What Do I Need To See To Make Me Take A Stock Trade?

Companies / Company Chart Analysis Mar 18, 2010 - 10:16 AM GMTBy: David_Grandey

The only pattern you'll ever need to know in uptrending markets is commonly referred to as a Pullback Off Highs (POH). And sure enough with the recent vertical leap to nosebleed levels we've seen in the indexes a bunch of names took off out like rockets.

The only pattern you'll ever need to know in uptrending markets is commonly referred to as a Pullback Off Highs (POH). And sure enough with the recent vertical leap to nosebleed levels we've seen in the indexes a bunch of names took off out like rockets.

All of those same names got away from those low risk entry points very fast leaving any trades taken now being of higher risk entries due to being away from those prime entry points that we use to manage risk from a technical perspective.

Each of them, and many other stocks, are extended and away from any low risk entry point. Buying them here would surely be of the dog chasing the bus variety types of trades at this point in time.

The big question then becomes so where does that leave us if the majority of high quality names aren't anywhere near prime buying entry points?

Well, that's where the 12 Most Important Words You Need to Know Comes In --

"What Do I Need To See To Make Me Take A Trade"

What do I need to see to make me take a trade on the long side from here? By the way ingrain that statement in your brain, post it next to your monitor or make it into a poster as IT WILL serve YOU well the rest of your life. They ARE your centering statement every day.

Below are examples of names that showed me the "What Do I Need To See To Make Me Take A Trade" centering statement. It's what we want to be on the look out for from here with any issue we are interested in on the longside.

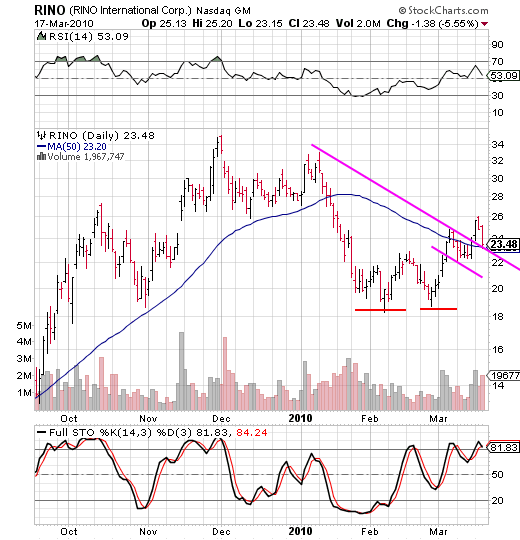

RINO -- RINO International

It ran from the trigger price of 24ish to 26 in short order. One and done hit and run and you got paid IF that is your plan.

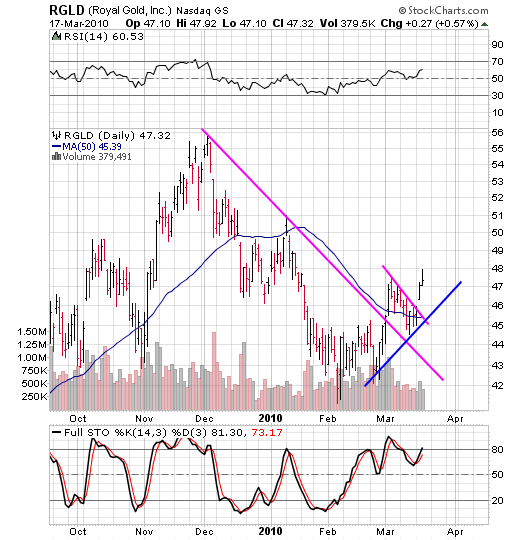

RGLD -- Royal Gold

Triggered Tuesday in a gap up. This stock opened at 46.31 so you had a blink your eye you missed it moment to buy the stock and here it is pushing 48.00. One and done hit and run and you'd be done.

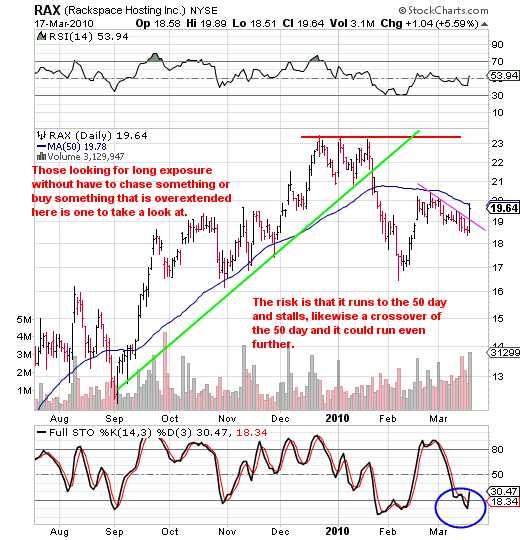

RAX -- Rackspace Holdings

Triggered and is crossing over the pink line. Now we get to deal with that 50 day average where it is thus far facing resistance. Still though all you had to do was wait for the crossover and you got a quick 64 cents out of it so far. Almost a one and done hit and run.

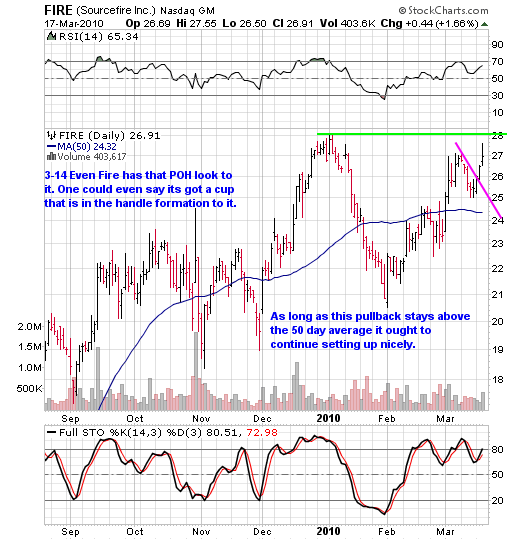

FIRE -- Sourcefire

Now approaching resistance. Nice quick one and done trade. All you had to do was wait for the break of the pink line.

Well there you have it. 200 shares of everyone that triggered and you've got a great week. This is what Pullback Off Highs patterns are all about.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.