An Attempt to Think Through the Greek Debt Crisis

Interest-Rates / Global Debt Crisis Mar 02, 2010 - 01:15 AM GMTBy: John_Mauldin

Today I am sitting listening to Ralph Merkle lecture on nanotechnology, part of a 9-day-long series of lectures on how accelerating change in technologies of all types will affect our world. 15-hour days and intense discussions are stretching my brain, but I still have to make sure you get your Outside the Box. Fortunately, I came across today's OTB last week from my friends at GaveKal, who offer a way to think about the Greek crisis and what it means for all European bonds.

Today I am sitting listening to Ralph Merkle lecture on nanotechnology, part of a 9-day-long series of lectures on how accelerating change in technologies of all types will affect our world. 15-hour days and intense discussions are stretching my brain, but I still have to make sure you get your Outside the Box. Fortunately, I came across today's OTB last week from my friends at GaveKal, who offer a way to think about the Greek crisis and what it means for all European bonds.

There are a lot of allegations about manipulation of European bonds. It's those nasty traders. GaveKal shows us data that bond yields are actually quite logical, given the debt of various countries. But they also warn us, as part of their conclusions:

"As of today, there seems to be no additional risk premium related to the possible dislocation of the Eurozone. Clearly, this possibility would have such devastating effect on world financial markets that investors cannot even think of it (even if many talk about it)."

I suggest you read at least the beginning and then the end of this piece, even if the data makes your eyes glaze over. (I must admit the data made me feel all warm and fuzzy, but then I am somewhat of a wonk.)

Have a great week. I am getting overwhelmed here in California, learning about the future. It is going to be amazing, even if our bonds drop in price. We will live in what may be the most interesting and exciting period of human history. What a contrast between the financial markets and what the scientists continue to amaze us with. It is one of the reasons I think we Muddle Through, in spite of our rather negative economic environment.

John Mauldin, Editor Outside the Box

An Attempt to Think Through the Greek Crisis

GaveKal Ad-Hoc Comment Asset Allocation & Economic Research

http://www.gavekal.com Thursday, February 25, 2010

When covering a news-event such as a train-wreck, journalists will typically take one of two angles: the descriptive narrative, full of gory details and hair-rising tidbits; or the human angle, with stories inviting reactions such as anger, admiration, pity, sadness, etc. from their readers. Which brings us to the latest financial train-wreck, namely Greece and the possibility that some of Southern Europe's weakest states will face difficulties in rolling over ever larger amounts of debt issued in a currency they cannot print.

Unfortunately, the looming crisis in Europe has typically led journalists scurrying to file either 'descriptive stories' on how a country like Greece could find itself in its current predicament, or 'human interest' stories on who has made, or lost, money out of recent events. But such stories clearly miss the forest for the trees. Surely the more interesting and important question is what the current unraveling in Europe means for economies going forward? Of course, figuring out what will happen next in Europe is as easy to grasp as a soapy eel. But this should not stop us from drawing some already very obvious conclusions. Moreover, one can probably assume that the panic-like situation currently prevailing in the markets must be generating some opportunities. But how can we identify those? Answering these questions is the aim of this paper.

1- A Review of Recent History

In spite of significant differences between countries in fiscal and regulatory policies, risk premiums on sovereign bonds in the first decade of Euroland's monetary union were hardly discernable. All across the Eurozone, governments enjoyed much lower interest rates and, for most, healthy growth in tax receipts. The atmosphere on financial markets was friendly.

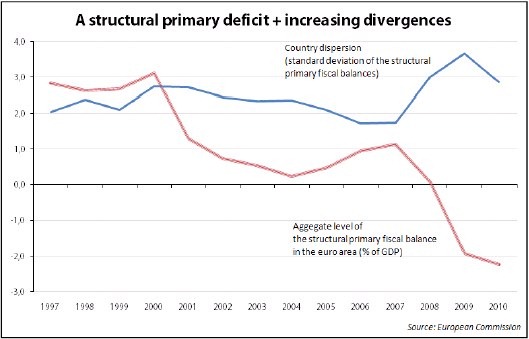

This European version of the 'bond conundrum' ended with the financial crisis. For a number of reasons, the EMU monetary party that had masked both the deterioration, and the dispersion, of underlying fiscal balances in the Euro area came to a crashing halt:

