Some Advice For Ben Bernanke on the State of the US Economy

Economics / US Economy Aug 07, 2007 - 05:28 PM GMTBy: Tim_Iacono

Here are a few words of advice for current Fed chairman Ben Bernanke who will prognosticate on the state of the U.S. economy in the FOMC policy statement today.

First, start assigning blame - get political man! The next few months are probably going to be pretty rough and next year might be even worse, so start pointing your finger at the guy who is responsible for all of this.

While you're worried about "inflation expectations", your predecessor is out there managing "blame expectations" and he is meeting with some success.

With images like this - him smiling, you dour - you're 'gonna get blamed for the whole mess if you don't do something about it now.

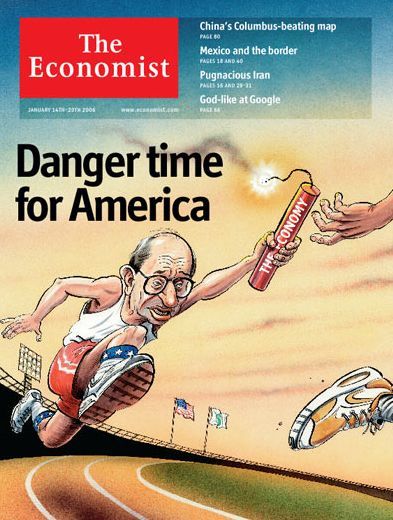

Feel free to use this cover from last year's "Fed transition" issue of The Economist as a visual aid (note that if the sharp boys on the other side of the pond were just a bit sharper, they'd have written "The Housing Bubble" instead of "The Economy" on that baton.)

Second, consult with a doctor - start laying the groundwork for your departure from the Fed due to some plausible medical condition that prevents you from completing your term. That seems to have worked wonders for others who are in tight spots - not only do you extricate yourself from a horrible situation, but you get a sympathy vote as well. Rare conditions work best.

Third, get some career counseling - it's not clear whether it was hubris or naivete that got you into the mess you are currently in, but before moving on to whatever you do next, go get some career counseling. Since the hubris/naivete problem appears to be common amongst dismal scientists, you may want to consider an entire career change - maybe you can go back to your roots in the public school system with another stint on a school board somewhere.

Lastly, become the complete opposite of Alan Greenspan - between now and the time you flee the Fed, start doing the opposite of what your predecessor would have done. This will help tremendously with the first item above. The idea of "Federal Reserve Chairman George Costanza" was first suggested by Alan Abelson at Barrons and then seconded by Barry Ritholtz at The Big Picture before you were even sworn in, but so far you have failed to take this advice, "What, me regulate?"

You can start today.

Don't give in to the pleadings of Jim Cramer and his ilk - instead of acknowledging the rapidly deteriorating credit situation and hinting that help will be on the way, start saying things like, "Credit excess must be cleansed from the system. It will be painful, but we'll be better off for it in the long run. The markets are working."

This would be the complete opposite of the "Greenspan put".

Do it. Do it today.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

hor dararath

14 Dec 07, 00:04 |

why the US currency getting down lately?

Dear sir! I would like you to give me some information about the US currency and economy.Why the currency getting down? |