Gold Supported by Geopolitical and Sovereign Risk as S&P and Moodys Warn US

Commodities / Gold and Silver 2010 Mar 15, 2010 - 09:02 AM GMTBy: GoldCore

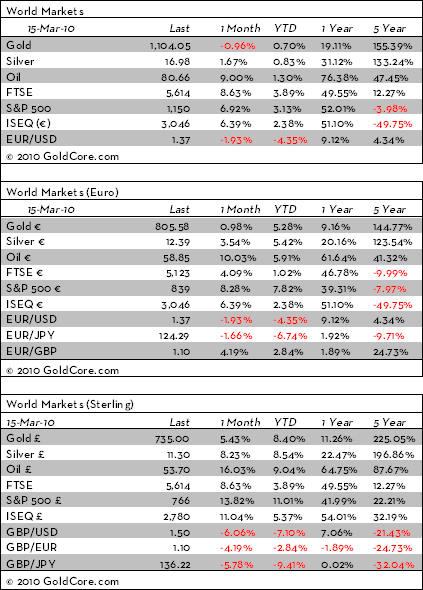

Gold fell in US trading on Friday from $1,119/oz to $1,098/oz to close with a loss of 0.54% and a loss of nearly 3% for the week. Silver was again more resilient and fell less than 2% last week. Gold has range traded from $1,102/oz to $1,106/oz so far in Asian and European trading this morning. Gold is currently trading at $1,103.00/oz and in euro and GBP terms, gold is trading at €804/oz and £732/oz respectively.

Gold fell in US trading on Friday from $1,119/oz to $1,098/oz to close with a loss of 0.54% and a loss of nearly 3% for the week. Silver was again more resilient and fell less than 2% last week. Gold has range traded from $1,102/oz to $1,106/oz so far in Asian and European trading this morning. Gold is currently trading at $1,103.00/oz and in euro and GBP terms, gold is trading at €804/oz and £732/oz respectively.

World equity markets are under pressure after mixed US economic reports and Chinese monetary policy tightening concerns. Asian stocks were mostly down, as are European shares so far this morning. Increasing geopolitical tensions between the US and China is likely making markets somewhat jittery (see below).

Sovereign debt issues and currency risk remain prevalent and look set to keep gold buoyant for the foreseeable future. Indeed, gold is increasingly being seen as a safe haven currency as seen in the recent record (nominal) highs in euro and sterling due to the challenges facing the UK and European economies.

These sovereign debt issues also face the US and thus the world's reserve currency the dollar. Late last week, S&P warned that the US' AAA credit rating is not guaranteed and today Moody's is warning that unless the US gets public finances into better shape, there would be "downward pressure" on its triple A credit rating.

Concerns about gold being a bubble are overdone with gold today only 19% above the price it was 12 months ago (and up 11% in sterling terms and 9% in euro terms). While many equity markets are up by some 40% to 70% in the same period.

Silver

Silver reached as high as $17.08/oz this morning in Asia. Silver is currently trading at $16.96/oz, €12.38/oz and £11.27/oz. Silver outperformed gold again last week and continues to exhibit signs that it might soon begin to play catch up with gold and target recent record (nominal) highs.

Platinum Group Metals

Platinum is trading at $1,610/oz and palladium is currently trading at $464/oz. Rhodium is at $2,550/oz.

News

Geopolitical tensions between China and the US appear to be escalating which is another bullish factor for gold. China PM, Premier Wen Jiabao, has defended China's increasingly assertive trade and foreign policies and vowed to fight any new signs of economic crisis and currency "protectionism". Tensions over Taiwan and Tibet continue and he chided the US for a 'disturbance' in relations.

Wen turned the tables on the U.S., renewing appeals for assurances from Washington about the safety of China's $800 billion in foreign exchange reserves invested in U.S. Treasury securities. Wen said the value of the U.S. dollar was a "big concern" and asked Washington to take unspecified steps to reassure investors.

The UK housing market has stalled again, fueling fears of a double-dip recession. There are growing concerns that the housing market could be facing a double-dip recession, as data released today shows house prices in March have risen by the smallest margin on record.

Finance ministers from the 16 countries using the euro meet today in Brussels to discuss the Greek debt crisis and Greece's progress in introducing the austerity measures needed to regain the confidence of the markets.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.