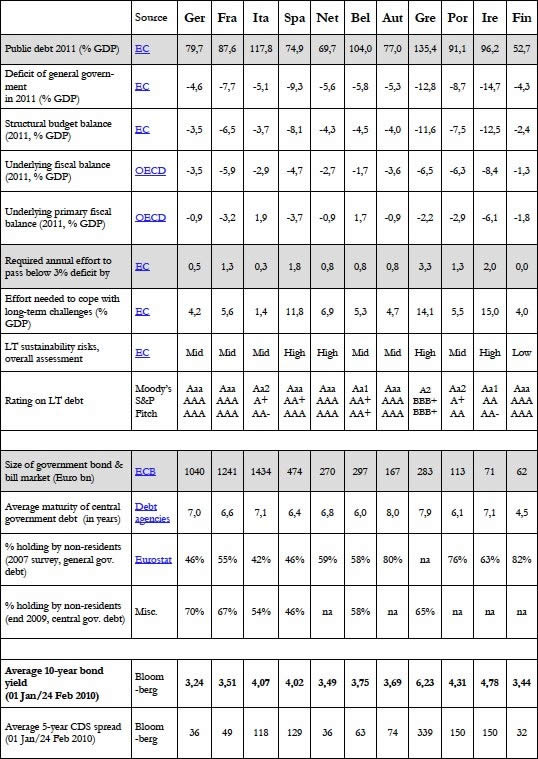

Now as everyone knows, the budgetary constitution of the EMU--the Stability and Growth Pact (SGP)--explicitly imposes limits to both public debt (60%) and deficit (3%) ratios. In turn, this means that the very existence of the Euro is constitutionally anchored on sound public finances; a key difference with other areas of the world. This is one of the reasons why although suffering from a comparatively less ugly fiscal situation than that of the USA, Japan or the UK, the Eurozone is now in the firing line. This also explains why, all of a sudden, everyone is scrambling for data to assess the health of public finances across the Eurozone (in a bid to make life easy for our clients, we have compiled this data in the table below. Please note that i) clicking on the source for each type of data will open a web link. ii) European Commission and OECD estimates for structural balances can differ for a number of reasons: date of estimates, method for calculating potential GDP and automatic stabilizers, exclusion of one-off measures, etc and iii) colored rows indicate the variable we use later in the paper in our model for explaining the structure of bond yield spreads in the euro area).

2- The Return of the Bond Vigilantes

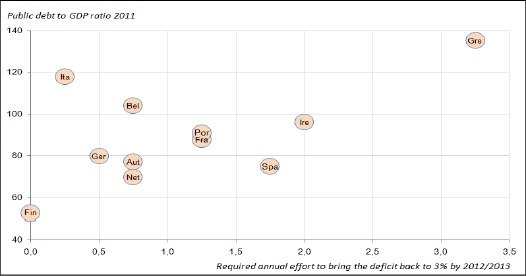

As we argued in The Return of the Bond Market Vigilantes, the first obvious conclusion one needs to draw from the Greek crisis, is that for the first time since the Asian Crisis, bond markets are back into control of fiscal policies. In our view, this is a reality that is set to last. Needless to say, European politicians would most likely prefer not to deal with this pressure but they should nevertheless see a silver lining to the current cloud: financial markets have now become the main and most efficient tool for the SGP to, finally, work! In that regards, the predictable postures denouncing the so-called 'attacks by financial speculators' look particularly misplaced. The reality is that, politicians having failed at the task, financial markets have now become the best ally of the Euro's founding fathers. Indeed, since the beginning of the year, sovereign spreads have been nearly perfectly aligned with the level of fiscal constraint imposed by the Maastricht Treaty to each country of the Eurozone. In other words, the market is doing the job that policymakers could not tackle.

The fiscal data presented on the table above helps us to understand the current structure of bond yields in the Eurozone. Working with publicly available official data rather than with potentially opaque in-house assumptions, we obtain a very good fit (97% correlation) between actual bond yields and a small number of key variables. Namely:

- The difference between the level of public debt estimated for 2011 by the European commission and the 60% Maastricht limit. The debt ratio carries several pieces of key information about past, current and future fiscal developments: the track record of the country, the debt burden, and the need for future adjustments. The correlation between public debt ratios and Eurozone bond yields has systematically been above 70% over recent months.

- The immediate pressure on governments as derived from the Excessive Deficit Procedure (EDP), which applies to countries experiencing a deficit-to-GDP ratio above 3% (except when the excess deficit is solely due to an economic recession). With the sole exception of Finland and Luxembourg, all Eurozone countries are currently being subject to an EDP. The European Commission estimates the required annual adjustment of the structural fiscal balance that is necessary to meet the 3% target within the coming two to three years. This is the number we use in our model.

