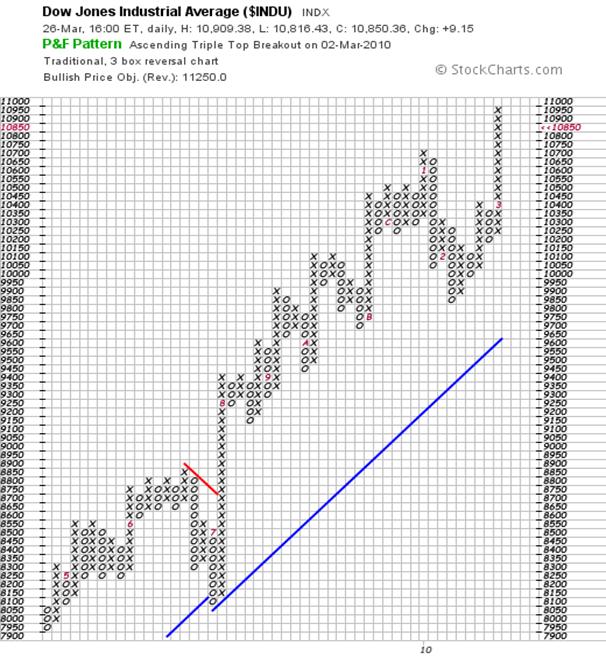

That just leaves us with stocks. The Dow continues in a liquidity drenched world of its own and that is the primary reason behind the sharp grinding move higher shown in the following chart:

The Dow is climbing at a greater than 45° angle and that is always dangerous as the slightest correction can drive it below the bottom band of the ascending trend line. You can see that in spite of a small gain on Friday, the Dow barely closed above the line. You can also see that the Dow is extremely overbought and yet the RSI and MACD are still pointed higher. Only the histogram is declining. This last week we saw the Dow climb above good resistance at 10,817 and it really hasn’t faltered although

it did fail to hold on to good gains from early morning rallies on both Thursday and Friday. The question as to how high the Dow can go is a good one as there is no further Fibonacci resistance until 11,245, and this corresponds nicely with the 11,250 price target from the preceding Point & Figure chart.

Personally I think the Dow is to be avoided at all costs. For those of you who bought the Dow on the major buy signal two weeks ago, I would think seriously about taking profits at the next new intraday high. With the Dow now sporting a price/earnings ratio of 20, and an average yield of 2.6%, it’s about as expensive as it’s been in a long time. Furthermore volume has not improved telling me that the large investors are still sitting on the sidelines. On the other hand there is no technical justification to sell the market short so all you can do is sit on the sidelines, watch, and wait. We are on the verge of another earnings season and so far profits are the result of cost cutting rather than increased sales. I’ve been around long enough to know that if you cut too deeply into your cost structure sales will suffer, and I believe that’s where we’re at right now. I suspect profits will disappoint and that has yet to be priced in. As usual, patience is required.

In conclusion we continue to be force fed the notion that things are getting better in the United States. Unfortunately, unemployment and housing do not reflect the improvement and since most Americans don’t have much else, they’re mired in the quicksand of debt and sinking deeper with each passing month. New home sales hit an all-time low in February while inventory increased to a 9.2 month supply. This is not a pattern that is con-

sistent with the idea of an expanding economy. Meanwhile real M-3 continues to contract and the signs of a further slowdown are everywhere if one only cares to look.

This week Obama’s health care program was passed by Congress and will serve to exacerbate the problems, and the debt in the US. Obliging millions of Americans to accept a program they can’t afford and won’t help them will only create social ill will. In the end the Obama plan will widen the deficit by trillions of dollars and will cost lives as an inefficient government loses patients in bureaucratic red tape. Right now everybody is being lulled to sleep by the tag team of a strong dollar and a strong Dow, but that is just so much sand in the eyes of the bear. Investors will find out the hard way that there it is not any different this time around. There is no new paradigm and history will repeat itself! As usual the average man on the street will learn this the hard way.By Steve Betts

E-mail: team@thestockmarketbarometer.com

Web site: www.thestockmarketbarometer.com

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.