Gold, A Quick Look at the Charts

Commodities / Gold and Silver 2010 Mar 21, 2010 - 08:13 PM GMTBy: Bob_Kirtley

Taking a quick look at the above chart we can see that gold prices appear to be stuck in a trading range for now and may continue to trade sideways until we get some sort of resolution to the European Fiasco. The long term trend is still up so we must learn to expect these knocks along the way. Shortly after gold had risen above the $600/oz level (many moons ago) we wrote that you would never see $600/oz gold again and the detractors fired in the brick bats accordingly, well it wont be too long before $1100/oz is history too

Taking a quick look at the above chart we can see that gold prices appear to be stuck in a trading range for now and may continue to trade sideways until we get some sort of resolution to the European Fiasco. The long term trend is still up so we must learn to expect these knocks along the way. Shortly after gold had risen above the $600/oz level (many moons ago) we wrote that you would never see $600/oz gold again and the detractors fired in the brick bats accordingly, well it wont be too long before $1100/oz is history too

Here we are at much higher levels and the doubters still abound in abundance. None us know for sure where gold will take us in the short term but we are however confident that gold prices are headed higher and will finish the year at higher levels than they are today.

The question of which vehicle will give us the biggest bang for our investment dollar will remain with us and we will continue to wrestle with it and try alternatives, but there is no substitute for having the real deal in your own hands. We see it as not just an insurance but also as an investment that is as good as, if not better, than any other investment available today.

Back to the gold chart, please note that the 200dma is still rising and is closing the gap with gold prices which will support gold prices and we see it as being very positive for gold.

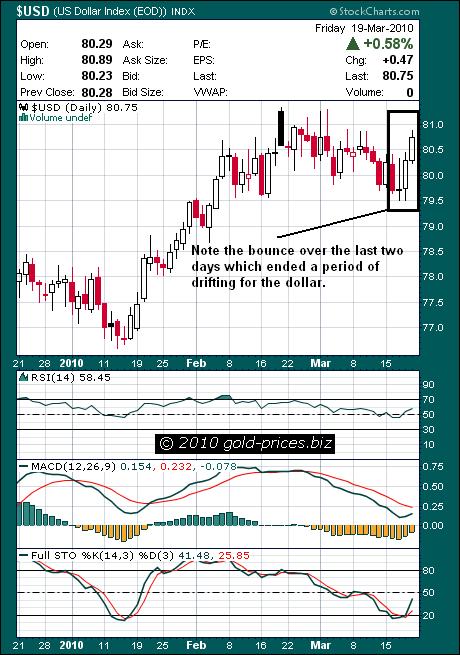

The USD has bounced and we note the inverse reaction by both silver and the HUI which have turned down sharply. Various programmed ’stops’ have been triggered by the fall in gold prices which added to the selling pressure on Friday, however, by the end of the trading session gold prices were stabilizing.

The US Dollar has bounced over the last two days to close at 80.75 on the US Dollar Index as shown on the above chart. India raising its interest rates played a bit part in this resurgence, however, the prime mover would appear to be the Euro which is clouded in uncertainty regarding an amicable solution to the financial problems in Greece.

Well fast forwarding to today all eyes will be focused on President Obama’s health care reform bill and how the market reacts to it. We understand that there are last minute changes being undertaken such as abortions will not be allowed on the state, but we will need to see the final draft, if and when it is passed.

Also look out for Thursday, when the European Union meet as we may get some indication as to just what they propose to do about the Greek problem.

Have a good one.

As a suggestion for those who do want leverage to the precious metals bull, the gold and silver funds together with the careful application of options trades could be a possible solution for you. This way we are exposed to any movement in gold prices which in turn is magnified by the effect of the option. Do remember that loses are also magnified in the same way so its not a strategy for the faint hearted. On the other hand the quality stocks are not performing as anticipated and a non-producing junior stock is a shot in the dark, however, its your money and its your call.

Our premium options trading service, SK Options Trading, has closed the last 7 trades, with an average gain of 51.17% in an average of 37 days per trade, why not drop by and take a peak.

For those interested in getting a bit more bang for your buck and adding a touch more excitement to your portfolio, then check out our Options Trading Service please click here.

Got a comment then please add it to this article, all opinions are welcome and appreciated.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.