- Our third factor measures the liquidity risk premium. Indeed, everything else being equal, small government bond markets will tend to be relatively more expensive than large ones for liquidity reasons. We have used the logarithm of the size of each bond market (in billions Euro), since the liquidity premium is not exactly proportional to the size of the market. The importance of the liquidity risk premium has been one of the surprising results of our exercise. It seems to explain why, for example, Portuguese sovereigns carry a much higher yield than French OATs, even though the overall fiscal risks for these two countries look roughly similar.

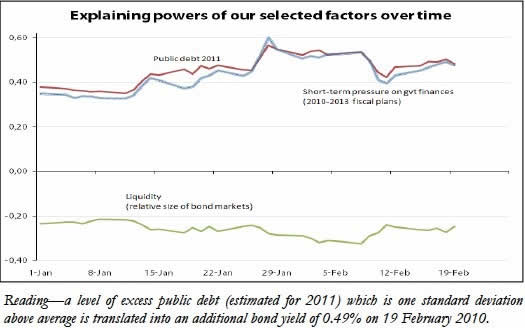

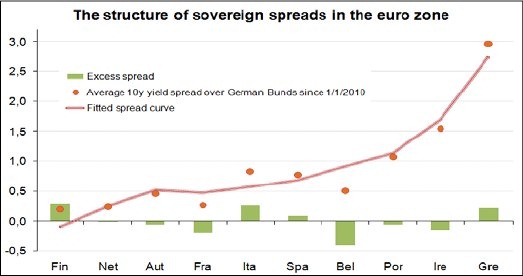

The chart below shows how bond yields are being affected by each of the three selected variables. Since the beginning of the year, the relative importance of our three factors has remained fairly stable, which is a good sign for the credibility of the analysis.

3- Singling Out the Misfits

In our work, we have been using these three factors in a simple linear regression model. And since the beginning of the year, we find that, on average, 10-year bond yields in the Euro area have been organized according to the following pattern:

Yield = 4.31+ 0.0201*(excess debt)+0.4723*(EDP adjustment)-0.564*(liquidity)

We have then calculated the theoretical spread over German Bunds for each individual country and compared it to the market price. The results can be found in the chart below:

Thus, for all of the complaints about market manipulation, it seems that the hierarchy of spreads over German Bunds has followed, since the beginning of this year, a pretty rational walk. Actual debt levels and short-term pressure on government accounts have systematically explained more than 85% of yield spreads. When a liquidity risk premium is applied, the explaining power of our model rises to above 95%. A very interesting predictability which leads us to the following conclusions:

- The hierarchy of sovereign spreads on Euro financial markets closely follows the logic of the Stability and Growth Pact (SGP). The European bond markets are thus remarkably consistent and sending a clear and powerful message to the governments of the euro zone to stick to the agreed rules or suffer the consequences.

- As of today, there seems to be no additional risk premium related to the possible dislocation of the Eurozone. Clearly, this possibility would have such devastating effect on world financial markets that investors cannot even think of it (even if many talk about it).

- Based on the fitted curve we can identify a few markets that potentially deserve either a lower or a higher spread than the one currently prevailing. Of course, one should not build too much on small deviations to the fitted curve, but one sovereign bond market looks particularly expensive, namely Belgium. The OLO market should normally trade with yield significantly above that of Austria, or even Italy (see The Italian Job). The credentials for the management of the Belgian debt crisis of 1993 may play a role in the overvaluation of the OLO market. But with Belgian public debt now rising again (it should pass the 100% mark next year) and with the Belgian banking system in deep crisis, we see little reason to hold any OLO in bond portfolios. Rather, we would advise to sell OLOs against a basket of Austrian and Italian bonds. Aside from Belgium, France and Ireland are the two markets that currently look vulnerable.

4- The Return of Country Risk

As mentioned above, it is hard to foresee how the current situation in Europe will play out, but the one thing we can be sure of is that the crisis is an important turning point for European investors in that it marks the return of country risk. Indeed, regardless of what the European Union may do to help Greece through its current crisis, the new reality is that Greece's funding costs (along with those of other European nations) will, from now on, increasingly be a reflection of Greek fundamentals rather than German fundamentals. This must mean that, like a phoenix rising from the ashes, country risk in Europe is all of a sudden back from the dead. It also means that discerning which countries are set to experience a rise in financing costs, and which countries enjoy a pull-back will once again be a driver of relative stock market performance. In that regards, we hope that our reader will find the equation we offered above both interesting and useful.

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.